Candy, flowers, jewelry, dinners: The gifts may be the same, but Cupid’s arrow will fly in new online directions this year for Valentine’s Day presents. And it might land right on your company’s bottom line after sales and use tax obligations.

Expected spending on Valentine’s Day gifts this year dropped to an average $164.76, down about $32 from a record high in 2020, according to the National Retail Foundation.

Of course, Valentine’s Day last year came just before the pandemic crushed brick-and-mortar retail and created a tidal wave of online shopping.

With consumers now planning fewer evenings out, spending on significant others saw the biggest drop this year. Further proof of COVID-19’s impact on spending plans is the decrease on teachers, classmates and co-workers: Consumers plan to spend an average of $10.77 on their children’s classmates and teachers, and an average of $8.47 on colleagues, both down from last year. Many in-person events, such as concerts or other performances, are also shuttered this year.

In contrast, the NRF says this year online is the most popular Valentine’s Day shopping destination visited by more than one in every three (39%) shoppers.

This year’s Valentine’s Day continues a trend that began a few years ago with holiday shopping and which has recently also been powered by the pandemic. The NRF reports that online and “other non-store sales” were standouts during 2020’s holiday season, growing almost 24% year over year to $209 billion as consumers shopped more online from all-online sellers or traditional retailers’ sites.

If your business sells popular Valentine’s Day items online, you should know a few rules related to sales tax and taxability. States vary in how they tax candy sales, for instance – sometimes as food, sometimes not, sometimes with no sales tax at all. Jewelry and other gifts are general tangible personal property and incur sales tax accordingly.

Most states require collection and remittance of sales tax on flowers purchased online for delivery, based on the florist’s location, on the customer’s and sometimes on the recipient’s.

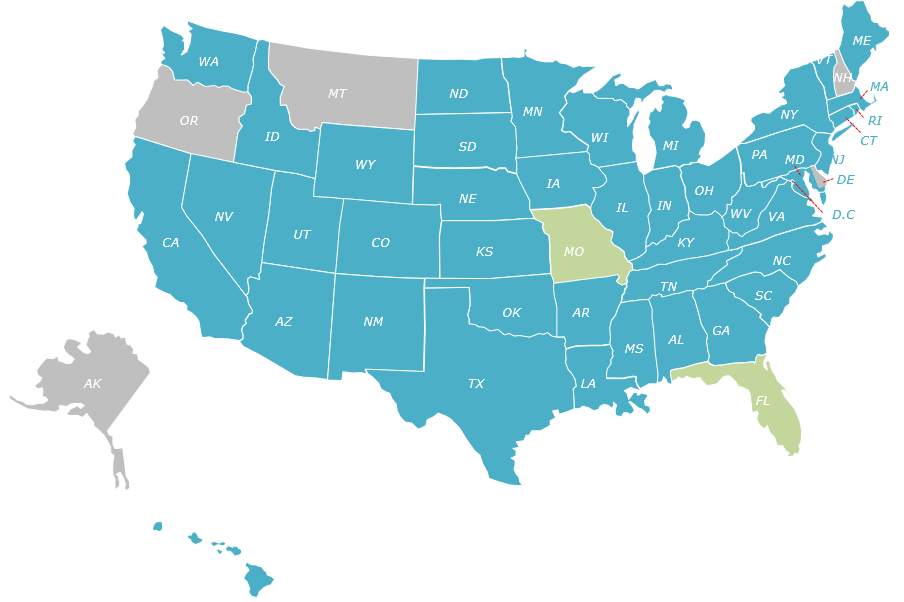

Don’t forget that the ongoing boom in holiday online shopping might easily push you over a given state’s nexus threshold and create sales tax obligations this Feb. 14th.

Sales tax compliance can seem overwhelming, but it doesn’t have to be a burden. Feel free to contact us for all your sales tax compliance needs. Want to learn more on this topic? Download our eBook The Guide to Getting Sales Tax Right.

.png?width=1200&height=628&name=2023%20logo%20with%20SOC%20and%20clearly%20rated%20(2).png)