Colorado Paid Family Leave: FAQs About the Program

Patriot Software

DECEMBER 12, 2022

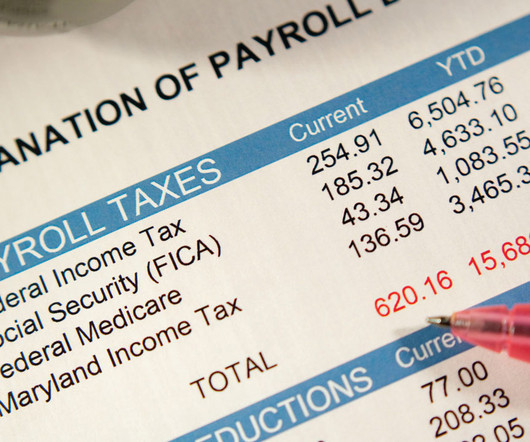

Back in 2020, Colorado voted to implement its own Paid Family and Medical Leave Insurance (FAMLI) program. And beginning in 2023, the Colorado paid family leave program takes effect. What does this mean for Colorado employers? It means you have a new payroll tax […] READ MORE.

Let's personalize your content