IRS Extends Tax Filing Deadlines in Some Areas of Tennessee

CPA Practice

DECEMBER 27, 2023

9, the IRS has announced a Tennessee tax deadline extension for affected taxpayers. Tennessee tax deadline extension The Tennessee tax relief extends various tax filing and payment deadlines that occurred from Dec. Tennessee taxpayers can visit the IRS’s disaster relief webpage for more information.

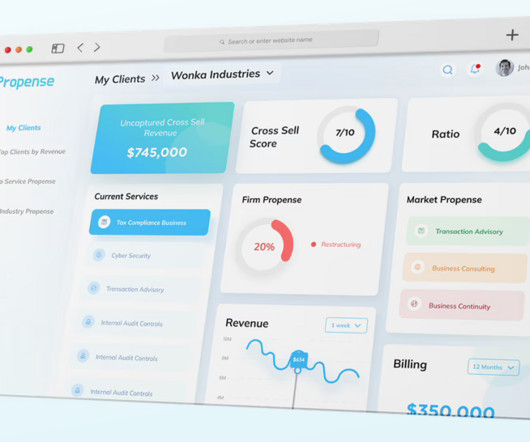

Let's personalize your content