Sales Tax

How to Solve Clients’ Sales Tax Compliance Headaches with Smart Outsourcing

Having outsourced professionals act as business management sherpas frees business owners and managers from tedious tasks and greatly reduces errors that can prove costly.

Oct. 24, 2023

![INTERNET_Sales_Tax_1_.56266450a70cb[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/34181/ET_Sales_Tax_1_.56266450a70cb_1_.5d1b54af7299f.png)

For almost as long as commerce has existed, small business owners have struggled with managing their finances and taxes, while at the same time running the operational side of their businesses. In the U.S., many of these entrepreneurs have long relied on the services of tax professionals or CPAs for year-end compliance needs, and to retroactively compile, reconcile and correct their clients’ books and produce financial reporting.

With the increasing adoption of cloud-based business systems, these small business owners have increasingly turned to outsourced CFO, tax, payroll, and bookkeeping services, giving them real-time guidance and daily operational support from these financial and business experts. Having outsourced professionals act as business management sherpas frees business owners and managers from tedious tasks and greatly reduces errors that can prove costly.

Sales and Use Taxes Can be Quicksand

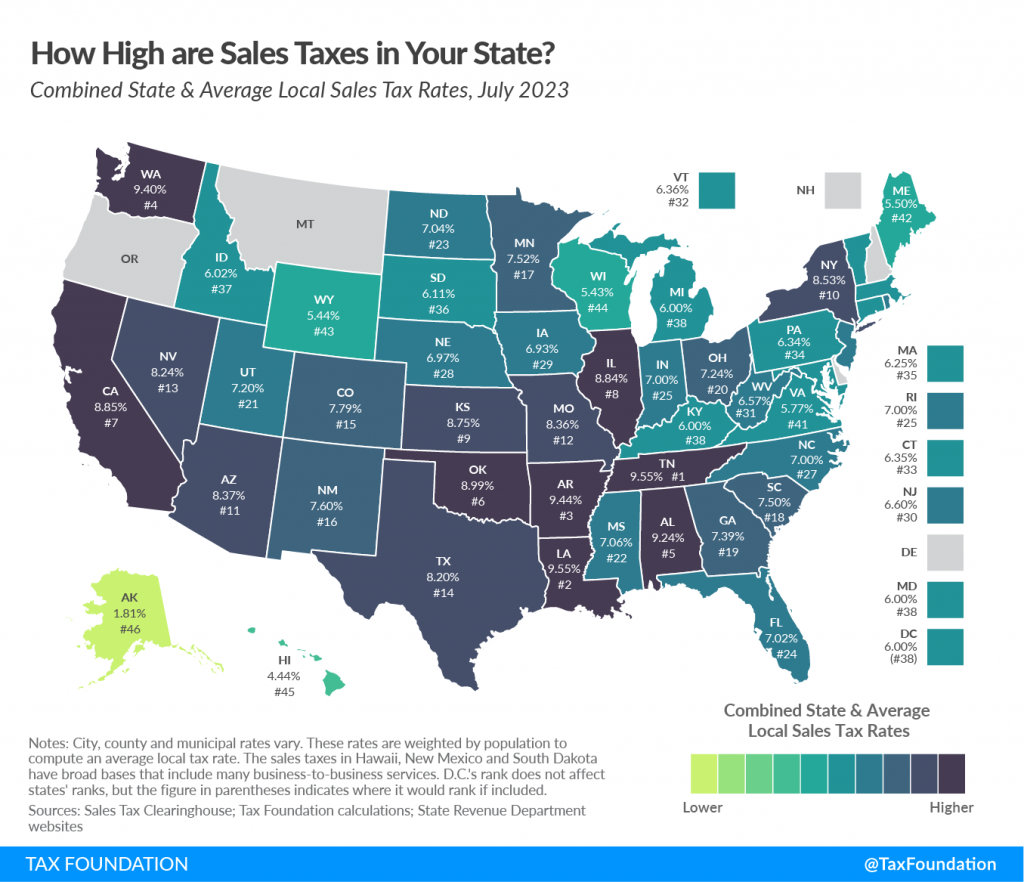

Unfortunately, there’s still one major area of business operations that’s overly complex and vexes many entrepreneurs: sales tax compliance. In the U.S., there are more than 13,000 taxing jurisdictions, including states, cities, counties, and a variety of special districts. Each has unique tax rates and rules defining taxability of products and services, including special exemptions, sales tax holidays, and other factors that can pose significant tracking challenges for businesses trying to stay compliant. In addition to these inherent complexities, states are continuing to adapt and amend sales tax regulations related to economic nexus following the S. Dakota vs Wayfair Supreme Court ruling in 2018.

Many small businesses don’t know how hard these local taxes can be until they are over their head and perhaps already facing a sales tax audit, according to Brian Miller, a CPA and tax manager at indinero, a financial advisory firm that offers outsourced CFO, tax, compliance, payroll, accounting and bookkeeping services. Most of the firm’s nearly 1,000 clients are venture-funded startups and small businesses with under 50 staff. These entrepreneurs can choose the level and type of services they want from indinero, depending on their needs.

“When we’re talking with clients, and when we’re providing them with accounting services, we see where they do business, where they have sales and staff, and we bring up the sales tax issue with them,” Miller said. “When their indinero controller has a subsequent discussion with them, it will be a natural addition to the conversation to note that, for instance, if they hired a new worker in Colorado, they need to register there. Or if there are other changes in sales and growth. And if they need some help with registration or sales taxes, we help them get in contact with Avalara, who are really the top experts in doing sales taxes for businesses in the U.S.”

As an example, Miller said they had a client with sales in New York but the client was unsure about associated sales tax reporting and collection requirements. “They didn’t know what they needed, so we conducted a nexus study and determined they did have obligations in the state, so we helped them get started with Avalara.” Avalara’s cloud-based compliance solutions handle sales tax calculations, reporting, returns, remittance, license and registration, exemption management and other services, in addition to tracking tax rates and rules across the above-mentioned 13,000+ taxing jurisdictions.

The Trusted Advisor Role

“At indinero, we want to be our clients’ trusted advisor,” Miller added. “We do their bookkeeping, accounting, CFO and tax work, help them with business structures and planning, and provide guidance in virtually all areas. But even with our staff of 230, we don’t have the bandwidth or expertise to manage the tedious requirements of sales tax compliance across thousands of jurisdictions. So, we recommend our clients use Avalara, who are by far the best in this area, and have sales tax and legal experts on their staff to ensure compliance.”

The indinero staff maintains an advisory role regarding their clients’ sales tax issues, providing guidance through the complexities as Avalara handles the tax compliance automation functions. “The client’s indinero controller is the quarterback of the relationship,” Miller said, “working closely with the clients and the sales tax technology solution, just as they do with the other business programs they use.”

Preferred Referral Partners are Essential

Indinero selected Avalara as its preferred referral partner for the sales tax compliance needs of its clients after exploring other solutions on the market and finding that none were as comprehensive or easy for clients to use. The firm engages with trusted providers like Avalara for referrals and uses a standardized onboarding checklist that helps the team identify the core areas of services a business will need – a methodology that Miller sees as essential to indinero’s success, and also includes tasking a specific staff member as point person for such referrals in a practice area.

For professionals who provide tax compliance services, Miller noted that their clients’ year-end source documents can provide some hints as to whether a business may need to revisit their sales tax processes or turn to a provider like Avalara.

“Tax pros should note whether a business added or changed business locations, had sales or staff in new states, or if they suddenly increased volume or dollar amount sales growth in one or more jurisdictions,” Miller said. “Since these issues can change their sales tax reporting requirements in different states, the tax professional should alert the client and help them resolve the situation before it becomes a problem.”