Accounting

Accounting-Related Class-Action Lawsuits on the Rise

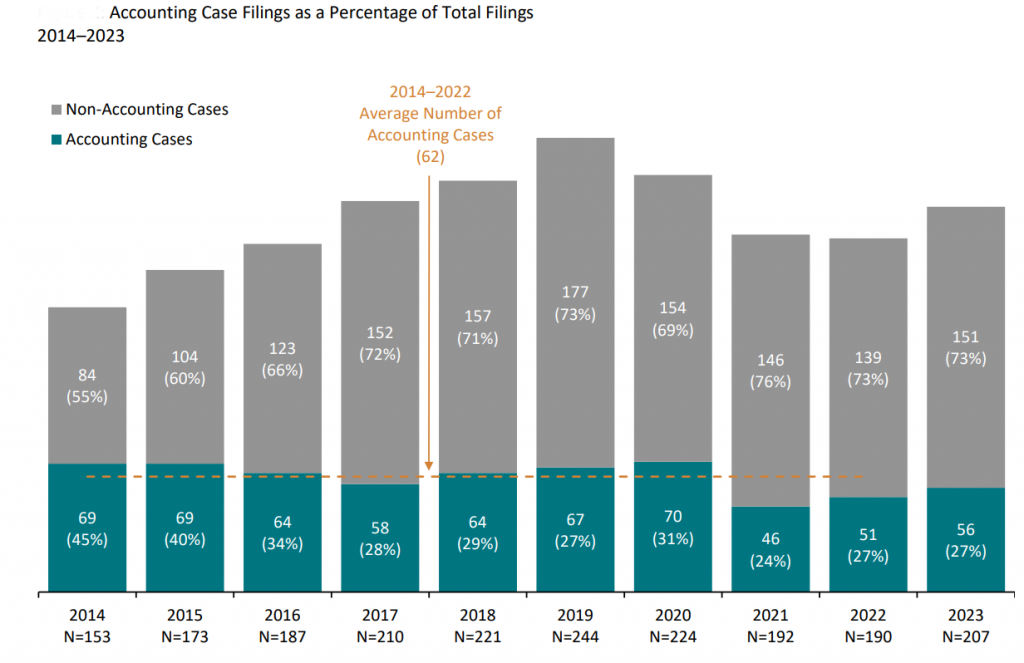

Accounting-related securities class-action filings rose 9.8% from 51 in 2022 to 56 in 2023, Cornerstone Research said.

Apr. 04, 2024

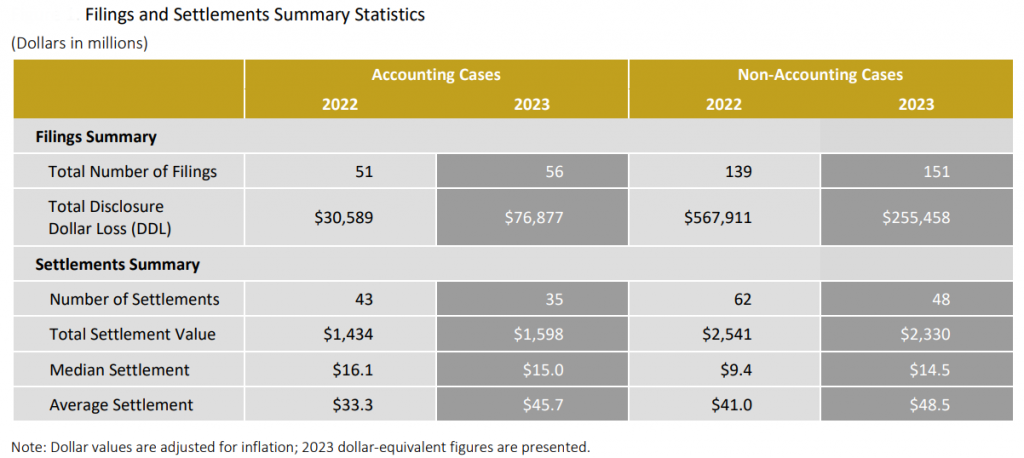

The number of accounting-related securities class-action filings rose 9.8% from 51 in 2022 to 56 in 2023, while the total value of settlements increased 11% year over year despite a decrease in the number of cases that were resolved, according to a new study from Cornerstone Research.

While accounting case filings have increased each of the last three years, the number of cases filed remained below the historical average of 62.

“Accounting cases” is defined by Cornerstone Research as cases “involving allegations related to Generally Accepted Accounting Principles (GAAP) violations, violations of other reporting standards, auditing violations, or weaknesses in internal controls over financial reporting.”

Accounting case filings with auditor defendants have been few and far between in recent years. In 2023, there were four such filings—two involved critical audit matters allegations and three of the four occurred in the first half of the year.

Despite the growth in accounting-related class-action lawsuits last year, cases took longer to be filed, with the median filing lag reaching 43 days, the longest in a decade, according to the study:

Accounting cases are typically filed more promptly than non-accounting cases. In 2023, as in prior years, the median filing lag for accounting cases remained shorter than that for non-accounting cases. However, the difference in filing lags between non-accounting and accounting cases [46 vs. 43 in 2023] was the narrowest since 2017 [11 vs. 10].

For defendant companies named in accounting case filings, the DDL Index (the dollar-value change in the defendant firm’s market capitalization) more than doubled in 2023 to $76.9 billion. This was the second largest for accounting cases in the last 10 years and came amidst a 44% decline in total DDL for all federal securities class-action filings in 2023, Cornerstone Research said. The increase was largely due to filings with a DDL of at least $5 billion, accounting for approximately half of the total accounting DDL.

“While the DDL substantially increased in 2023 compared to 2022, the trend of plaintiffs filing accounting cases against smaller issuer defendants continued,” Frank Mascari, a report co-author and a principal at Cornerstone Research, said in a statement. “At $719 million, the issuer defendant’s median-market capitalization in 2023 accounting case filings was 46% less than the 2014-2022 average and was the lowest in the last 10 years.”

Other additional accounting case filing trends include:

- Revenue recognition continued to be the most common GAAP violation alleged in 2023.

- The first-year dismissal rate of 2023 accounting case filings was 36% lower than the average first-year dismissal rate over the last 10 years.

- Accounting case filings in the financial sector doubled in 2023, returning to historical levels.

- Accounting case filings involving financial statement restatements continued to rebound after a 10-year low in 2021, and they were the second highest in the last 10 years.

The total value of accounting-related securities class-action settlements increased slightly from $1.4 billion in 2022 to $1.6 billion in 2023. The increase was led, in part, by the presence of four mega settlements (equal to or greater than $100 million), which represented 65% of the total value of all accounting case settlements and resulted in the average settlement amount increasing from $33.3 million in 2022 to $45.7 million in 2023, according to Cornerstone Research. In contrast, the median settlement amount declined from $16.1 million in 2022 to $15.0 million in 2023.

Almost 90% of the total value of all accounting cases settled was attributable to settlements involving institutional lead plaintiffs.

Despite the increase in value, there were just 35 accounting case settlements in 2023, an almost 19% decrease from 2022 and the third fewest observed over the last 20 years.

“As discussed in our recent Securities Class Action Settlements—2023 Review and Analysis, securities class actions as a whole have recently settled at more advanced stages of litigation, contributing to a drop in the number of settlements,” said Laura Simmons, a report co-author and a Cornerstone Research senior advisor. “This is especially true for accounting class actions, which have progressed even further before settling than non-accounting cases. In particular, only 37% of accounting cases were settled before the motion for class certification was filed, compared to 54% of non-accounting cases.”

Other key settlement trends include:

- In 2023, accounting case settlements with alleged GAAP violations but no internal control weaknesses hit a five-year peak.

- The size of issuer defendants in accounting cases settled in 2023, as measured by total median assets, decreased by 70%.

- In 2023, the number of settled accounting cases involving restatements fell to the lowest level since 1998. The number of accounting case settlements alleging internal control weaknesses declined to the lowest level in 10 years.

- Median “simplified tiered damages” in 2023 were lower for settlements involving accounting allegations than non-accounting cases.

Of the 35 settlements in 2023, 11 occurred in the Second Circuit Court, the most of any circuit court.