Payroll

Colorado Businessman Gets 15 Months for $737K Employment Tax Evasion

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS.

Jul. 23, 2023

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS.

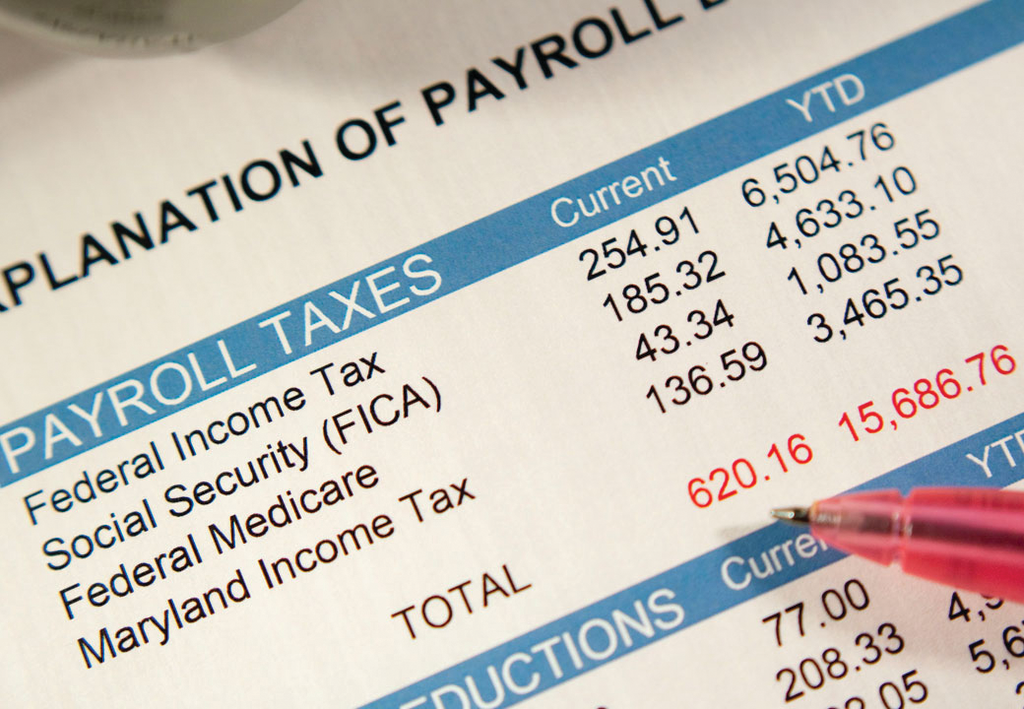

According to court documents and statements made in court, Frank Stevens of Bow Mar, Colorado, co-owned restaurants and an oil production business, which had employees from whose paychecks he withheld income and Social Security and Medicare taxes.

Starting in approximately 2002 and continuing for many years, Stevens did not pay over the withheld payroll taxes to the IRS or file the required quarterly employment tax returns for his businesses. After failing to collect from the businesses, the IRS assessed the tax against Stevens personally.

To prevent the IRS from collecting through bank levies the taxes he owed, Stevens kept the balances of his personal and business bank accounts low, often leaving them with only $0.01. Stevens transferred, or directed employees to transfer, just enough funds to cover expenses and then moved any remaining money to a bank account not subject to IRS levy. In total, Stevens caused a tax loss of approximately $737,128.

In addition to the term of imprisonment, U.S. District Judge Daniel D. Domenico ordered Stevens to serve three years of supervised release and to pay a $10,000 fine and $1,096,138.14 in restitution to the United States.

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division made the announcement. Trial Attorneys Peter Anthony and Julia Rugg of the Tax Division prosecuted the case.