For scaling businesses, invoice payments rapidly grow in volume and complexity. However, many companies still rely on manual processes to manage accounts payable—and these outdated practices are causing problems across their financial operations.

A manual approach slows down the payment process and increases the risk of errors and fraud while jeopardizing relationships with strategic vendors. AP teams already deal with limited resources and reduced headcounts. Now, they’re under greater pressure to ensure timely, accurate payments that can keep up with high volumes and demand.

The question is: How can businesses achieve the efficiency, accuracy, and speed necessary to manage high-volume AP? By applying AP best practices and integrating advanced automation solutions, businesses can streamline payment transactions and empower their teams to manage financial operations effectively, no matter the scale.

Key takeaways

- Managing high-volume AP is crucial for businesses because it impacts a company’s cash flow management, accurate financial reporting, and relationships with suppliers and vendors.

- Manual, paper-based processes are time-consuming and error-prone, leading to late payments and other disruptions. End-to-end automation enables businesses to efficiently process invoices and pay vendors quickly and easily.

- By adhering to AP best practices, businesses can enhance efficiency, improve accuracy, and streamline the entire AP process.

An overview of high-volume accounts payable

High-volume AP involves managing a large number of invoices and payments. This process encompasses invoice processing, verification, approval, and payment execution.

Managing high-volume accounts payable is crucial because it impacts a company’s cash flow management, financial reporting accuracy, and relationships with suppliers and vendors. Efficient processing, approval, and payment execution help minimize errors, reduce fraud risks, and ensure timely payments, which are vital for maintaining good vendor relations, operational efficiency, and financial stability.

The steps in processing invoice payments

The invoice approval workflow enables teams to review, approve, and process invoices for payment. Although this process may vary depending on your company’s specific policies and procedures, it typically involves the following five steps:

- Invoice capture

- Invoice approval

- Payment authorization

- Payment execution

- AP analytics

1. Invoice capture

First, invoices are received through various means such as mail, fax, email, or web portal and entered into the AP system manually or via automated capture. Challenges can arise in this step if there is no set process for receiving invoices or companies have multiple locations. Manual data entry is also prone to error.

Companies taking an automated approach to invoice capture typically leverage technology such as OCR. However, this technology can have limitations since it delivers a lower accuracy rating than other solutions. Many OCR technology platforms advertise an 85%-90% accuracy rating. However, this rate still implies that one (or more) out of every 10 invoices contains errors. Even if the accuracy rating is higher, there may be limitations in capturing the information, with some solutions not being able to dissect line item data from the rest of the invoice

2. Invoice approval

Once the invoice is in the system, the details and amounts on the invoice are verified and approved. This step may require coding or PO matching. If handled manually, this step may require AP teams to physically carry an invoice from desk to desk to get signatures. If automated, the invoice approval requests are automatically routed to the right people. The right AP automation solution will also enable decision makers to review and approve invoices digitally via email, so they don’t need to sign into complicated systems to approve payments

3. Payment authorization

Before payments can be made, they must be authorized by a controller or CFO. This can be done manually, via email, or with the help of AP automation.

4. Payment execution

Approved payments are executed by rendering payment using methods preferred by the AP department and the supplier, such as checks, ACH, virtual cards, or another method. However, manual processes may lead to separate workflows for the accounts payable team. The AP check run, in particular,. For some companies, this is the last step in the process.

Did you know? It costs between $4 and $20 to prepare each check, including labor, materials, and postage. But that’s not all–checks are the most vulnerable payment method when it comes to fraud. In fact, check fraud is expected to reach $24B in 2024.

5. AP analytics

Companies that use an AP automation technology platform can access analytics for real-time data on AP metrics, aiding in strategic decision-making and operational improvements. AP analytics and reporting can help teams optimize the payment mix, better forecast accounts payable, or take advantage of early-payment discounts.

Challenges in managing high-volume AP

High-volume AP comes with its own challenges. Paper-based processes and manual invoice approval workflows can lead to delays and disruptions, such as lost or duplicate invoices, delayed payments, and increased risk of errors. Here are some top challenges in managing high-volume AP:

- The ability to scale

- Reaching sales goals

- International payments

- Payment methods

- Late or duplicate payments

1. The ability to scale

Companies often struggle to scale their AP processes. According to PYMNTS, 98% of companies with a high number of payments say they will not reach business goals related to growth if they can’t handle increases in AP. Failure to scale these processes can severely limit your operational flexibility and growth potential, negatively impacting your ability to achieve strategic business objectives and maintain a competitive edge.

Case study: Forge Biologics Supports Explosive Business Growth with MineralTree

When Forge Biologics experienced rapid growth, going from 30 to 200 employees in an 18-month window, they knew the business needed a new strategy for addressing accounts payable.

As Steve Goden, SVP of finance and operations, explained, “On-time payments are important to companies in any industry, but they are especially vital to biotech firms like us, especially as we enter the early stages of high growth. For example, when we need a referral from a supplier, we want them to be happy and able to recommend us. Paying suppliers on time goes a long way to maintaining the positive relationships that can drive our business forward.”

Forge Biologics invested in MineralTree as its AP automation solution. They are able to process invoice payments faster and Goden noted that they didn’t need to increase headcount to do so. “If we attempted to keep using our past approach, we would need at least two more AP headcount to manage the growing volume of invoices.” AP automation can help companies adjust to the growing needs of the business while improving important vendor relationships. Read the full case study here.

2. Reaching sales goals

Inefficiencies and delays in processing payments can also strain vendor relationships and disrupt supply chains, hindering your capacity to meet market demands. This can directly impact your ability to reach sales goals and company objectives. A PYMNTS’ study found that 97% of companies said it would be challenging for their company to meet their sales goals if they could not handle the volume of AP.

3. International payments

As companies grow, they are often required to pay vendors across the globe. However, managing high-volume AP is particularly challenging with international payments, as it introduces complexities related to currency exchange rates, compliance with various international regulations, and the logistical difficulties of executing cross-border transactions efficiently. These factors can significantly increase the burden and risk of international business.

4. Payment methods

You have more options than ever for paying invoices. For many teams, paying strategic vendors in their preferred format is a priority. However, each payment method typically requires a new workflow, which can complicate processing systems, require additional resources and time, and strain your already overloaded AP teams.

AP teams and vendors often prefer digital payments, but optimizing the payment mix can be difficult. About 71% of companies surveyed want to convert more AP spend to electronic payment methods. However, 40.4% of businesses noted that vendor enrollment is a challenge. This process can be time consuming, especially for departments with a high number of invoices. The right AP automation platform will be a collaborative partner that can help enroll vendors in digital payment methods.

Since 93.3% of companies use paper checks in at least a portion of their payment mix, ensuring that the AP check run is easy for the team is important. With AP automation, teams can use one workflow to cover a range of payment types.

5. Late or duplicate payments

Paper-based methods and manual workflows can lead to lost invoices and late payments. Vendors may not get paid on time because invoices get sent to the wrong office, or there may be duplicate payments since vendors may send invoices via multiple means. These issues strain vendor relationships and increase the administrative burden on your AP department to rectify errors and track down misplaced invoices.

4 tips for managing high-volume accounts payable

Making invoice payments on time is a crucial function of any business. When managing high-volume AP, you need processes and practices that can enhance efficiency, accuracy, and the overall management of financial operations. We compiled a list of 4 tips to help you level up high-volume AP below.

1. Improve the invoice approval process

Streamlining the invoice approval processes can significantly enhance efficiency while reducing errors and delays and enabling remote operations. By transitioning from manual, paper-based processes to advanced automation solutions, you can directly route invoices to the right stakeholder for approval with scheduled follow-up reminders as needed. This approach allows approvers to review and approve invoices from anywhere on any device connected to the internet. As a result, your teams can scale efficient AP processes in remote work environments.

2. Optimize payment methods using analytics

You can optimize payment methods using AP analytics to analyze payment trends and supplier preferences, helping teams reduce costs and boost operational efficiency. By leveraging payment analytics, your AP team gains actionable insights to improve and innovate operations.

Teams can use analytics to forecast accounts payable, better manage cash, or optimize the payment mix. This approach ensures a seamless and strategic transition that aligns with supplier capabilities and preferences.

3. Convert check spend to virtual card

Converting check spend to virtual cards is a strategic move to efficiently manage high-volume AP. Virtual cards offer a secure and efficient alternative to traditional payment methods, providing rebates and cost savings that benefit the bottom line. Virtual cards are also a more secure payment method.

Consider the case of Quartzy—a distributor that provides millions of life science products to thousands of leading brands, labs, and research groups—which transferred to MineralTree’s SilverPay virtual card. The virtual card gave Quartzy a quick, easy way to pay suppliers while earning cash-back rebates from its AP. MineralTree even identified and integrated additional suppliers willing to accept virtual cards, enabling Quartzy to add $100,000 in rebates. Read the full case study here.

4. Embrace the cloud

Cloud-based AP makes it easier to manage and track invoices, while ensuring vendors are paid on time. It also offers flexibiltiy to accounts payable teams, who may be working in a hybrid environment or who may have multiple office locations.

5. Automate the end-to-end process

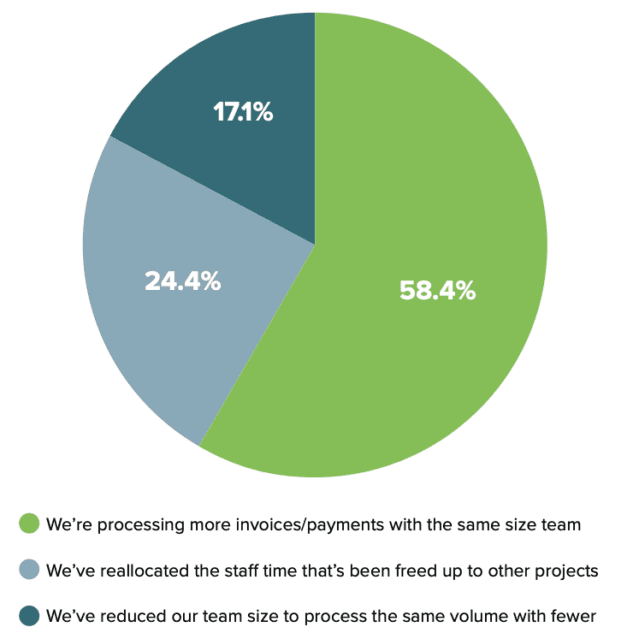

Advanced AP automation is the most effective way for finance teams to do more with less. According to MineralTree’s recent State of AP Report, 58.4% of AP teams are managing more invoices with the same size team since automating their process.

Automation enables your team to efficiently process invoices and pay vendors quickly and easily—streamlining the end-to-end AP process from invoice capture and approval through payment processing and reconciliation. That includes features like automatic invoice routing, approval reminders, and other operations that can scale as your organization grows. It’s no wonder why most companies say AP is the most important function in finance to automate.

Final thoughts

It’s time to move away from manual processes. Integrating end-to-end automation can enhance operational efficiency, reduce costs, and strengthen crucial supplier relationships for high-volume AP processes.

MineralTree can help businesses manage large amounts of invoices. By removing manual steps, your AP team will be more efficient, allowing team members to focus on strategic initiatives.

As your collaborative partner, MineralTree can help enroll vendors into virtual cards. The forward pay feature allows companies to be strategic about their DPO, and the in-depth payment analytics help companies make better decisions. Additionally, MineralTree integrates with numerous ERPs so that your ERP remains the system of record. There are also resources available for scaling companies for ERP migrations. MineralTree’s pricing model doesn’t focus on the number of users, so your entire team can access the platform.

Learn more about how MineralTree can help your organization streamline its AP management process today. Schedule a demo today.

High volume accounts payable FAQs

1. What is considered high volume accounts payable?

What’s considered high volume can vary significantly between organizations, depending on industry, company size, and financial operations. Generally, high-volume AP is characterized by processing hundreds to thousands of invoices monthly. High-volume AP demands efficient, often automated systems to manage, ensuring accuracy, timely payments, and effective cash flow management.

2. What metrics are important in accounts payable?

Key AP metrics include invoice processing time, cost per invoice, payment accuracy rate, and the percentage of invoices linked to purchase orders. These metrics collectively help assess efficiency, cost-effectiveness, and the overall health of the AP process.