Accounting

AICPA Says it Has a Plan to Fix the CPA Talent Shortage

With its Pipeline Acceleration Plan, the AICPA said it has a framework in place to make accounting more appealing to students.

May. 18, 2023

One of the biggest questions currently being asked by many throughout the accounting profession is, “How can we make accounting more appealing to students?” There’s plenty of accounting jobs out there that need to be filled—more than 300,000 accountants and auditors have left the profession in the past few years. But modest starting salaries, horrible work/life balance (especially in public accounting), and time-consuming and strict requirements to obtain CPA licensure have resulted in declining student interest in accounting careers—thus creating a talent shortage in the profession.

But the AICPA said today it has a framework in place to fill that CPA pipeline back up.

The AICPA released an overview of its Pipeline Acceleration Plan on Thursday, the intent of which is to “identify ways to integrate the changing needs of new recruits and young professionals; increase flexibility and accessibility in the licensure pathway; and drive awareness of the wide range of career pathways within the profession in ways that result in a more robust supply of new CPAs.”

The plan, which builds on earlier drafts to create a nationwide CPA pipeline strategy, will be presented next week at the spring meeting of the AICPA’s governing council. The AICPA said the plan will continue to evolve and expand as existing milestones are met and new initiatives are added.

“Building the CPA pipeline requires a united effort from all stakeholders tied to the profession,” Susan Coffey, CPA, CGMA, the AICPA’s CEO of public accounting, said in a press release. “We need to work together to raise awareness about the rewarding work we do, broaden the range of talent we draw from, and address stumbling blocks that derail too many prospective CPA candidates. As the largest national body for the accounting profession, the AICPA is uniquely positioned to channel ideas into action and mobilize efforts in a coordinated way to achieve success. Our plan offers a framework for moving forward but is by no means the last word—this is an evolving process that will require resolve, foresight, and close collaboration with important partners.”

The AICPA said considerable attention, discussion, investment, and research is being focused on a variety of initiatives at each stage of the CPA pipeline—from the Center for Audit Quality-led Accounting+ student awareness campaign to CPA Evolution and the launch of the new CPA exam in January 2024.

In collaboration with such stakeholders as state CPA societies, accounting firms, academia, state boards of accountancy, the National Association of State Boards of Accountancy, and the CAQ, the AICPA identified initiatives that address the following key areas:

- Awareness: Increasing awareness about the accounting profession and promoting the benefits of a career in accounting.

- Improved perceptions: Dispelling outdated perceptions and leveraging updated, positive messaging that can help the profession resonate with today’s students.

- Training and education: Providing high-quality accounting education and training opportunities.

- Firm culture and business models: Equipping firms with the tools to offer competitive salaries and benefits, as well as career advancement opportunities and compelling work.

- Diversity, equity, and inclusion: Attracting and retaining a broader range of talent.

- Partnering with educational institutions: Affiliating with colleges and universities to offer internships, scholarships, and other programs to attract individuals to the profession, help defray costs, and assist students in developing the skills needed to succeed as a CPA.

Fixing the talent shortage takes actions that “must be anchored in data that identifies root causes and measures the impact of new and existing efforts,” the AICPA said.

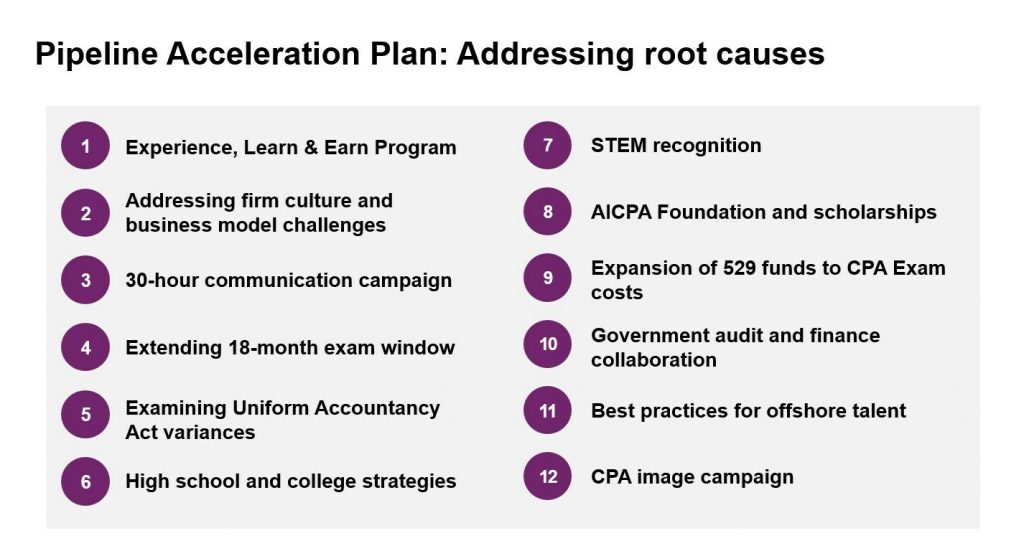

There are 12 initiatives—some considered near-term, some mid-term, and others long-term—the AICPA said it’s focusing on to fix the accountant shortage.

The Pipeline Acceleration Plan also includes several recommended actions not included in earlier drafts, according to the AICPA:

Expand 529 funds to CPA Exam costs: The AICPA and state CPA societies are working with federal legislators on the Freedom to Invest in Tomorrow’s Workforce Act (H.R. 1477), which would allow the use of 529 college savings plans to include expenses required to obtain or maintain postsecondary credentials, including CPA-related costs such as exam review courses.

Support for the government audit and finance sector: To address concerns over the ability of local governmental entities to find skilled auditors and finance professionals, the AICPA is collaborating on solutions with the National Association of State Auditors, Comptrollers and Treasurers (NASACT). A working group involving key stakeholders, such as state auditors, state comptrollers, state treasurers, CPA firm representatives, and local government representatives, will explore opportunities and best practices for hiring CPAs to work in state and local government and finding qualified CPA firms to audit local governmental entities.

Develop best practices for offshore talent: The AICPA is examining the need for best practices and other potential resources that would help small and medium-sized firms partner successfully where needed with offshore talent suppliers. This is in addition to the expansion of the administration of the CPA exam in India and South Korea, and exploration of offering the CPA exam in the Philippines.

Explore launch of a CPA image campaign: The AICPA said it is looking into a campaign that would create positive awareness of the profession with middle school and high school students. The initiative would build on the CAQ’s Accounting+ initiative, and the AICPA said it will work with state society input and perspectives to draft a feasibility plan later this year.

“Collectively, these initiatives paired with ongoing investments such as CPA Evolution, aim to increase flexibility for CPA candidates and enhance the reputation of the profession. They are designed to deliver action and drive results,” the AICPA said. “Continued dialogue with stakeholders will shape and expand this plan.”