Income Tax

The Next Tax Deadline is May 15 for Tax-Exempt Orgs

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

May. 07, 2024

While the April 15 tax deadline for most Americans to file their individual annual tax returns has passed, there are several deadlines each year, some for individuals, businesses, nonprofits and even organizations that are tax-exempt.

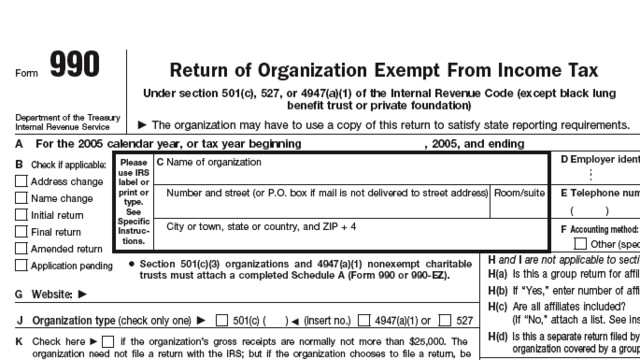

The next major deadline on the calendar is May 15, 2024, is for tax-exempt organizations that follow a calendar year (Jan-Dec) reporting period. This includes entities that file Forms 990, 990-EZ, 990-PF, 990-N, 990-T, and Form 4720.

The IRS requires mandatory electronic filing of returns for organizations who meet certain requirements:

- Those filing basic 990, EZ, PF and T must e-file.

- Private foundations filing a Form 4720 for CY 2023 must file the form electronically.

- Charities and other tax-exempt organizations can file these forms electronically through an IRS authorized e-file provider.

- Organizations eligible to submit a Form 990-N must do so electronically and can submit it through Form 990-N (e-Postcard) on IRS.gov.

The IRS says it encourages organizations to review their forms for accuracy and to submit complete returns. If a return is incomplete or the wrong form for the organization, the return will be rejected. Common errors include missing or incomplete schedules.

Tax-exempt organizations may request a six-month automatic extension by filing a Form 8868, Application for Extension of Time to File an Exempt Organization Return. In situations where tax is due, extending the time for filing a return does not extend the time for paying tax.