What If you can’t pay your self assessment income tax bill on time

Menzies

JANUARY 7, 2024

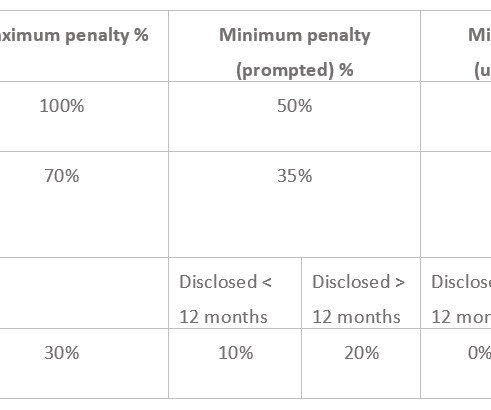

Menzies LLP - A leading chartered accountancy firm. If you find in this time of uncertainty that you are unable to pay your self assessment income tax liability, there is help at hand. How you contact HMRC will depend on how much tax you have to pay (see below). Once you are happy please complete the process.

Let's personalize your content