The Internal Revenue Service's Direct File free tax filing pilot program officially closed Friday and reported that 140,803 taxpayers used it in the 12 states where it was available.

The IRS

The leading states with accepted returns included California (33,328), Texas (29,099), Florida (20,840), New York (14,144) and Washington (13,954). Across the 12 pilot states, taxpayers using Direct File claimed more than $90 million in tax refunds and reported $35 million in tax balances due.

"Last week, the IRS concluded one of the most successful filing seasons in recent memory, which saw monumental progress in our efforts to transform the taxpayer experience as directed under the Inflation Reduction Act," said IRS Commissioner Danny Werfel during a press conference Friday. "The conclusion of the 2024 filing season also marks the closure of the Direct File pilot, a yearlong effort to study the interest in and feasibility of creating a direct e-filing system people can use to file their federal income tax return. Direct File is an important part of our efforts to meet taxpayers where they are, give them options to interact with the IRS in ways that work for them, and help them meet their tax obligations as easily and quickly as possible."

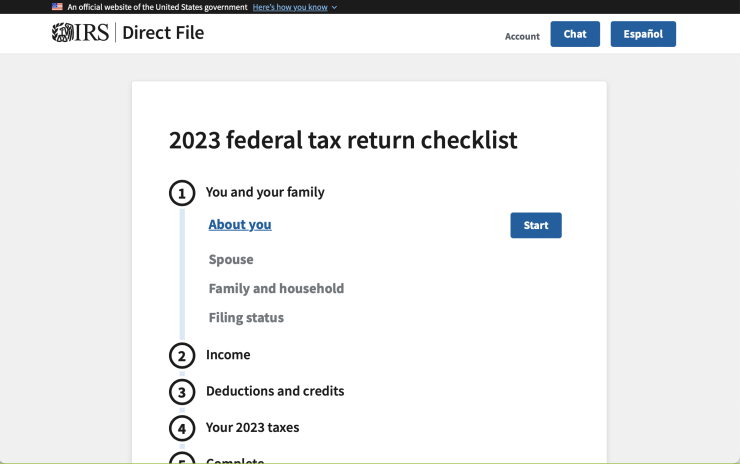

More than 3.3 million taxpayers started an online eligibility tracker to see if they could use Direct File; 423,450 taxpayers logged into Direct File; and 140,803 taxpayers submitted accepted returns. In cases where users' tax situation was out of scope for the pilot, they were directed to other options to complete their tax returns, including the separate Free File program that provides free software from the private sector, Werfel noted.

Wally Adeyemo, deputy secretary of the Treasury, said he met last week with finance ministers and central bank governors from the U.K., Australia and other countries and told them about how excited he was about the Direct File pilot. They were surprised because many of their countries have long offered free tax filing similar to Direct File.

Over the course of the pilot test, he said Direct File users saved an estimated $5.6 million in tax preparation fees on their federal returns alone. He said he has talked with taxpayers in states like Texas, New York and Washington, and many of them said it took less than a few hours to file their taxes using Direct File. He also cited survey figures indicating that 90% of respondents ranked their experience with Direct File as excellent or above average, and 90% of the respondents who used customer support also ranked the experience as excellent or above average.

"Direct File not only saved people money, not only saved people time, but helped people have a good experience with the IRS because ultimately our goal is to make sure the IRS works for the American people, both helping them do what the vast majority of them want to do without prompting, which is file their taxes in a way that is easy and safe and also in this case free," said Adeyemo.

Through the end of the pilot, the total amount spent by the IRS was $24.6 million, including a

"It's important to remember that Direct File is a new technology product," said Werfel. "With any new product, you have fixed development costs. The cost per user only decreases as more people use the product. We intentionally designed this pilot not to have a large number of users in order to focus on delivering a strong, stable product."

TurboTax maker Intuit disputed the IRS's cost estimates. "The IRS claims of spending only $24.6 million taxpayer dollars on Direct File are clearly low, inaccurate, and the IRS even acknowledges conveniently leaving out necessary costs to build and run the pilot," said Intuit spokesperson Rick Heineman in an email. "Facts matter: 140,000 taxpayers or around 0.7% of those eligible for Direct File actually filed for free compared to TurboTax, which files millions of completely free tax returns each year and has delivered 124 million free tax returns over the last 10 years. IRS claims of $90 million in refunds to Direct File filers acknowledges that those that filed their taxes with Direct File potentially received average refunds of around $640, which is thousands of dollars lower than the IRS's own data showing the nation's average refund is around $3,000. This means filers using Direct File not only paid for an already free service with their tax dollars but on average also got a substantially smaller refund. The reality remains the same today as it did the day Direct File launched: 100% of Americans can already file their taxes completely free of charge, free to the government and actually free to taxpayers."

Separately, a new

Compared to individuals who filed using other methods such as professional tax preparers, paid software or self-preparation, the research found that Direct Filers are much more likely to say the process is simpler, cheaper and faster. Some 61% of users reported that tax filing this year was more straightforward than last year when Direct File was not available (compared to 25% among those who used other filing methods saying the same). In addition, 44% of Direct File users said tax filing was less expensive than last year (as opposed to 10% among others). Over a third (36% versus 13% among others) said that tax filing took less time than last year, with more than 60% of Direct File users being able to file in under an hour.

"The two essential things the IRS needed to do to make this year's pilot a success were to build a stable tool that worked and to make sure that users liked it and found it easy to use," said Adam Ruben, vice president of campaigns and political strategy at the Economic Security Project, in a statement. "This survey shows that Direct File users loved this free and simplified tax filing option and found it simpler, cheaper and faster. That makes this year a big win and a strong foundation for expanding Direct File next year to more states, more tax situations, and with the IRS filling in more of the data it already has."