7 min read

February 20, 2024

.jpeg?width=600&height=338&name=AdobeStock_328824244_Preview%20(1).jpeg)

In the AEC (Architecture, Engineering, and Construction) industry, the core function of your business is a far cry from bookkeeping and accounting.

|

Key Takeaways

|

However, selecting the right accounting software is essential to successfully operating and managing your company. While it's a non-core aspect of your business, your back office and its function are vital to your ability to fulfill your company's mission and future vision.

For this reason, you must select the right accounting software for your AEC firm.

What Are QuickBooks and Intacct?

QuickBooks® and Intacct® are two leading accounting software products created by the financial software companies, Intuit® and Sage®, respectively. Both offer comprehensive bookkeeping and accounting solutions, customizations, integrations, and a wide array of features and customizations. While their popularity on the market has shown that both of these products are exceptional options, they are quite different, and it's important to determine which is truly best for your AEC firm before making a selection.

Read More: The Pros and Cons of Outsourced Accounting Services for Businesses

QuickBooks vs. Sage Intacct: A Quick Comparison

AEC Industry Specifics

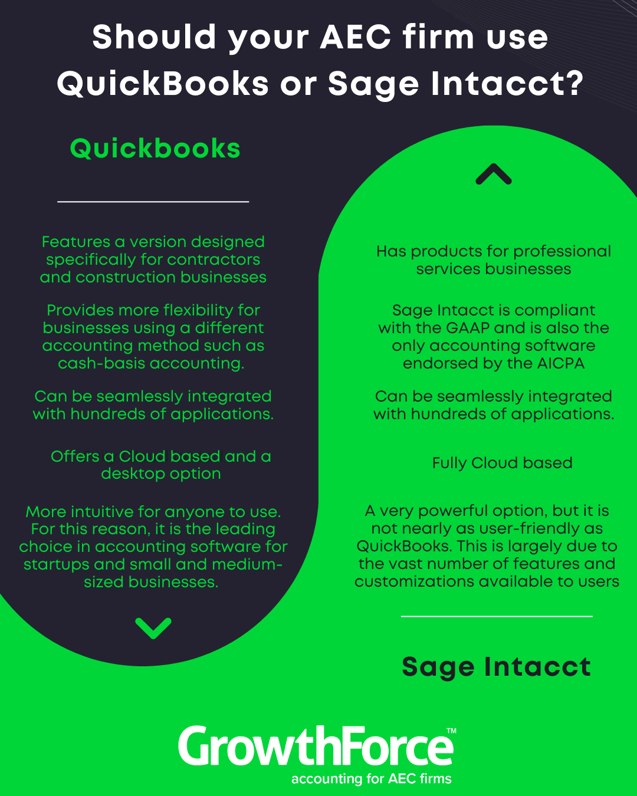

Both software solutions offer industry-specific versions that are designed to accommodate the needs of businesses in different industries. For example, both Intacct and QuickBooks have a product for professional services businesses, and QuickBooks also features a version designed specifically for contractors and construction businesses.

Features and Capabilities

Both Intacct and QuickBooks offer comprehensive accounting software features. They both provide robust financial reporting, management reporting, payables and receivables management, payroll management, and vendor and client management.

Between the two products, available features vary in terms of customizations and scope, with Sage Intacct offering more than QuickBooks.

Compliance

Sage Intacct is compliant with the generally accepted accounting principles (GAAP) and is also the only accounting software endorsed by the American Institute of Certified Public Accountants (AICPA).

QuickBooks provides more flexibility for businesses using a different accounting method such as cash-basis accounting. In the AEC industry, however, most businesses are required (or choose) to use the accrual accounting method, as it is necessary for GAAP compliance.

Integrations

Both QuickBooks and Intacct can be seamlessly integrated with hundreds of applications. These applications can be used to expand your accounting software's capabilities from 100% financial to management accounting and enterprise-wide operational management. By integrating a variety of applications into your business's operations and accounting software, you can use QuickBooks or Intacct to track non-financial metrics making them effective enterprise resource planning tools.

Customizations

Both QuickBooks and Intacct accommodate customizations. However, they do so in different ways. The Sage Intacct product your business uses will be delivered with the customizations you need set up and ready to go. QuickBooks, on the other hand, includes features that can accommodate manual customizations that are set up by the user.

For example, Sage Intacct has built-in class features that allow users to pull reports on a granular level while QuickBooks requires users to create these categories within the software.

On this point, both software solutions offer powerful customization capabilities, and either can be adequately customized to meet most business's needs.

Remote Access

Sage Intacct is fully cloud-based. This means the entire robust accounting software, all of its features, and all of its integrations are completely accessible via the cloud from any location where you have internet access. This is excellent for businesses with multiple locations, business owners who travel, and companies leveraging the benefits of accountancy outsourcing.

QuickBooks offers a variety of accounting software products, including a cloud-based product called QuickBooks Online (QBO). QuickBooks Online is a robust, cloud-based accounting software option. Its features and capabilities differ from QuickBooks Desktop but provide most businesses with everything they need to effectively and efficiently manage their back offices while assisting business leaders with the financial insights they need to make smart management decisions.

Read More: Why You Should Outsource Your Engineering Firm's Back Office

Ease of Use

For financial professionals working in the accounting industry, the usability of QuickBooks and Intacct is a moot point. For business leaders who do not have a background in bookkeeping and accounting, however, ease of use is essential. If you are not able to effectively use or understand how your accounting software works, then you won't be getting the most out of it. You also might wind up making mistakes or paying for more features than your business truly needs.

QuickBooks is much easier and more intuitive for anyone to use. For this reason, it is the leading choice in accounting software for startups and small and medium-sized businesses.

Intacct is a very powerful option, but it is not nearly as user-friendly as QuickBooks. This is largely due to the vast number of features and customizations available to users. If you do not understand what they all mean, what they can do, or how to use them, then you will most likely struggle to manage your back office with Intacct.

User Limits

Unique user limits is another useful point of comparison between QuickBooks and Intacct. The biggest QuickBooks Online package caps users at 25. Sage Intacct has no limit on unique users. So, it can continue accommodating your business no matter how large it grows and how many individuals need access to the accounting system.

6 KPIs Every AEC Firm Should Be Tracking.

The AEC Scorecard™: The only scorecard designed for Architecture, Engineering. And Construction leaders to make data-driven decisions.

Multiple Entities and Scalability

QuickBooks is an excellent option for startups and SMBs, easily accommodating smaller-scale growth. Sage Intacct is the better option for mid-market and fast-growing businesses because it can accommodate businesses growing at the next level. Intacct can easily accommodate multiple entities, multiple locations, and even global companies operating with different currencies. With these larger companies and corporations, Intacct can quickly shift from a global to a granular view while integrating all financials for real-time closeouts.

Cost

Cost is, of course, one of the most important factors to consider when choosing an accounting software solution for your business, and the cost of QuickBooks compared to Intacct is very different.

How Much Does QuickBooks Cost?

QuickBooks is a highly affordable software solution. It's excellent for small businesses with an entry price point to QuickBooks Online ringing in at just $15 per month. For a more robust version of QBO, users can subscribe to QBO Advanced for $100 per month. With QuickBooks, however, you receive the entire product you pay for, whether you need the whole product or not.

How Much Does Sage Intacct Cost?

Comparatively, the cost of Sage Intacct is much higher. Sage does not publish prices for its software online, as they are highly variable and dependent on the unique set of features and capabilities that each customer requires. While the company advertises that you'll only be paying for the features you need, it is estimated to cost an averaging of around $10,000 for an annual subscription.

Which Accounting Software Should Your AEC Firm Use?

Both QuickBooks and Intacct are powerful accounting software solutions with a wide range of tools, integrations, and customizations that can meet the needs of a wide range of businesses in the AEC industry.

The choice between the two primarily comes down to the size of a business and its accounting software budget. Typically, QuickBooks is recommended for small and medium-sized businesses, and Intacct is recommended for larger, fast-growing, mid-market companies with greater needs and bigger budgets.

How to Outsource Accounting Services: Pair the Right Accounting Software With Outsourced Accounting for AEC Firms

Working with an outsourced accounting service provider can help ensure you choose the right accounting software for your AEC firm. To outsource your back office successfully, we recommend choosing an outsourced accountancy provider with extensive experience working with AEC clients. These providers will be familiar with the ins and outs of the industry, the compliance and regulations that are unique to AEC businesses, and the challenges you face in your company every day.

With the right accounting software, you'll be able to easily collaborate.