Jump to:

| What is sales tax? |

| What is use tax? |

| Sales tax vs. use tax |

| Summary |

Calculating, collecting, and reporting sales tax and use tax can get complicated as a business grows, and it can be easy to confuse these two types of indirect taxes. Changing tax regulations can also make it challenging to keep pace. However, it is important to understand both the differences and similarities to help ensure compliance and visibility into a company’s costs.

Sales tax and use tax are both a form of indirect tax, meaning they are a tax that can be shifted to others. While they are both a tax paid to the government on the purchases of goods or services, there are differences in how they are collected and paid to the government.

They are an important source of revenue for the government and every state with a sales tax also imposes use tax. This is meant to prevent state residents from avoiding the sales tax by purchasing their goods online. To gain a better understanding of sales tax versus use tax, let’s take a closer look.

What is sales tax?

Sales tax is a tax imposed on the sale of goods and services. It is typically a percentage of the purchase price and is added to the final cost of the product or service. The rate of sales tax varies by location, with different states and localities having their own rates. In the United States, sales tax is not a federal tax, but rather a state and local tax. Sales tax revenue is used to fund various government programs and services such as education, transportation, and healthcare.

Sales tax is a tax collected by a company on the retail sales of goods and services when the final sale in the supply chain is reached.

Retail sales taxes are important sources of revenue within the United States. Forty-five states and the District of Columbia collect statewide sales tax. There are also local sales taxes, which are collected in 38 states. Local sales taxes can, in some instances, even exceed state rates.

At the state level, it is not uncommon to have more than one sales tax rate. Items deemed necessities like groceries may have a lower tax rate (or even be exempt) in an effort to provide some low-income tax relief. Meanwhile, some states may apply a higher tax to goods and services usually consumed by tourists, like hotels and rental cars.

As noted above, many states also have local sales taxes. Local sales taxes often apply to the same items as the state sales tax. Therefore, calculating the total state and local sales tax typically involves adding the state rate to the local rate and multiplying it by the cost of taxable items.

Given that sales tax rates often differ at the state and local levels, this can sway a consumer to shop across borders for a lower rate or buy their products online.

For instance, when this article was published, Louisiana ranked among the states with the highest average combined state and local sales tax rates at 9.6 percent; whereas, Maine ranked among the lowest at 5.5 percent.

What do governments do with the sales tax revenue generated? Oftentimes, much of what is collected in sales tax revenue goes into a General Fund. This is then used to pay for various services and projects (like schools and infrastructure) across the state.

For example, in California, retail sales of tangible items are generally subject to sales tax. The state sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific state fund allocations, and to other local jurisdictions.

California does exempt some items from sales and use tax, including:

- Sales of certain food products for human consumption (many groceries)

- Sales to the U.S. Government

- Sales of prescription medicine and certain medical devices

- Sales of items paid for with food stamps

Clearly, there are several factors to consider as it relates to sales tax. Therefore, it is important to have the right tools and resources in place to navigate the complexities and ensure compliance.

Who remits sales tax?

The responsibility of remitting sales tax typically falls on the seller or merchant who makes the sale. It is their responsibility to collect the sales tax from the customer at the time of the sale and then remit that tax to the appropriate government agency. The seller must keep accurate records of their sales and the taxes collected, and file regular reports with the government agency that collects the tax. Failure to remit sales tax can result in penalties and legal consequences for the seller.

Sales tax is added to the sales price of a good or service and is then charged by the retailer to the end consumer. The retailer then remits that collected tax to the government. Tax jurisdictions only receive tax revenue when a sale is made to the end consumer.

It should be noted that, when buying supplies or materials that will be resold, businesses can issue resale certificates to sellers and are not liable for sales tax.

Consumers, as well as companies, are likely most familiar with sales tax versus use tax. Sales tax is easier to understand since consumers can clearly see their tax burden on the receipt of purchase.

Examples of sales tax

To further illustrate the application of sales tax, let’s consider a few examples. First, keep in mind that the tax must be collected on the amount of the sale that is taxable.

In general, the total amount of taxable sales times the sales tax rate equals the sales tax amount.

Example A

Let’s assume the sales tax rate is 0.0825. The formula would then be: Total Amount × 0.0825 = Sales Tax Amount.

To further illustrate: A consumer buys a new jacket from a retailer for $150.00. The sales tax rate that the retailer must charge the consumer is 0.0825 percent. In this scenario, the sales tax is $12.38 ($150.00 × 0.0825 = $12.38).

Example B

The retailer could also set the sales price to include the sales tax amount. This, however, must be clearly stated on any documents used to promote the sale. In this scenario, let’s assume the sales tax rate is 8.9 percent and the retailer has included the sales tax amount in the total selling price.

To “back out” the sales tax amount from the advertised price, the retailer would divide the total price (which includes the sales tax) by one, plus the sales tax rate.

To further illustrate: A shoe shop has shoes that are being advertised as $100.00 with tax included. The sales tax rate is 8.9 percent. To calculate the selling price of the shoes, divide $100.00/1.089 = $91.83.

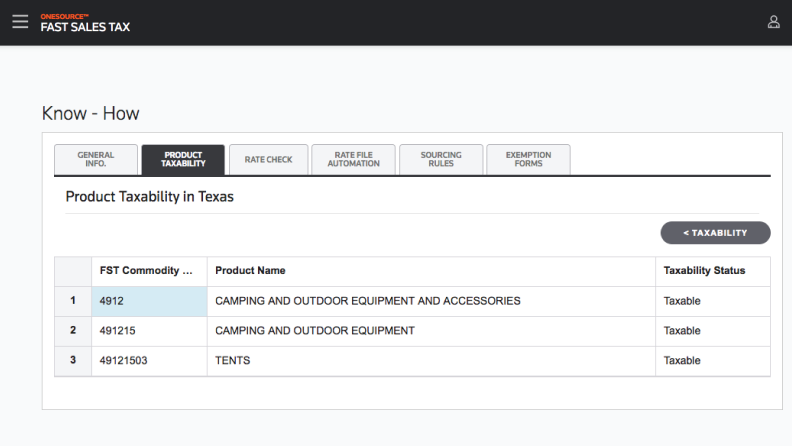

ONESOURCEFast Sales Tax features:

|

|

What is use tax?

Use tax is a tax that is imposed on the use, storage, or consumption of goods and services that were purchased without paying sales tax. It is typically imposed by the state or local government where the goods or services are used, and the rate is often the same as the sales tax rate. Use tax is designed to ensure that people who purchase goods and services from out-of-state vendors or online retailers pay the same amount of tax as they would if they purchased the goods or services locally. Like sales tax, use tax revenue is used to fund various government programs and services.

Use tax refers to the tax imposed on the taxable goods and services that were not taxed at the point of sale. Each state that imposes sales tax levies a use tax for purchases made outside of the state. So, in general, use tax rates are the same as sales tax rates.

Use tax most often occurs when a consumer orders goods from outside of the state (such as online) and the retailer (not having nexus, or presence, in the consumer’s state) does not have to charge sales tax on the purchase.

The bottom line: Taxing authorities want consumers to pay a sales tax on all purchases they make, whether it’s a tax a company charges to the consumer and then remits to the government (known as sales tax), or a tax the consumer pays to the government (known as use tax).

Who remits use tax?

The responsibility of remitting use tax typically falls on the purchaser of the goods or services. If the purchaser did not pay sales tax at the time of purchase, they are responsible for reporting and paying the use tax directly to the appropriate government agency. However, in some cases, the seller or merchant may also be responsible for collecting and remitting use tax on behalf of the purchaser. This can vary depending on the specific laws and regulations of the state or locality where the purchase was made.

Use tax only applies to out-of-state purchases where no sales tax was collected and, as noted earlier, the consumer is typically responsible for remitting use tax per calendar year. People can use tax return due dates to pay use taxes. However, many consumers do not pay the tax. Because of this, the Supreme Court made some updates to sales and use tax regulations in the South Dakota v. Wayfair case and established a new definition of nexus. You can check with your state’s Department of Revenue or Taxation to view specific laws in your region.

As a result of the rulings, if a business sells goods in any state — even if they do not have a physical presence in that state (also known as economic nexus) and the transaction is online only — it may now be obligated to register in that state and collect sales tax. Before Wayfair, nexus depended on a company’s “physical presence” in the state.

For companies that do business digitally, indirect tax software tools are especially important to ensure compliance with complex economic nexus laws and with states’ various sales tax requirements.

Examples of use tax

To further illustrate the application of use tax, let’s consider a few examples.

Example A

In Georgia, for instance, a use tax is imposed upon the first instance of use, consumption, distribution, or storage in the state of non-exempt tangible personal property purchased at retail outside of Georgia.

To further illustrate, let’s take a closer look at the tax imposed on non-exempt items brought into Georgia.

In this scenario, a contractor buys a bulldozer in another state and pays state sales tax but no local sales tax. The following week the contractor transports the bulldozer into Georgia and performs a job in Hall County. The contractor now owes Georgia state use tax on the purchase price of the bulldozer at a rate of 4 percent. The contractor’s Georgia state use tax liability will be reduced by the sales tax previously paid in the other state. In addition, the contractor owes Hall County use tax on the purchase price of the bulldozer at the Hall County sales tax rate.

Example B

Now consider the tax imposed on non-exempt items and taxable services that were not taxed at the point of sale. If a taxpayer purchases taxable goods or services in Georgia without the payment of tax, the taxpayer must accrue and remit the tax.

So, for example, a retailer buys light bulbs tax-free under terms of resale to sell in its store. The retailer takes the light bulbs out of inventory to light up the store. That business owner now owes sales tax on the price for which they purchased the bulbs. The sales tax in this case is commonly referred to as “use tax” because it is not paid at the point of sale, but accrued at the time of use.

Another example is if a person purchases a bicycle online. The seller does not charge sales tax. The bicycle is delivered to the buyer in Georgia. That buyer now owes “use tax” on the bicycle’s sales price.

Example C

Let’s now consider some use tax scenarios in Arizona.

Consider, for example, an Arizona resident who orders a stove and refrigerator from a company based in New Hampshire. However, the buyer had them shipped directly to their cabin in Colorado. The buyer plans to install these items in the cabin when they visit. Does the buyer owe Arizona use tax on this purchase?

No. The Arizona use tax only applies to property used, consumed, or stored in the state. Since the stove and refrigerator were never stored or used within Arizona, the taxpayer is not required to report or pay Arizona use tax on this purchase.

Another example: Let’s say a person orders assorted specialty luncheon meats, cheeses, and crackers from a company based in Wisconsin for consumption at home in Arizona. Will Arizona use tax apply to this purchase?

No. In this case, the taxpayer would not report the purchase of this item. Luncheon meats, cheeses and crackers purchased for home consumption are food products, which are exempt from tax.

Clearly, calculating, collecting, and reporting sales tax and use tax can quickly become complicated. In today’s business environment, it can be challenging for retailers and remote sellers to keep pace. That’s why leveraging the right tools and solutions to ensure compliance is critical.

Sales tax vs. use tax

The differences

Sales tax and use tax are both types of taxes that are imposed on the sale of goods and services. The main difference between the two is that sales tax is a tax on the sale of tangible personal property, while use tax is a tax on the use of that property within a state.

Sales tax is generally charged by the seller at the time of the sale, while use tax is typically self-assessed by the purchaser when the seller has not charged sales tax. Use tax is often applied to goods that are purchased outside of the purchaser’s state and then brought into the state for use, as well as to goods that are purchased online or through catalogs.

The similarities

The similarities between the two taxes are that they both generate revenue for state and local governments, they are both collected by the state, and they both aim to tax the consumption of goods and services.

Additionally, both taxes are subject to exemptions and exclusions for certain types of purchases, such as food, medicine, and certain types of equipment.

Summary

In conclusion, both sales tax and use tax are types of taxes that are levied on different transactions. Sales tax is typically charged at the point of sale on goods and services, while use tax is usually charged on items that were purchased outside of the state but are used within the state.

The main difference between the two taxes is where they are applied. Sales tax is applied to the purchase price of goods and services, while use tax is applied to the value of the item when it is first brought into the state.

It’s important to note that not all states have a use tax, but all states with a sales tax also have a use tax. Additionally, the rates for sales tax and use tax can vary depending on the state and the type of item being taxed.

Ultimately, understanding the differences between sales tax and use tax is important for individuals and businesses alike, as failure to comply with these regulations can result in penalties and fines.

Blog PostLearn how to avoid incorrect indirect tax calculations and protect your organization |

|