Like most professionals, lawyers think if they do good work (and a lot of it), good things (like revenue) will happen. Sometimes good things do happen, but to ensure steady growth, every firm needs to focus on value drivers.

But lawyers don’t create firms because they love balance sheets, data entry and double-entry accounting. Often times, the attorneys that decide to strike out on their own are doing so because they truly love the practice of law, not the work of running a business.

At first, they’ll succeed thanks to their talent and hard work. But at a certain point, they’ll grow to a size where they can’t get any further on their own — or they realize that they need more than just the latest version of some law firm accounting software.

That’s where a virtual CFO comes in: A consultant whose entire focus is the financial health of the company.

From a financial perspective, the fundamentals of a legal practice are similar to other service-based companies.

But a sound grasp of accounting practices is only table-stakes for a virtual CFO. Think of a VCFO as a non-voting member of the management committee: someone to consult on high level business decisions in every area of a law firm management from staffing to technology to client relations.

What Size Law Firm Benefits from Virtual CFO Services?

Small to mid-sized firms and firms in a major growth stage are best suited to working with a Virtual CFO.

Smaller firms with under five partners will have a bookkeeper who knows QuickBooks or some other accounting software or look for support from a dedicated law firm bookkeeping service; they might also be getting some dedicated help with tax planning already.

They may not be getting the best, timeliest information about the firm’s finances, but by the end of the year, they’ll get there. They most likely use cash basis accounting, rather than running their statements using both accrual (for forecasting) and cash (for tax purposes).

At around five partners, firms often hire a controller, which means they might develop a more sophisticated accounting system, but they’ll still lack strategic advising. Then, once a firm hits 30 partners, they often have a full finance department; however, those firms could benefit from advisory services, especially if their finance department isn’t trained to focus on the right things.

Bottom line: Law practices in the $3-$30 million range of revenue is the sweet spot for offering Virtual CFO services. They’re not big enough to afford a full-time CFO as well as an accounting team (controller, accounts receivable, etc.), but they want to move beyond record-keeping and towards something more sophisticated.

What Are Law Firm Metrics?

Metrics are at the heart of profit-focused law firm accounting, which should:

- Help law firms accomplish financial goals by breaking down their revenue into non-financial drivers.

- Can be consistently controlled and monitored through clear metrics that are then used to determine a firm’s revenue forecast.

- Uses the amount of expected revenue in the firm’s pipeline to inform and adjust the forecast.

The typical metrics used in law firm accounting are:

- cash

- financials

- production

- pipeline

We’ll break them down below.

Law Firm Accounting Metrics: Cash

Strong accounting starts with having several dedicated bank accounts:

- A general cash account for day-to-day operating expenses. Reconcile financial transactions (cash and credit cards) on a weekly basis.

- Cash reserves for partner tax distributions and any other large investment the firm is considering, whether it’s an office build-out or expansion, or a new investment in technology. Together, these two accounts should amount to 10-30% of annualized revenue. The exact amount depends on a firm’s risk profile, as we discuss below.

- A client trust account [also know as an iolta account]: When a firm takes possession of client money, such as settlements or retainers, this account is required to segregate and account for client funds. It’s a mirror image of the client retainer liability account on the balance sheet. According to the State Bar Association, lawyers’ trust accounts are required to perform a three-way trust reconciliation every 30-90 days. These three-way reconciliations must be available on demand, in the case of an audit.

Working Capital Targets

The operating account, combined with the cash reserve account, is considered working capital. Together, these financial accounts safeguard a firm against unforeseen events. To calculate a safe balance, there are two questions to consider:

- Operating expenses: operating costs (rent/mortgage, utilities, maintenance/repairs, office expenses, payroll, subscriptions, professional dues, insurance), tax distribution to partners, distribution of profit to partners.

- The length of the cash cycle: How many days does it take the firm to convert effort into cash from the day the client engages to the day their payment hits the checking account. A firm that bills monthly with 30-day payment terms would have a 60+ day cash cycle. Contingent firms could have a 18-month+ day cash cycle.

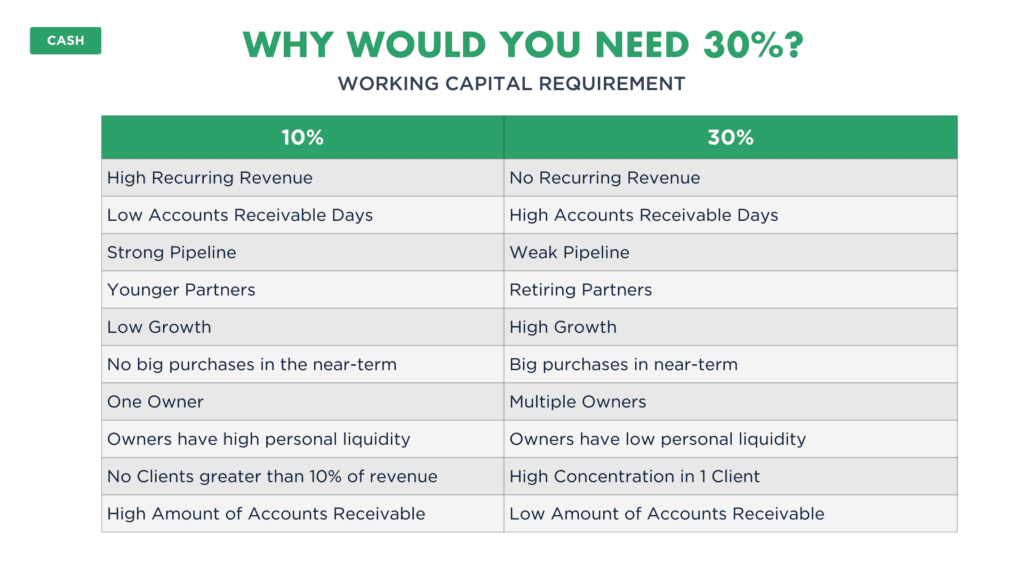

This information informs working capital targets which should be from 10-30%:

On the 10% end of the spectrum: Firms that bill hourly and have good billing practices with a short cash cycle can convert effort into cash relatively quickly; firms with annuity work that don’t need to depend on finding new clients.

On the 30% end of the spectrum: Firms that are less disciplined in their billing and have higher cash needs; firms that have most of their work concentrated in just a few clients; contingent firms.

Other factors to consider:

What is the economic climate like, as it relates to the firm’s area(s) of practice? If there is the risk of a downturn, a higher balance in the cash reserve account is a source of protection.

What are the firm’s long-range plans? Firms in high-growth mode need more cash to get new space or make an acquisition. Cash reserves need to account for partners’ exits, planned or not.

Cash flow management is the lifeblood of a healthy firm: Not only does it ensure there is enough in the bank to keep the lights on, it also makes sure there’s enough to distribute to the partners for quarterly estimated tax filing. It’s also essential for knowing how much excess cash can be distributed to equity partners: Once that money goes out the door and into the partners’ accounts, it’s not coming back.

Law Firm Metrics: Financial Data

When we look at law firm financial metrics, we always want to be using accrual-based profit and loss.

We start with revenue, subtract labor and burden (salaries of billing employees plus benefits) to establish gross profit.

Then, we subtract overhead (administrative, marketing and facility costs, including related salaries and benefits), to yield net income.

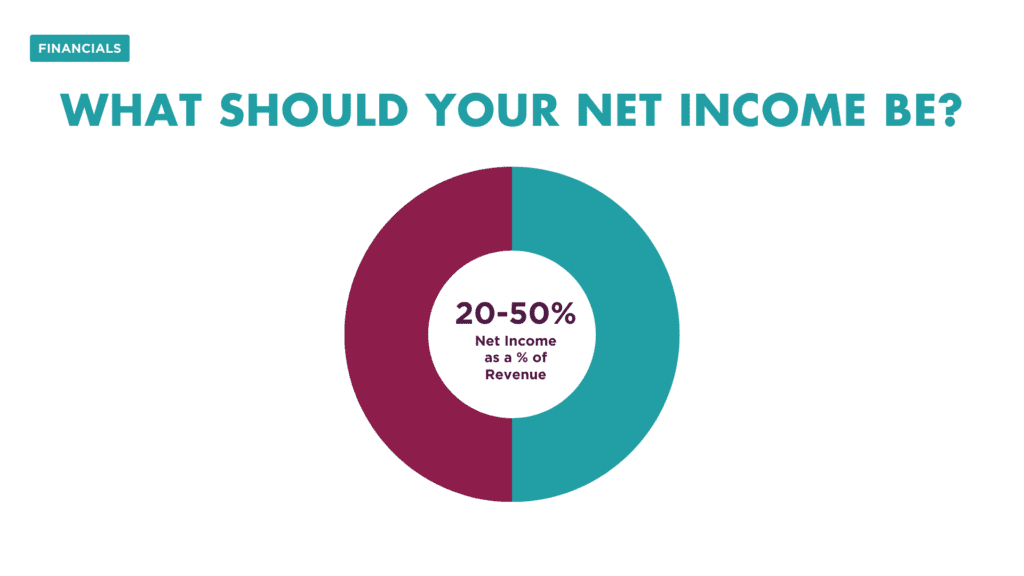

How much profit should a firm be making? Net income could be anywhere between 20-50% of revenue.

Law Firm Metrics: Production

A solid grasp of a firm’s potential for production starts with time-tracking: a practice management tool like Clio or Practice Panther makes it easy, and the insight that comes from developing a day-to-day time-tracking habit is invaluable. Is everyone in the firm hitting their billable hours? Can the firm reach its growth goals with the current number of full-time employees (FTEs) or is it time to hire?

A lot of firms focus on their standard bill rate, but with production metrics it’s possible to hone in on what really matters: average bill rate and effective bill rate. How much is the firm actually bringing in for every hour worked? If that number is lower than expected, that’s an area to focus on, rather than raising the standard rate.

Production metrics are also invaluable to help guide decisions in terms of changes the firm might want to make to charge hour expectations or PTO: With this metric it’s possible to calculate the cost of small changes across the firm.

Pipeline

Pipeline is another way to talk about capacity. Is there enough work for the current staff? Does the firm need more clients — or more FTEs? How many months of work are currently under engagement?

With pipeline metrics, firms can measure their success at getting and retaining clients.

To calculate pipeline metrics, a firm must calculate its capacity: the amount of engaged work compared to the expected charge hours of each member of the firm.

If that percentage is low, it means effort needs to be directed towards marketing; if that percentage is high, it might be time to hire new staff, streamline processes, or let go of lower-level clients (ideally with a referral to a reputable firm).

The other important component of pipeline is to know: How long does it take to move from the client’s initial outreach to signing an engagement letter?

To find this out, we recommend dividing prospective clients into multiple stages, depending on how close they are to signing on. These markers allow firms to measure how long it takes for a prospective client to become a client or a lost opportunity. This level of granular detail also allows firms to look for any ‘leaks’ in the pipeline: places where a large number of prospective clients tend to get lost. That will help determine if there’s an issue with pricing, messaging or communication, for example.

By measuring the segments, a firm gets two metrics: the closing percentage, i.e., the number of opportunities that enter the pipeline that are converted into clients (clients/opportunities) and the days it takes to convert a lead into a customer (average sales cycle).

Metrics and Financial Forecasting

Together, these metrics form the basis of dynamic forecasting. Updated in realtime to compare projected and actual revenue, the forecast is forward-looking accounting. It allows a firm to proactively plan for growth goals and to react quickly to any unforeseen roadblocks — whether individual, industry-wide or broad economic issues. On the flip side, it ensures a firm can make the most of potential opportunities, for example, having enough cash in a downturn to take advantage of well-price expansion opportunities or to hire top talent that was let go elsewhere.

Meet Regularly with Your Virtual CFO

Law firms who use traditional legal accounting services might be surprised at the frequency of meetings with their virtual CFO. For busy legal professionals, it might feel time-consuming at first, but weekly or bimonthly meetings allow a virtual CFO to move beyond the typical limitations of traditional accounting and become a strategic advisor. These weekly meetings aren’t just presentations of spreadsheets; they are deep dives into the opportunities and challenges that the firm is facing.

A typical month will start with a look at pipeline (three months and beyond). Week 2 will focus on forecast. Week three is a review of the financial reports from the previous month with a focus on KPIs. Week 4 allows for attention to special projects. (When we do bi-monthly meetings, we do a forecast and a financial statement meeting.)

The Benefits of Weekly Meetings with a Virtual CFO Include:

Accountability: When attorneys stay on top of their cash, they quickly learn the benefits of making sure all their partners are billing regularly. Clients don’t just send checks; every partner has to bill and collect on a regular basis.

Regular bank reconciliations: Without regular reconciliations, it’s impossible to determine if that “extra” cash sitting in the bank account is available for distribution. Weekly cash flow meetings show not just want happened last week but also helps keep tabs on big, expected receivables. That information allows partners to make educated decisions about the need to draw on a line of credit or to invest time in tightening up on billing practices.

Confident distributions: With an understanding of a 13-week cash flow, partners can get comfortable making distributions, since they know their cash position at all times.

Zero-in on Leverage

Of all the KPIs law firms need to work on, leverage is one of the biggest. If you look at the structure of a CPA firm, leverage might be one partner to ten non-partners. The legal industry tends to have much lower ratios: One attorney I know admitted their firm’s ratio was .9, which means they had more partners than staff.

On the one hand, this means lawyers are keeping tight watch on their cases. That’s not a bad thing, by any means. Doing good work is how they got to where they are today. On the other hand, it means they aren’t training their staff to streamline their workflow, growing their firm, or doing higher level client work. They probably feel a little bit like they’re on a hamster wheel.

If a firm is willing to invest in training junior colleagues, they’ll see the short-term “loss” of time repay itself when they’re able to pass down work on a weekly basis. A well-leveraged firm will see overall productivity going up – both in quality of work and number of billable hours.

If you’d like to learn more about virtual CFO services for law firms, you can visit our service offerings page.

All Insights