Taxes

AICPA Asks IRS for Guidance on Excess Business Losses

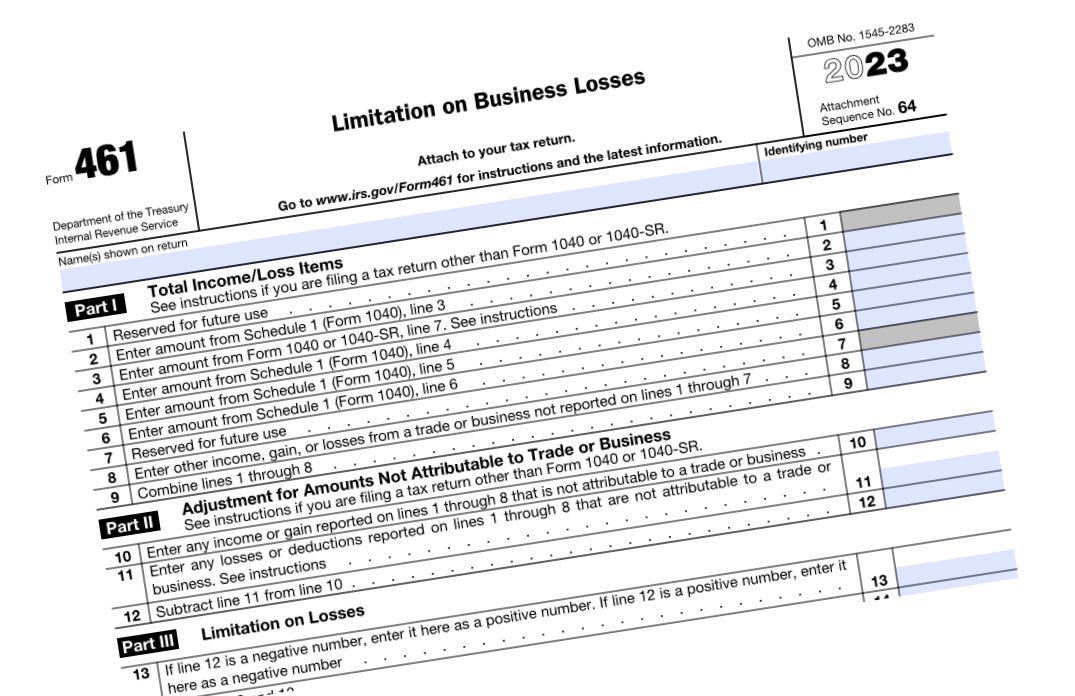

IRC Section 461(l) disallows EBLs for taxpayers other than C corporations for tax years beginning after 2020 and before 2029.

Mar. 13, 2024

The American Institute of CPAs has sent a letter to the Internal Revenue Service requesting guidance on section 461(l), also known as the limitation on excess business losses (EBLs) of noncorporate taxpayers, enacted under the Tax Cuts and Jobs Act (TCJA). The letter also provides recommendations to help the IRS deliver practical guidance that would be helpful to both taxpayers and tax practitioners.

IRC Section 461(l) disallows EBLs for taxpayers other than C corporations for tax years beginning after 2020 and before 2029. The limitation has broad applicability and the potential to impact a wide range of taxpayers.

AICPA’s recommendations focus on the following:

- Operating Principles

- Definitions Related to Business Income

- Definitions Related to Business Deductions and Losses

- Treatment of Gains and Losses

- Treatment of Qualified Plans

- Treatment of Industry Specific Issues

- Application to Trusts and Estates

“Despite having been enacted several years ago, there is currently very little guidance from the IRS relating to IRC section 461(l),” says Peter Mills, Senior Manager, AICPA Tax Policy & Advocacy. “The AICPA’s recommendations highlight several areas that are important for the IRS to address and will be helpful to many taxpayers, as well as the tax professionals assisting them.”