Reduce the Impact of the 3.8% Net Investment Income Tax

RogerRossmeisl

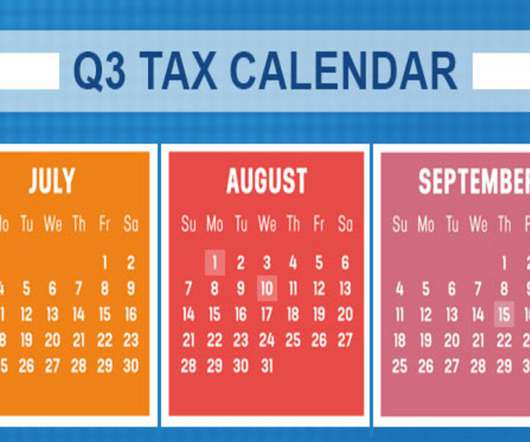

JULY 16, 2023

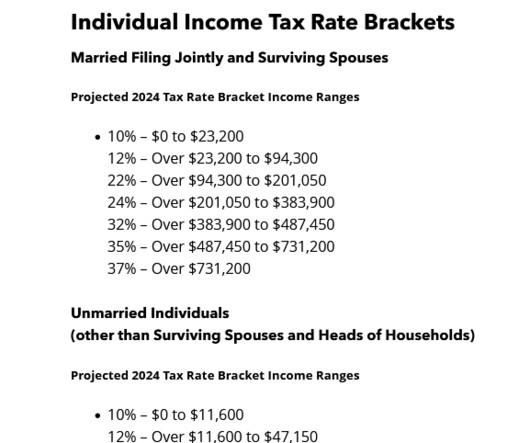

High-income taxpayers face a regular income tax rate of 35% or 37%. net investment income tax (NIIT) that’s imposed in addition to regular income tax. Net investment income includes interest, dividend, annuity, royalty. Net Investment Income Tax appeared first on Roger Rossmeisl, CPA.

Let's personalize your content