Earn $20 per Book Promoting My Tax Preparer Book from Home in Your Spare Time

AdviceForTaxpreparers

SEPTEMBER 8, 2020

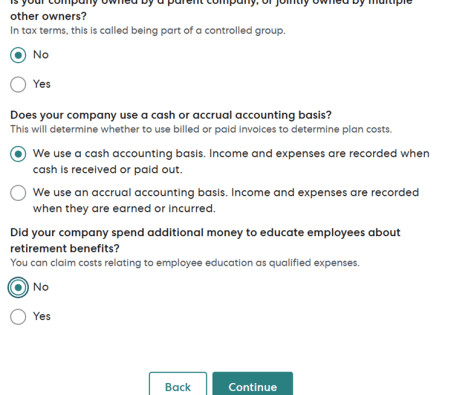

Advice for Tax Preparers Making tax preparers lives easier one blog at a time HOME. Earn $20 per Book Promoting My Tax Preparer Book from Home in Your Spare Time. by Bill Meador, CPA, JD. the method you use to advertise the tax preparer book is entirely up to you. Here is how it works.

Let's personalize your content