Today’s fast-paced business landscape demands unprecedented levels of efficiency and accuracy, especially in the finance sector. To keep pace with these changes, it’s imperative for financial functions to rethink their processes to boost productivity. Under the finance umbrella, accounts payable (AP) is particularly ripe for digitalization, with the potential to streamline operations and enhance efficiency.

With insights from our upcoming State of AP Report 2023, let’s explore the importance of digital transformation for finance, the challenges faced, and the actionable steps businesses can take to improve productivity.

An Overview of Productivity in Finance

Finance encompasses a range of functions that directly impact decision-making, planning, and overall business strategies. Digital transformation, the process of integrating advanced technology and innovative solutions, allows finance teams to streamline and automate time-consuming tasks so they can improve productivity and focus on more strategic, value-adding activities.

In recent years, finance has been quick to transform various aspects of its operations and infrastructure. Traditional AP has a lot of manual, paper-based processes, including invoice review, data entry and cutting checks. Although these processes are time-consuming and error prone, AP workflows have been slow to digitally transform. It’s an ideal area for improvement since efficient AP management is crucial for ensuring that the company’s financial obligations are met in a timely, accurate, and secure manner.

According to our upcoming State of AP Report 2023, AP has been consistently identified by finance professionals as the most crucial function to digitize for three consecutive years. With digital transformation, businesses can streamline and automate the AP workflow, reducing manual errors, enhancing transparency, and optimizing cash flow, ultimately contributing to a more efficient and agile financial operation.

Why Productivity Matters in Finance

Financial accounting productivity facilitates healthy cash flow. Effeciency in finance is particularly important across the AR & AP function, as these departments handle the influx and disbursement of company funds. Automation and digital tools make it easier for these teams to have a more accurate view of cash flow, while mitigating costs spent on manual tasks, such as checks or human error.

Finance professionals are facing a number of headwinds that make improving productivity essential. These challenges, comprised of both external forces and internal mandates, include:

An Uncertain Marketplace

The global economy is facing a number of challenges, including rising inflation and interest rates, supply chain disruptions, and geopolitical instability. These challenges are putting a strain on businesses’ financial resources, making it essential to reduce costs across the board and improve efficiency wherever possible. The upcoming State of AP Report 2023 highlights that almost half of respondents (49.1%) express concerns about reducing AP processing costs.

Doing More with Less

Businesses are constantly looking for ways to operate more efficiently, with the same or fewer resources. This holds especially true in today’s economy. In fact, nearly 6 in 10 respondents (58.8%) are anxious about doing more with less. Finance is often seen as an internal mechanism to help reduce costs. In periods of economic uncertainty, like now, they’re being asked to do more than ever, underscoring the need to reduce time spent on low-value back-office functions.

7 Steps to Improve Finance Productivity

Fortunately, financial operations can overcome these key challenges and increase employee effectiveness by making a few adjustments to their operations, including:

1. Embrace Digital Transformation

Financial functions that digitize and automate back-office tasks can empower their employees to do more in a given day. For example, businesses that rely on manual invoice processing spend up to $12.44 per invoice on average compared to those that embrace digital transformation by automating AP processing and only spend $4.98 per invoice on average. This is because when paper or email processes are involved employees have to spend more time and energy per invoice.

2. Improve the Invoice Approval Workflow

Traditional, email- and paper-driven invoice approval methods are burdensome for financial professionals and prohibit remote or hybrid working environments. They require document conversions, time-consuming follow-ups with decision-makers, and error-prone manual data entry. Enhancing the invoice approval workflow through AP automation tools can reduce manual effort and boost productivity. The tool routes invoices to the right approver, sends automatic reminders, enables approval from any location on any device, and can seamlessly capture invoice data using optical character recognition (OCR) technology combined with human reviews to ensure 99.5% accuracy on each invoice.

3. Create a More Secure Environment

Security breaches can be costly and time-consuming to remediate. By embracing digital transformation, businesses can better protect themselves from security risks and fraudulent activity. For example, bad actors could send phishing emails using the correct vendor name but include fraudulent payment details. The right accounts payable software can help reduce the risk of invoice fraud and vendor fraud by providing real-time visibility into transactions and flagging suspicious activity. These features not only safeguard sensitive data and support compliance but also streamline employees’ workflows by eliminating disruptive security breaches.

4. Enroll Vendors in Virtual Payments with the Right Partner

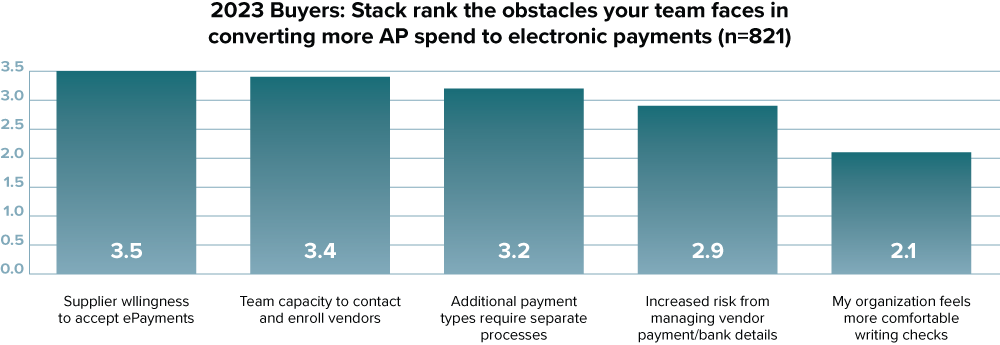

Enrolling vendors in digital payment methods remains a challenge for many organizations, with nearly three in 10 respondents indicating that their capacity to contact and enroll vendors for e payments was the second largest barrier cited behind vendor willingness to accept them. Overcoming this hurdle requires a strategic partnership. As a global payments company, MineralTree can alleviate this burden by offering a comprehensive list of vendors that accept virtual cards. Alternatively, we can enlist our Professional Services team to help you enroll vendors in electronic payments to maximize your rebate potential and efficiency.

5. Improve Visibility into the Process

Lack of visibility into AP processes can cost finance teams hours each week. For example, if a vendor calls to inquire about a late payment, the AP team may end up searching through emails and other documents to find the information they need. By contrast, an end-to-end AP automation solution creates a centralized repository of all invoice data and other relevant AP documentation, giving teams easy access to the information they need.

AP reporting can also improve visibility into the process, while improving the decision making capabilities of your department. By implementing solutions that provide real-time insights and AP analytics, finance professionals can also easily find the status of any invoice, provide quick turnarounds for documentation requests, and make informed decisions more quickly.

6. Switch to Electronic Payment Methods

Adopting electronic payments is a win-win for all, especially considering that digital payments streamline AP activity for employees, reduce the risk of payment fraud, and get vendors paid quickly. With a virtual card payment method like SilverPay that integrates into your existing workflow, you can deliver virtual payments to your vendors via email, faster than ACH and more securely than a check. This digital leap expedites transactions and minimizes manual intervention, helping to enhance operations’ efficiency and profitability.

7. Automate the End-to-End AP Process

The true power of digital transformation lies in embracing digitization across the board, so that time and cost savings from individual processes build on each other. The State of AP Report 2023 highlights that a staggering 84.7% of respondents reported increased efficiency due to AP automation. Embracing end-to-end AP automation goes beyond mere process optimization – it fundamentally reshapes the AP landscape, ushering in smoother workflows, elevated productivity, and a streamlined approach to managing financial operations.

Companies That Leveraged AP Automation to Improve Productivity

End-to-end automation can revolutionize the AP process, helping businesses save time and money and improve their bottom line. MTB Management and House of Cheatham are just two examples of businesses that benefited from end-to-end AP automation, and saw gains in productivity and efficiency:

MTB Supports 50% Growth with Automated Processes

MTB Management, a rapidly growing franchisee, had been grappling with a paper-based accounts payable (AP) process that led to inefficiencies, security concerns, and scalability challenges. Recognizing the need for a change, they adopted MineralTree’s AP automation solution and SilverPay, a virtual card payment method. Previously, MTB Management had to manually enter a substantial portion of invoices received by mail, a struggle that was compounded by the CFO’s preference on using physical documents for approvals.

With MineralTree, MTB Management embraced automation, digital invoicing, and streamlined approvals. The result was more efficient invoice processing, reduced delays, and the adoption of secure payment options. Despite a 50% surge in invoice volume, the time dedicated to AP duties plummeted from 30 to only 10-15 weekly hours. This achievement translated into cost savings, enhanced staff productivity, and readiness for business growth.

House of Cheatham Digitizes Its Processes to Unlock Efficiency

House of Cheatham, a manufacturer of personal and beauty care products, recognized the need to enhance its finance processes. Their manual AP processes involved paper-heavy invoice processing and time-consuming coding, with email approvals lacking transparency and causing delays. This created inefficiencies, scalability issues, and limited real-time visibility. House of Cheatham turned to MineralTree’s AP automation solution to elevate their operations and boost productivity.

Transitioning to email-based invoicing, they harnessed MineralTree’s automated invoice capture and coding features, which simplified workflows and provided greater transparency. The automated system is also seamlessly integrated with House of Cheatham’s ERP system. This transformation led to a reduction in paper usage and simpler processes, resulting in increased time savings and employee effectiveness. Formerly taking up to six hours a week, the payment process with MineralTree took only five minutes, allowing House of Cheatham’s accounting department to redirect 20 hours per week toward higher-level work.

Final Thoughts

Facing pressure to make the most out of limited resources, finance professionals must harness the potential of digital transformation to streamline operations. As a critical finance function, AP holds immense potential for improving efficiency and productivity in the workplace.

By embracing key productivity tips and partnering with a global payments company like MineralTree, your finance team can deliver real value, reduce costs, and achieve newfound heights of efficiency. MineralTree offers:

Expertise

With over two decades of expertise in the AP field, MineralTree has extensive experience and knowledge of the key challenges businesses encounter. These deep roots have allowed us to cultivate a robust network of vendors.

Technology

MineralTree offers a suite of cloud-based AP automation and payments solutions that can help businesses save time, reduce costs, and improve efficiency. With unlimited user access, you can scale AP processes without additional costs.

Support

MineralTree has a dedicated team of experts who are available to help businesses implement and use their AP automation solutions. Our team is also able to collaborate directly with your suppliers on electronic payments transformation.

To learn more about payment trends and why now is the time to digitize AP processes, download the State of AP Report 2023.