As a busy business owner, you’re always looking for ways to save your time and money. And, you certainly don’t want to waste your precious time, energy, and hard-earned cash on accounting tasks. The solution? Accounting software.

Along with saving your money and time, there are plenty of other advantages of accounting software. Ready to find out what they are?

Types of accounting software: Overview

Before we dive into the benefits of accounting software, let’s quickly go over what accounting software is.

Accounting software can be cloud-based (aka online). Or, you can get downloadable software that you store on a device, like your computer.

Cloud accounting software securely stores all of your information in the cloud. Because it’s all online, you can easily access your books on the go. Plus, you don’t have to worry about doing manual updates or downloading anything. Desktop accounting software requires you to download and store the software on your computer. With desktop accounting, you’re responsible for backing up your accounting data and doing regular updates.

Accounting software can also vary based on complexity. For example, if you’re a new business just starting out, you may want to get a basic accounting software package. On the other hand, if you’re an experienced entrepreneur, you may need something with more advanced accounts, like premium accounting.

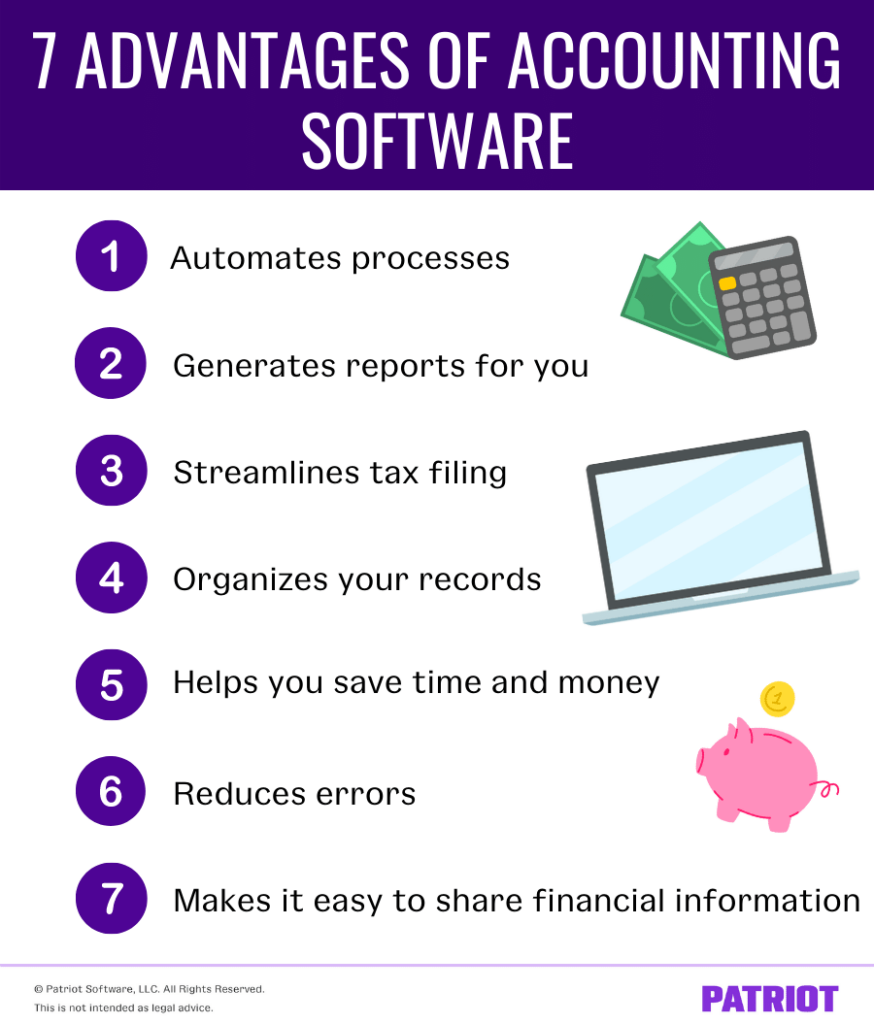

Advantages of accounting software

Whether you’re starting your first business venture or have been in business for years, there are countless advantages of using accounting software. Here are seven benefits of accounting software for small businesses to keep in mind.

1. Automates processes

Nowadays, automation is everything. And with accounting software, you can automate a ton of processes and stop wasting time on manual tasks.

Here are just some of the processes you can automate with accounting software:

- Invoicing

- Credit card payments

- Payment reminders

- Importing data

2. Generates reports for you

When it comes to managing your business’s books, you need an easy way to create and pull financial reports. This is where accounting software can come in handy.

Accounting software makes it a snap to gather financial reports and information for your business. Need to see your accounts receivable? There’s a report for that. Want to see account trial balances? There’s a report for that, too.

Compiling information for a spreadsheet by hand can take up hours of your day. With accounting software, getting the report you need can be done with just a couple of clicks.

3. Streamlines tax filing

Tax time can be stressful enough as is. And, throwing in extra work, like putting together reports and compiling financial data, can make it even more of a burden. To help streamline tax filing, use accounting software.

Accounting software allows you to store receipts, invoices, and income statements all in one platform—making it a lifesaver for the tax season. Instead of scrambling to gather everything for tax filing, you can conveniently access it in one spot with accounting software.

4. Organizes your records

The last thing you want as a business owner is sloppy books. To help keep your accounting books nice and tidy, use accounting software.

Accounting software makes it easy to organize your accounts, receipts, invoices, and other records. That way, you don’t have to scramble to find information or stress about inaccurate records.

5. Helps you save time and money

As a business owner, there’s nothing more precious than your time and money. It’s what helps keep your business’s doors open, after all. And with accounting software, you can get back more time in your day and cut costs.

Accounting software lets you streamline your accounting processes to save time. Features like invoice payment reminders and the ability to receive credit card payments can automate tasks and put more time back into your day. And depending on the software you select, you can cut costs associated with accounting and ditch expensive software solutions. Talk about a win-win.

6. Reduces errors

Let’s face it: mistakes happen—especially when you’re dealing with a whole lot of numbers and some confusing accounting rules. Luckily, accounting software can help your business reduce errors (and headaches).

Some common accounting mistakes include:

- Making transposition errors (e.g., writing 52 instead of 25)

- Reversing entries (e.g., credit instead of debit)

- Making errors of omission

- Not reconciling your books

With accounting software, you can avoid making blunders in your books. And therefore, keep your books accurate and organized.

7. Makes it easy to share financial information

Have an accountant who helps you with certain aspects of your books? If so, accounting software can make it a breeze to share financial information with your accountant.

With accounting software, you have every aspect of your books right at your fingertips. This makes it easy to gather reports and other information for your accountant. And depending on your accounting software provider, you may even be able to give your accountant direct access to your books (e.g., separate login).

Need an easy way to track your business’s income and expenses? Say hello to Patriot’s easy-to-use online accounting software. Get in, get out, and get back to business. Try it free for 30 days today!

This is not intended as legal advice; for more information, please click here.