Form 943: What to Know About Agricultural Withholding

Patriot Software

SEPTEMBER 6, 2022

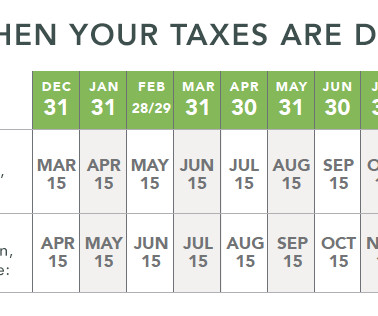

Various types of employers must withhold taxes from employees’ wages, including employers hiring farm workers. If you are an agricultural employer, you likely withhold taxes from your employees’ pay. Form 943, Employer’s Annual Federal Tax […] READ MORE. So, what is Form 943? What is Form 943?

Let's personalize your content