The Community Reinvestment Act (CRA) was enacted nearly 50 years ago to help low- and moderate-income (LMI) households access credit and financial services. Federal bank regulatory agencies have issued a final rule on the CRA with a goal of strengthening and modernizing the regulation considering changes to the banking industry that have occurred since the last significant revision in 1995. Banks will need to prepare for these finalized CRA requirements, which will go into effect in stages beginning on April 1, 2024, and continuing on January 1, 2026 and January 1, 2027.

Key Takeaways

- Asset thresholds for small, intermediate and large banks will increase

- Most of the rule’s requirements will go into effect on January 1, 2026 to give banks time to prepare for implementation

- Data reporting requirements, which only apply to large banks, will become applicable starting January 1, 2027

- The rule allows small banks to be evaluated under the existing framework or opt in to be evaluated under the new framework

- The final rule does not include a start date for examinations pursuant to the performance tests in the amended regulation

What Are The New Asset-Size Thresholds?

These new thresholds do not go into effect until January 1, 2026:

Small banks will be those with total assets of less than $600 million. This is an increase from $376 million under the current regulation. Agency estimates indicate that this increase will transition approximately 778 banks from intermediate to small status.

Intermediate banks will be those with total assets of at least $600 million, but less than $2 billion. This is an increase from a range of $376 million to $1.503 billion under the current regulation. Agency estimates indicate that this increase will transition approximately 216 banks from large to intermediate status.

Large banks will be those with total assets of $2 billion or more. This is an increase from $1.503 billion under the current regulation. While not a separate category, additional requirements will apply for large banks with total assets of $10 billion or more.

As under the current regulation, the minimum asset threshold for an intermediate or large bank must be met for two consecutive calendar year-ends for a bank to reach intermediate or large status, and these thresholds will be adjusted annually for inflation. The new regulation includes a definition for limited purpose banks that includes those banks that are considered a limited purpose or wholesale bank under the current regulation.

What Changes Must be Made to Assessment Areas?

The new regulation includes two types of assessment areas, facility-based assessment areas and retail lending assessment areas.

Facility-Based Assessment Areas

Facility-based assessment areas are similar to current assessment areas other than the requirement that they must include full counties. An exception to the full-county requirement exists for small and intermediate banks so long as the assessment area consists of contiguous whole census tracts. This section of the regulation becomes effective April 1, 2024, but note that the new definition of small and intermediate banks does not become effective until January 1, 2026. Until and unless clarification is received, a conservative approach would be for only banks that meet the current definition of a small or intermediate bank to have a facility-based assessment area that does not consist of entire counties.

Retail Lending Assessment Areas

Retail lending assessment areas are applicable only to large banks and do not become effective until January 1, 2026. Retail lending assessment areas must be established when less than 80% of retail lending occurs within facility-based assessment areas. Retail lending assessment areas will then need to be designated in any nonmetropolitan area of a state or MSA where at least 150 closed-end home mortgage loans or 400 small business loans were originated or purchased during each of the prior two calendar years.

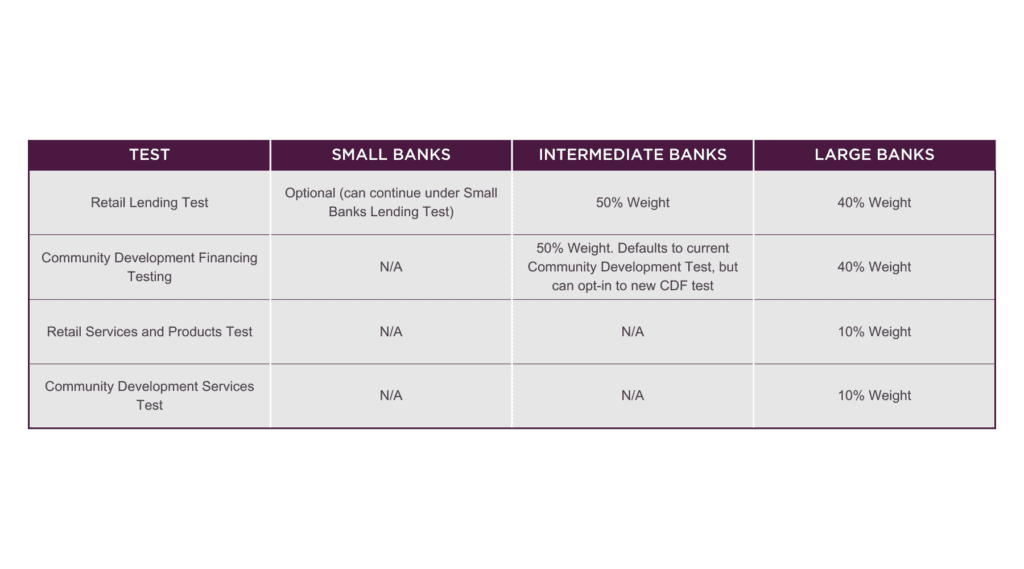

What Changes for Small Banks?

Nothing, if you so choose. Small banks may opt-in to the new Retail Lending Test or continue to be evaluated under the current Small Bank Lending Test.

What is the Retail Lending Test?

While the Retail Lending Test is optional for small banks, intermediate and large banks will be evaluated using this test that becomes effective January 1, 2026 but for which the agencies have yet to indicate when evaluations under the test will begin.

A couple of new terms to become familiar with are Retail Lending Volume Screens and Major Product Line Standards, which will be used to determine which products will be evaluated in a manner similar to the borrower profile and geographic distribution analyses under the current rule.

The loan types, i.e., home mortgage, multifamily, small business, small farm and automobile, that will be evaluated can vary by assessment area and by Outside Retail Lending Areas. These are areas nationwide where the bank originated or purchased loans in a product line that is being evaluated outside any of its facility-based or retail lending assessment areas. The bank’s lending performance will be evaluated in outside retail lending areas for large banks and in certain circumstances for intermediate and small banks.

Intermediate and small banks will be evaluated when more than 50% of certain loans have been originated or purchased outside of its assessment areas during the prior two calendar years OR at the bank’s option.

What Changes for Intermediate Banks?

As is the case under the current regulation, intermediate banks will be subject to two tests that are each weighted at 50%. The Retail Lending Test described above will replace the current lending test. Banks will then have the option to be evaluated under the current Community Development test for intermediate banks that encompasses community development loans and services along with qualified investments OR the new Community Development Financing Test.

The new test will evaluate the bank’s dollar volume of community development loans and investments relative to its deposit base and using the Impact and Responsiveness Review described below. This test will also include standardized benchmarks that will be used during the evaluation process.

What Changes for Community Development Activities?

These changes will be effective January 1, 2026:

Eleven Qualification Criteria will be available to qualify a loan, investment or service as a community development activity with mechanisms available to receive full or partial credit for the activity. These criteria include familiar terms such as affordable housing, revitalization and stabilization as well as economic development; familiar terms with a new twist such as community supportive services; and new terms such as essential community facilities and infrastructure, disaster preparedness and weather resiliency, among others.

An Illustrative List and Request for Confirmation of Eligibility will become available from the Board, the FDIC, and the OCC.

The Impact and Responsiveness of community development activities will be evaluated using a non-exhaustive list of a dozen factors such as the benefit to counties with persistent poverty or census tracts with a poverty rate of 40% or higher; support of an MDI, WDI, LICU or CDFI; support of businesses or farms with gross annual revenues of $250,000 or less; benefits or serves residents of Native Land Areas or benefits projects financed with LIHTCs or NMTCs.

Geographic Limitations to receive credit for community development activities based on their location within a bank assessment area or a broader statewide or regional area will be removed – yes you will be able to receive credit for conducting these activities anywhere nationwide!

What Changes for Large Banks?

Under the new regulation, large banks will be evaluated under four tests instead of the current three. The four tests and related weighting factors are the Retail Lending Test (described above and weighted at 40%), the Community Development Financing Test (described above and weighted at 40%), the Retail Services and Products Test (described below and weighted at 10%) and the Community Development Services Test (described below and weighted at 10%).

Additional Testing for Large Banks

The Retail Services and Products Test will evaluate a bank’s credit and deposit products and programs along with the responsiveness of these programs to the needs of LMI communities. It will also assess the delivery systems, including digital, as well as the availability of branch and remote service facilities using benchmarks.

The availability and usage of responsive deposit products would also be evaluated and only receive positive consideration for those banks with more than $10 billion in total assets or at the option of large banks with total assets of $10 billion or less.

The Community Development Services Test will include both a qualitative review of community development services and an Impact and Responsiveness Review (see above under Changes for Community Development Activities). The proposed rule dropped the requirement that a community development service must be related to the provision of a financial service in nonmetropolitan areas. This change was not reflected in the final rule so regardless of location, community development services must continue to relate to the provision of financial services. Similarly, the proposed metric of community development services to full-time employees for those banks with total assets of greater than $10 billion is not reflected in the final rule.

Anders Banking and Financial Institutions advisors will continue to monitor this and other banking legislation to ensure your organization has the information it needs to maintain compliance and remain alert to changing regulations. Learn how our team can help your institution adjust to new and altered regulations, and the associated fees, by contacting Anders below.

All Insights