In today’s competitive business landscape, mergers and acquisitions (M&A) have become a crucial growth and value-creation strategy. As buyers navigate the complexities of deal-making, contingent consideration (AKA earn-outs) can provide a powerful tool to bridge valuation gaps and align interests between buyers and sellers. With the support of experienced valuation specialists, such as those at Withum, you can optimize your acquisition strategy and unlock the full potential of contingent consideration. This article will explore the benefits of incorporating contingent consideration in your acquisition strategy and provide examples of various structures to help you make informed decisions.

5 Benefits of Contingent Consideration

- Aligning Interests: Contingent consideration aligns the interests of both parties by linking part of the seller's compensation to the future performance of the acquired business. This incentivizes the seller to contribute to the success of the company post-acquisition, ensuring a smoother integration and maximizing value creation.

- Mitigating Risk: Earn-outs can help buyers mitigate the risk of overpaying for a target company by tying a portion of the purchase price to the achievement of specific financial or operational milestones. This reduces the upfront cash outlay and protects the buyer if the acquired business underperforms.

- Bridging Valuation Gaps: Contingent consideration can help bridge valuation gaps between buyers and sellers, particularly in situations where there is uncertainty around the target company's future performance. By linking the final purchase price to future results, both parties can reach a mutually agreeable valuation.

- Facilitating Deal Closure: Earn-outs can help facilitate deal closure by providing a flexible mechanism to address potential disagreements on valuation or future performance expectations. This can expedite negotiations and lead to a more efficient deal-making process.

- Structure is Flexible: Contingent consideration structures can be customized to suit the specific needs and objectives of both the buyer and the seller. This flexibility allows parties to design earn-outs that address unique challenges, such as industry-specific risks, growth potential, or integration concerns, ultimately leading to a more successful acquisition outcome.

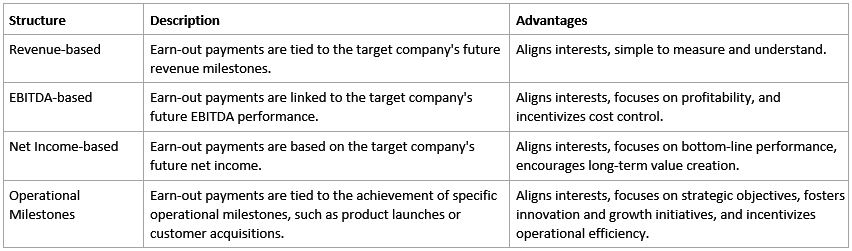

Examples of Contingent Consideration Structures

The following table outlines various contingent consideration structures that can be tailored to suit the specific needs of your acquisition:

Incorporating contingent consideration in your acquisition strategy can provide significant benefits, including aligning interests, mitigating risk, bridging valuation gaps, facilitating deal closure, and can be structured with flexibility. By carefully selecting the appropriate earn-out structure, buyers can unlock value and drive successful M&A outcomes.

How Withum’s Valuation Experts Can Help

To further enhance the effectiveness of your contingent consideration strategy, consulting a valuation specialist at Withum can provide invaluable insights and guidance. Withum’s team of valuation experts can help you:

- Determine the appropriate earn-out structure by assessing your unique situation and recommend the most suitable contingent consideration structure, considering factors such as industry dynamics, target company performance, and deal-specific objectives.

- Establish performance milestones that incentivize the seller while protecting the buyer's interests.

- Fair value the earn-out for financial reporting purposes to ensure compliance under ASC 805 audit standards.

By leveraging the expertise of Withum’s valuation specialists with knowledge of the Appraisal Foundation’s contingent consideration guidance, you can optimize your strategy, ensuring a smoother acquisition process and maximizing value creation for all parties involved.

Author: Benjamin Rodriguez | [email protected]

Contact Us

For more information on this topic, please contact a member of Withum’s Forensic and Valuation Services Team.