What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting while you do the rest.

Accounting software has made doing your own accounting much simpler and allows for many business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and as such certain accounting steps that not everyone is aware of are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

Want to Feel More Confident Using QuickBooks Online?

Check out these resources that are designed to help Canadian small business owners set up, use, and understand QuickBooks Online more effectively:

📘 QuickStart Your QuickBooks : A detailed, practical guide with step-by-step instructions, screenshots, and best practices to help you manage your accounting without stress in QBO. Learn More

🎥 QBO Made Simple Masterclass: A 60+ minute series of short video trainings that walk you through the key features, common tasks and time saving tips in QuickBooks Online. Learn More

What is a bank reconciliation?

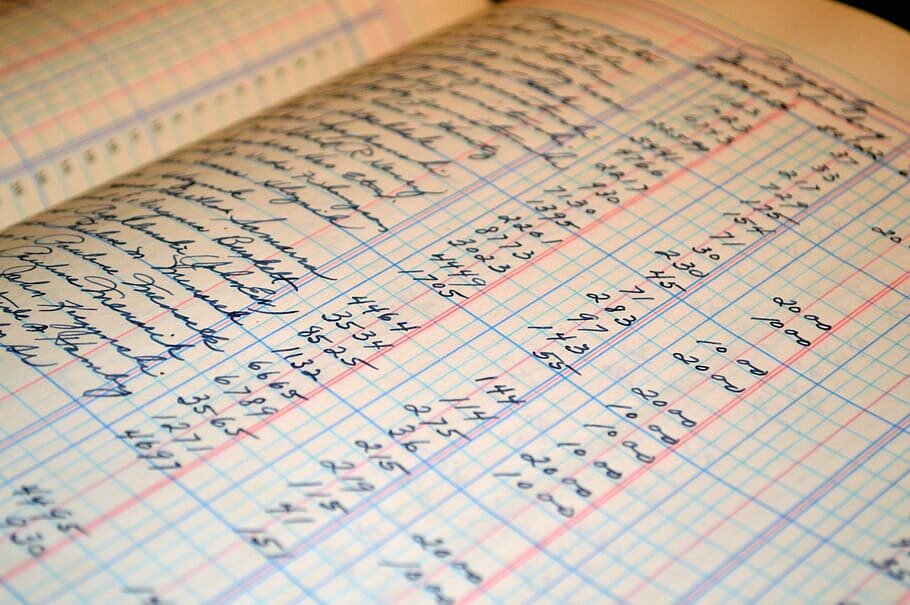

A bank reconciliation (or bank rec as it is commonly known) is a process whereby you ensure that the transactions on your bank statement (the monthly statement that you receive directly from your bank) match the transactions that you have recorded in your accounting.

It involves checking each transaction on the bank or credit card statement and ensuring that it appears in your books and vice versa. Any discrepancies between the bank statements and your books must then be resolved.

Why do you need a bank reconciliation?

A bank reconciliation is essential to ensure that the bank balance in your books is correct and that all transactions that pass through the bank are recorded. The process helps to identify missing transactions, errors and omissions and to ensure that your accounting is accurate and complete. Without a bank reconciliation i.e. a verification that the bank balance matches the books, it would be very easy to erroneously record or even make up bank transactions thereby rendering your financial reports inaccurate and ultimately, meaningless.

What types of differences does a bank reconciliation uncover?

Accounting software will often have differences between the bank statement and the bank balance due to transactions such as cheques issued and deposits received that are still in transit. Eg. When you give someone a cheque they may take a few days (or months) to cash it. This will be referred to as an “outstanding” transaction on the bank reconciliation and will remain unchecked until the cheque is actually cashed. This is not an error, but simply a difference that is identified through the process of doing a bank reconciliation.

There are various types of differences and discrepancies that a bank reconciliation can uncover some of which include:

Outstanding cheques that have not yet been cashed

Deposits in transit i.e. deposit that might be made on the last day of the month but only appear on the next bank statement

Bank charges such as monthly fees, per transaction charges, e-transfer fees etc. that you only see once you receive your monthly bank statement

Interest expenses such as overdraft interest, credit card interest and interest on loans that also are not know until the bank statement is received

Monthly credit card fees

Transactions amounts that are incorrect

Transactions that have not been entered (missing transactions)

Transfers between accounts such as payments to the credit card accounts, loan payments and withdrawals by the owner/shareholder or repayments)

Bank errors

How often do you need to do a bank reconciliation ?

Typically a bank reconciliation is done monthly since banks send monthly statements. However, these days online banking allows you to retrieve your bank details anytime you want so you if you have numerous transactions , you can also do it more frequently.

Although at least monthly is recommended for those who do their own bank reconciliations, it is not uncommon for very small businesses/self employed owners to do them quarterly or even annually before they hand over their accounting to their accountants

How do you do a bank reconciliation?

This assumes that

you have a separate and dedicated bank account for your business, which every business owner should have. However, if you don’t have a separate bank account, then a bank reconciliation might simply involve reviewing your business related bank transactions for the month and ensuring that you have reflected them in your books or your spreadsheet.

You are using accounting software with a bank reconciliation module

A bank reconciliation is a straightforward process but requires meticulous attention to detail. Since you are comparing numbers, you need to make sure that each number corresponds exactly.

To do a typical bank reconciliation you need the bank statement and the detailed balance in your bank account from your books (often referred to as a cash subledger or a cash register).

You will need the following information from your bank statement as a starting point

Opening balance per the bank statement

Closing balance per the bank statement

Date range of the bank statement

Most accounting software will provide you with a reconciliation interface where you enter the details above and then check off each transaction in the books against the transactions in the bank statement. The transactions that then appear on one but not the other need to be reviewed and entered, if applicable, and any discrepancies need to be corrected.

For example, you might only enter your bank charges or transfers between accounts at the end of the month when you are doing your bank reconciliation. It is important to note that if the process is followed, and all transactions from the bank statement are entered and checked off, you bank balance will always reconcile. However, even if it does reconcile you may still be left with unresolved transactions that have to be reviewed,

How do you do a bank reconciliation in Quickbooks Online ?

Luckily accounting software has made the process significantly easier as many of these software such as Quickbooks Online and Xero download the transactions automatically (once you link your accounts) and also match the transactions that have been entered. This leaves you only with unmatched transactions to resolve.

In the banking section of Quickbooks Online you will notice a “bank balance” amount and “amount in Quickbooks” for each account which has been “linked” and is automatically downloaded transactions. When all of the downloaded transactions have been entered, these amounts should be identical. If not, it likely means that there are unresolved transactions. (the other possible for the difference between the bank balance and in Quickbooks amounts are that the latest transactions have not yet been downloaded but the balance has been updated)

To reconcile your account in QBO, go to “reconcile” which can be found by going to the “accounting” tab on the left hand side. This will bring up the reconciliation interface where you would enter the ending balance from the statement and the statement date. Once done, it will take you to the actual reconciliation where all transactions that have been downloaded and entered will be automatically matched. Your job is to go in and determine why some transactions are not matched and how to fix them. Some of the possible errors include:

Outstanding cheques which have not yet been cashed. Nothing needs to be done, unless they are very old in which case they should be written off.

Duplicate deposits or payments. The solution to this is to determine why these were entered twice and ensure that the correct one is selected and properly applied to the invoice or bill.

Transfers to and from other accounts that are duplicated. These should be reviewed in the same way as above.

Multicurrency transfers that use the QBO rate instead of the bank rate. In this case, you can simply change the rate on the transaction to match the bank rate.

Differences in payment or deposit amounts (often by just 1 or 2 cents) that need to be adjusted to match the bank. Alternatively, if the discrepancies are very small you can enter them as bank charges.

Once everything matches and any differences have been resolved, you would click on “Finish Now” which can be found on the top right dropdown (“Save for Later). Finishing the bank reconciliation records it as having been reconciled in the system and any inadvertent changes in the future to the bank reconciliation can then be easily identified by going to the “history by account” which shows you changes to the bank transactions after you have done the reconciliation.

Doing a regular bank reconciliation is a key accounting function to ensure the integrity of your accounting and reports. If you’re a bit of numbers nerd like me or if you like things organized, it can also be quite satisfying to do.

For more about information regarding our products, services and articles relating to QuickBooks, please refer to our QuickBooks page.

Looking for Help with Your Accounting?

Check out my resources below:

📘 QuickStart Your QuickBooks : A detailed, practical guide with step-by-step instructions, screenshots, and best practices to help you manage your accounting without stress in QBO. Learn More

🎥 QBO Made Simple Masterclass: A 60 minute series of short video trainings that walk you through the key features, common tasks and time saving tips in QuickBooks Online. Learn More

💬 Consulting Services Need help with setup, cleanup, or questions specific to your business? Book a one-on-one session for personalized guidance. Learn More.