With the settlements with various pharmaceutical companies and distributors being finalized recently, there’s been a lot of uncertainty about what the accounting for these settlement funds looks look. The timing of the receipts, as well as whether or not your organization was an original party to the settlement. Luckily the great folks over at the GFOA released a video explaining the accounting in less than ten minutes! In a nutshell, the accounting would be as follows:

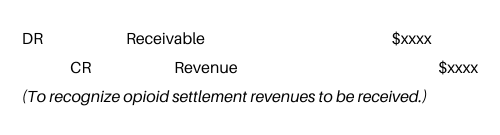

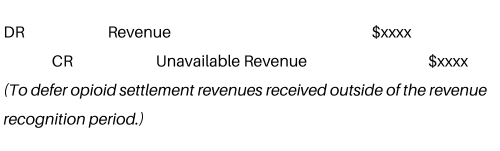

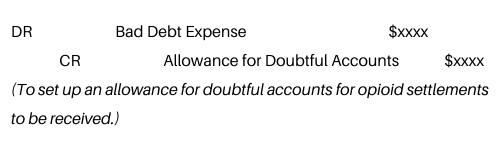

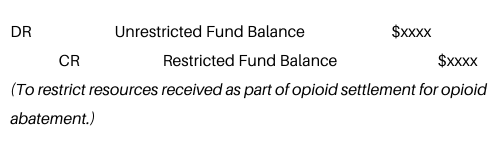

If you are an original party to the settlement (California Subdivision Agreement), the settlement funding qualifies as an exchange transaction in accordance with GASB 33, and you would recognize the revenue and a receivable for the funding. Keep in mind your organization’s revenue availability period, and defer any funding received outside the availability period as unavailable revenue. Finally, there could be some uncertainty about the collectability of the settlements. If this is the case, an allowance for doubtful accounts should be determined and recorded. Any settlement funds received as a member of the Subdivision Agreement should be reported in a separate special revenue fund, with any fund balance being restricted for combatting the opioid crisis.

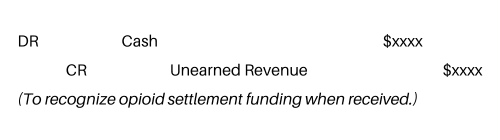

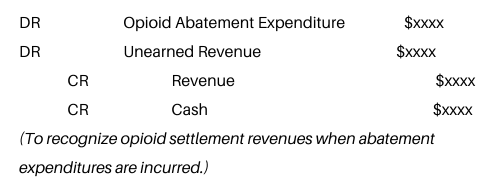

If you are not an original party of the settlement (California Abatement Fund), the settlement funding received qualifies as a nonexchange transaction. As such, no revenue would be recognized until offsetting opioid crisis mitigation expenditures have been incurred. Upon receipt of the funds, an unearned revenue would be recorded, and revenues are only recognized as offsetting expenditures are incurred. Additionally, no receivable would be recorded for any future settlement fund expected to be received. These funds may or may not be set up in a special revenue fund, depending on whether your organization is also part of the Subdivision Agreement. If not, then recording the funding in the General Fund would be acceptable.

Hopefully, this helps answer questions or clarify anything that was uncertain about the settlement. If you have any continuing questions regarding the settlement, please don’t hesitate to contact your LSL auditor or advisor!