The fitness and wellness industry is a broad and diverse sector that encompasses various products, services and activities that aim to improve the physical, mental and emotional health of consumers. In 2023, the industry faced many challenges and opportunities as it adapted to the changing needs and preferences of consumers in the wake of the Covid-19 pandemic. This report will provide an overview of the main trends, innovations and developments that shaped the fitness and wellness industry in 2023.

Market Size and Growth

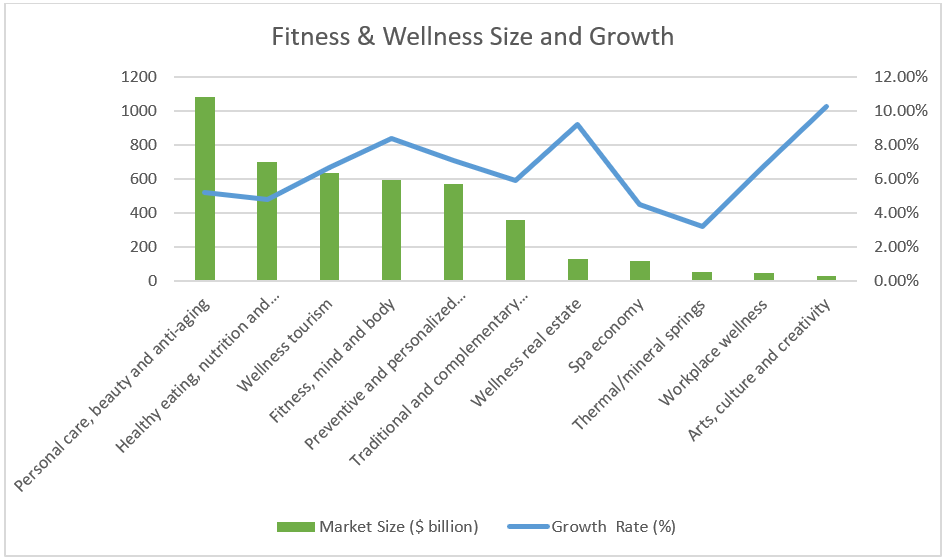

According to the Global Wellness Institute (GWI), the global wellness economy was valued at $4.5 trillion in 2023, growing by 6.4% annually since 2019. The wellness economy includes 11 segments: personal care, beauty and anti-aging; healthy eating, nutrition and weight loss; wellness tourism; fitness, mind and body; preventive and personalized medicine and public health; traditional and complementary medicine; wellness real estate; spa economy; thermal/mineral springs; workplace wellness; and arts, culture and creativity.

The following table shows the market size and growth rate of each segment in 2023:

The fitness, mind and body segment was one of the fastest-growing segments in the wellness economy, driven by the increasing demand for physical activity, mental health and mindfulness solutions among consumers. The segment includes various sub-segments such as gyms, fitness studios, fitness equipment, fitness apps, online platforms, wearable devices, yoga, meditation, tai chi, pilates, etc.

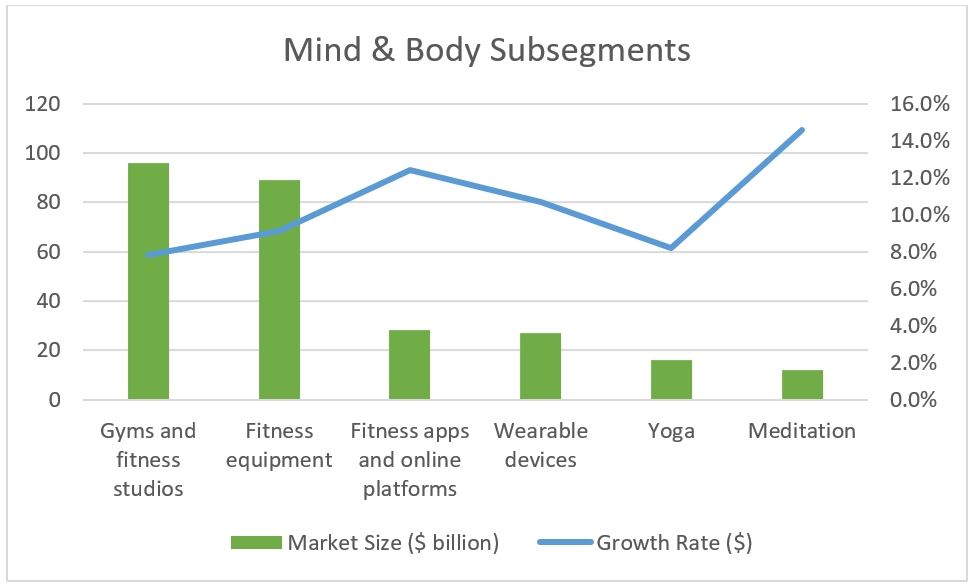

The following table shows the market size and growth rate of some of the sub-segments in the fitness, mind and body segment in 2023:

Key Trends

Some of the key trends that influenced the fitness and wellness industry in 2023 were:

- Personalization: Consumers sought more personalized products and services that catered to their individual needs, preferences and goals. Brands leveraged data, technology and innovation to offer customized solutions such as supplements, diets, workouts, coaching, etc.

- Digitalization: The Covid-19 pandemic accelerated the adoption of digital platforms and tools for fitness and wellness purposes. Consumers used apps, online platforms, wearable devices, virtual reality, etc., to access fitness and wellness content, services and products anytime and anywhere.

- Holistic approach: Consumers became more aware of the interconnection between physical, mental and emotional health. Brands offered holistic solutions that addressed multiple aspects of wellness such as nutrition, physical activity, emotional wellbeing and sleep.

- Socialization: Consumers sought more social interaction and community support for their fitness and wellness journeys. Brands facilitated social engagement through online platforms, gamification, group classes, events, etc.

- Sustainability: Consumers became more conscious of the environmental impact of their fitness and wellness choices. Brands adopted more sustainable practices such as using eco-friendly materials, reducing waste, supporting local communities, etc.

Key Innovations

Some of the key innovations that emerged or gained popularity in the fitness and wellness industry in 2023 were:

- Genetic testing: Some brands used genetic testing to provide personalized recommendations for nutrition, fitness and health based on consumers' DNA profiles.

- Artificial intelligence: Some brands used artificial intelligence to analyze data, generate insights, create content, provide feedback and optimize outcomes for consumers.

- Biometric feedback: Some brands used biometric feedback to measure consumers' physiological responses such as heart rate, blood pressure, stress level, etc., and adjust their fitness and wellness programs accordingly.

- Smart clothing: Some brands developed smart clothing that integrated sensors, electronics and software to monitor consumers' health and performance, provide feedback and guidance, and enhance comfort and functionality.

- Neurostimulation: Some brands used neurostimulation to modulate consumers' brain activity and influence their mood, cognition, motivation, etc., for fitness and wellness purposes.

Key Developments

Some of the key developments that occurred or were announced in the fitness and wellness industry in 2023 were:

- Mergers and acquisitions: The fitness and wellness industry witnessed several mergers and acquisitions as brands sought to expand their offerings, reach new markets, access new technologies and gain competitive advantages. Some of the notable deals were:

- Peloton and Lululemon entered into a five-year strategic global partnership in which Peloton will become Lululemon’s exclusive digital fitness content provider and Lululemon will be the primary athletic apparel partner for Peloton.

- EGYM, the global fitness technology and corporate health innovation leader, is raising up to €207 million in growth capital from its new investor Affinity Partners, a global investment firm based in Miami, USA, as well as from existing investors Mayfair Equity Partners, and Bayern Kapital in a Series F financing round.

- WW (formerly Weight Watchers) signed an agreement toacquire telehealth platform Weekend Health, also known as Sequence, for $106 million.

- New products and services: The fitness and wellness industry saw the launch of many new products and services that aimed to meet the evolving needs and preferences of consumers. Some of the notable launches were:

- Apple Fitness+, a subscription-based service that offered access to a variety of workouts led by expert trainers, integrated with Apple Watch and other Apple devices.

- Nike Adapt, a line of smart shoes that automatically adjusted to consumers' feet size, shape and activity level, using sensors and motors.

- Fitbit Luxe, a premium fitness tracker that featured a sleek design, a color touchscreen, advanced health metrics and stress management tools.

- SoulCycle at Home, a home version of the popular indoor cycling studio that offered live and on-demand classes, music playlists and community features.

- Regulations and policies: The fitness and wellness industry faced some regulatory and policy changes that affected its operations and growth. Some of the notable changes were:

- The FDA approved Ozempic, a new injectable drug for weight loss that reduced appetite and increased metabolism.

- The EU implemented the Green Deal, a set of policies that aimed to make Europe carbon-neutral by 2050, which impacted the environmental standards and practices of fitness and wellness brands.

- The WHO issued new guidelines for physical activity and sedentary behavior, which recommended at least 150 minutes of moderate-intensity or 75 minutes of vigorous-intensity physical activity per week for adults.

Key Reflections

The fitness and wellness industry experienced significant growth, innovation and transformation in 2023. The industry responded to the changing needs and preferences of consumers who sought more personalized, digital, holistic, social and sustainable solutions for their fitness and wellness goals. The industry also faced some challenges such as competition, regulation and uncertainty due to the Covid-19 pandemic. The industry is expected to continue to evolve and expand in the coming years as new technologies, trends and opportunities emerge.

Author: Mike Tiplady, CPA | mtiplady@withum.com

Contact Us

Reach out to Withum’s Fitness and Wellness Services Team for more information on how we can help.