Breaking News: Federal Court Ruled Corporate Transparency Act Unconstitutional – Beneficial Ownership Information Reporting on Hold

Withum

MARCH 2, 2024

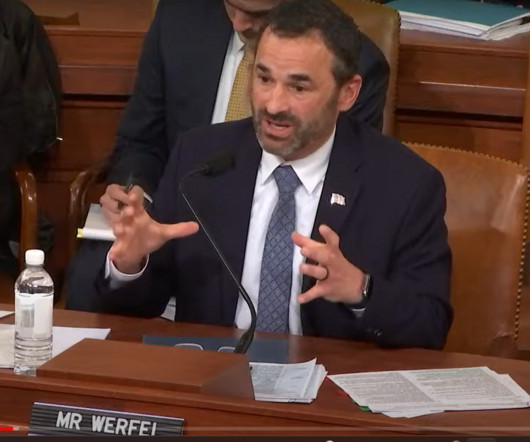

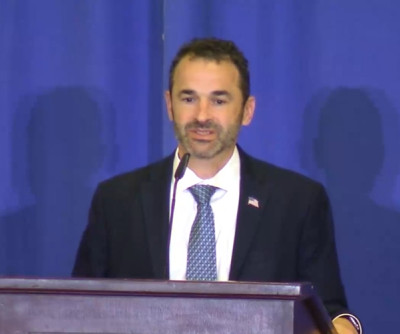

In a surprise decision Friday night, a federal district court ruled that the Corporate Transparency Act (“CTA”) is unconstitutional, effectively placing the Beneficial Ownership Information (BOI) reporting on hold. By way of background, the CTA was enacted on January 1, 2021 as part of the 2021 National Defense Authorization Act as an attempt to prevent money laundering and tax evasion by requiring new reporting for certain companies doing business in the US.

Let's personalize your content