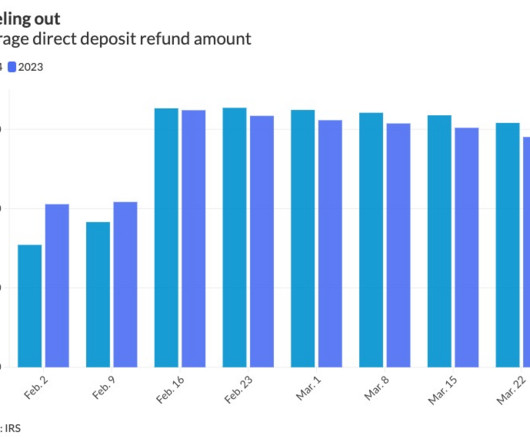

IRS wraps up tax season

Accounting Today

APRIL 15, 2024

The Internal Revenue Service reported stronger performance on Monday, April 15, as it concluded this year's tax filing season, saying it had answered 1 million more phone calls from taxpayers and helped 170,000 people in person compared to last year.

Let's personalize your content