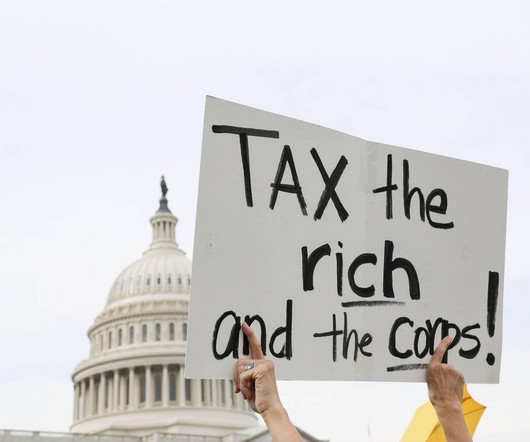

4% Corporate Tax Rate for Businesses

BuildYourFirm

OCTOBER 28, 2020

What business owner would not be interested in a 4% corporate tax rate, zero capital gains, and zero dividends tax? Puerto Rico has been willing to supply a lucrative tax incentives because it needs money from business owners and investors here in the US.

Let's personalize your content