As a small business owner, there’s no better way to understand the health of your business than through your cash flow. But, what is cash flow? Cash flow is the money that moves in and out of your business. Your cash flow either keeps your business afloat or can cause it to sink. Read on to get the scoop on cash flow.

What is cash flow?

Business cash flow is the amount of money that moves in and out of your company. You can use your cash flow to track your business’s income and expenses.

Your business generates revenue when it takes in money from sales or receives interest from investments, licensing agreements, and royalties. Your expenses occur when you spend money (e.g., purchasing products or paying rent and electricity bills).

Positive and negative cash flow

Depending on how your business is doing, cash flow can either be positive or negative.

A positive cash flow means your business has more money coming in than going out. In other words, your revenue is higher than your expenses. If you have a positive cash flow, your business’s liquid assets increase (e.g., your business is making a profit).

A negative cash flow means that your business has more money going out than coming in. In this case, your business’s expenses are greater than your revenue. If you have a negative cash flow, your business can’t cover expenses from sales alone and may need help to make up the difference. A negative cash flow means that your business is operating at a loss.

Cash flow vs. profit

Cash flow and profit aren’t the same, even though they are related. So, what’s the difference between cash flow vs. profit? Both are ways to understand the financial health of your business. While cash flow is a more general term, profit is more specific.

Cash flow is the net flow of cash in and out of your business. Profit is the amount of money left over after you pay your expenses.

You can distribute profits to the owners or shareholders of your business or reinvest in your company.

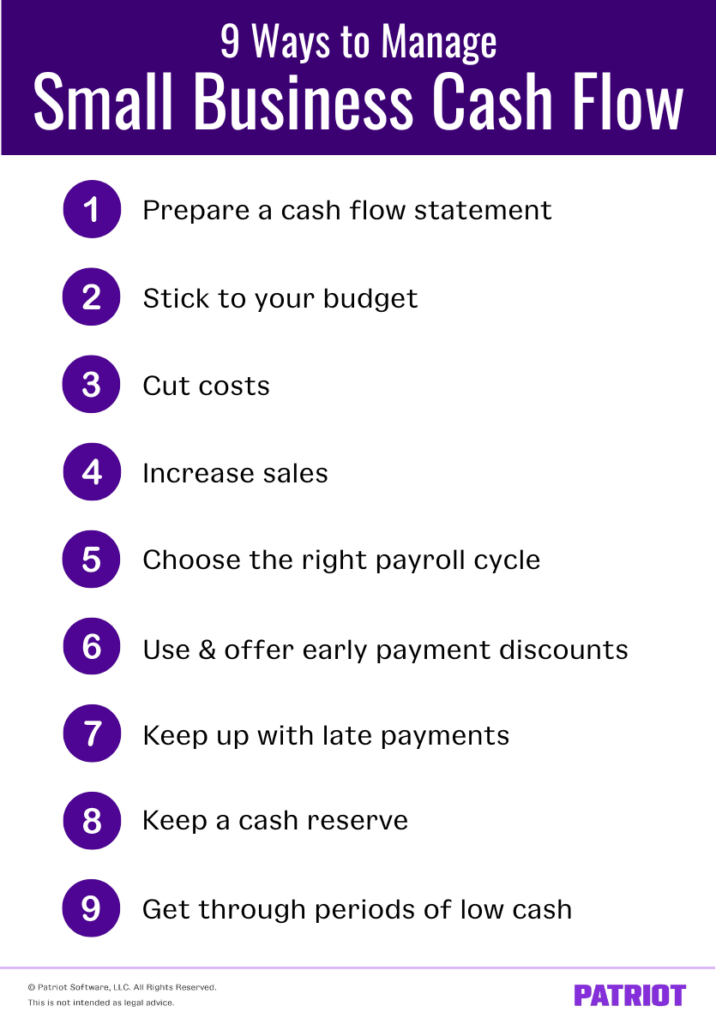

9 Ways to manage small business cash flow

Is your business losing money? Gaining it? You’ll never know unless you track cash flow. Use these nine simple steps to manage your cash flow and keep it healthy.

1. Prepare a cash flow statement

A cash flow statement shows the money you generate and use in a specific period. And, it lets you know the financial health of your business. Cash flow statements focus on three business activities:

- Operating activities reflect how much cash comes from your products or services. A positive number means you’re earning more than you spend.

- Investing activities include cash from investments (e.g., purchasing or selling assets or loans made to vendors). This should be a negative number, which means you’re actively investing in your business.

- Financing activities include cash from investors and banks and any dividends or the repayment of loans made by the company. A negative number indicates you’re paying off debt.

2. Stick to your budget

Once you have your cash flow statement, your budget becomes a more powerful tool. A cash flow statement helps you know what you can spend. And, a budget lets you control how much you spend and when.

To create a budget, you need to know your cash flow and your business’s current and future needs. Once you decide where and how to spend your money, you can focus on increasing your revenue. But a budget only works if you stick to it.

Here are some ways to make a budget you can live (and work) with:

- Set realistic numbers

- Get input from your employees (the budget affects them, too)

- Leave room for the unexpected

- Revisit the budget periodically

Your budget isn’t set in stone. You may realize that your budget needs to change. Does your budget allow too much spending or not enough? If you’re overspending or underspending because of your budget, make some adjustments.

With an accurate budget, you know what you can and can’t spend while keeping your finances healthy.

3. Cut costs

As a business owner, you’re always on the lookout for ways to cut costs. There are cheaper alternatives for most of your business expenses—you just have to find them. For example, you may be able to find a lower premium on your insurance or a way to save costs on electricity.

While cutting costs, make sure you aren’t paying for unnecessary expenses (e.g., continuing software subscriptions you no longer need).

4. Increase sales

You can increase your sales by expanding your customer base. Revamping your merchandising skills is a great place to start.

Remember these things about merchandising:

- E-commerce is a booming industry you can easily join. For Q2 of 2022, e-commerce sales skyrocketed to over $257 billion. Want in on the action? Start an online store, focus on user experience, and don’t forget about search engine optimization (SEO) research.

- Social media is a great way to find new customers. Ninety-three percent of marketers are using social media for their business. Find the right platform for your business or industry, and be authentic!

- Your town or region is overflowing with unique character. Embrace your customers where they live. Local holidays and events are a great way to let your customers know you care.

- The in-store shopping experience is just as important. Shopping isn’t just about buying the perfect item. It’s about the experience. Keep your customers’ experience in mind when cleaning, arranging, and organizing your store or office.

5. Choose the right payroll cycle

Depending on your business, one payroll cycle may be better than the other. For instance, if your business has a slower revenue stream, paying monthly may be easier than paying weekly. On the other hand, if your business has a fast revenue stream (e.g., restaurant) you may prefer a weekly or biweekly payroll cycle.

If you have a slower revenue stream and pay too often, you may be short on cash. Balance your revenue and wages by picking a payroll cycle that fits your business’s income and needs.

Keep in mind that you may not have a say in your pay frequency. Check with your state’s Department of Labor for any requirements you need to follow about payroll frequency.

6. Early payment discounts

Don’t let customers hold on to the money they owe you. Late-paying customers can slow down your cash flow. Consider offering customers early payment discounts to get them to pay you more quickly.

You may be able to benefit from early payment discounts, too. Your vendors may offer early payment discounts you don’t know about. Be on the lookout for early payment discounts you can take advantage of. But, keep in mind that paying too much debt too quickly is an easy way to burn through your funds.

7. Don’t let late payments fall to the wayside

Even with early payment discounts, some customers just don’t pay on time. Again, late-paying customers can hurt your cash flow. To ensure you receive payments, you may need to take other actions, like sending reminders or collection letters.

Remind customers about how much they owe you a few days before the invoice’s due date and after the due date passes. If your payments are still nowhere to be found, send a collection letter to the customer.

Make sure the collection letter includes:

- Amount the customer owes

- Items purchased

- Payment instructions

Keep in mind that collection agencies typically keep a portion of the amount owed. You may find that the cost of using a collection agency isn’t worth it.

8. Keep a cash reserve

A cash flow statement and a budget can help you manage your cash flow. But, they work best when things go according to plan. And when things don’t go according to plan, that’s when a cash reserve can come into play.

Unexpected expenses come up in business. Keep a small business cash reserve to help things run smoothly and deal with unexpected expenses. Think of your cash reserve as a rainy day fund for when things get tough.

9. Get through periods of low cash

If you suddenly find yourself short on cash, don’t panic. Sometimes, having low funds is simply part of running a business. But when it gets too close for comfort, there are several steps you can take to stay afloat.

If you need to take care of a cash shortfall, consider using:

- Small business line of credit

- Business credit card

- Short-term loans for working capital

Staying on top of your business accounts can seem like a full-time job. Patriot’s accounting software makes your life easier by tracking your cash flow and providing accurate financial reports. To top it all off? You get free, USA-based, expert support. Get your free trial today!

This article is updated from its original publication date 11/8/2016.

This is not intended as legal advice; for more information, please click here.