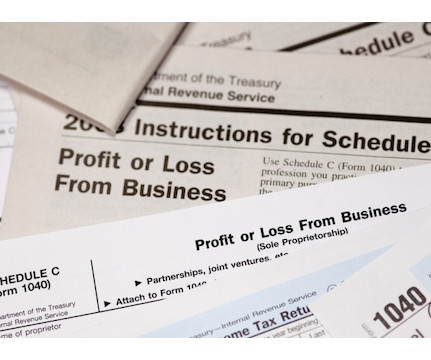

How New Business Start-up Expenses are Handled on your Tax Return

RogerRossmeisl

AUGUST 5, 2021

Entrepreneurs often don’t know that many of the expenses incurred by start-ups can’t be currently deducted. You should be aware that the way you handle some of your initial expenses can make a large difference in your federal tax bill.

Let's personalize your content