When compared to traditional small businesses, early-stage technology startups have nuances that they need to consider when putting together their financial statements and chart of accounts. Often, I find that entrepreneurs have used a financial model to assist them in their fundraising efforts. While helpful there, this model often differs wildly from their actual financial operations.

Laying the right foundation

Having a good chart of accounts lays the foundation for a clean set of financial statements that are easy to understand. Beyond that, the right chart of accounts contains information that the management teams can use to make important decisions.

Sometimes, founders make the mistake of not paying enough attention to the chart of accounts. In other instances, though, the chart of accounts is too detailed, making it an unpleasant, time-consuming chore to record transactions — and one with no real value-add.

To help early-stage tech founders and their accountants/bookkeepers with this crucial step, we created two sample charts of accounts based on our years of experience.

Here is the link to download.

Using this tool

This chart of accounts is designed to upload into Quickbooks Online, but the basic framework can be used for other G/L packages such as Xero and Wave Apps.

The first chart of accounts is for an e-commerce startup that sells inventory, and the second one is for a Software as a Service (SAAS) company.

The chart of accounts can be imported into a brand new Quickbooks Online account by following the instructions here. Using account numbers ensures that accounts are ordered the way you want to see them presented.

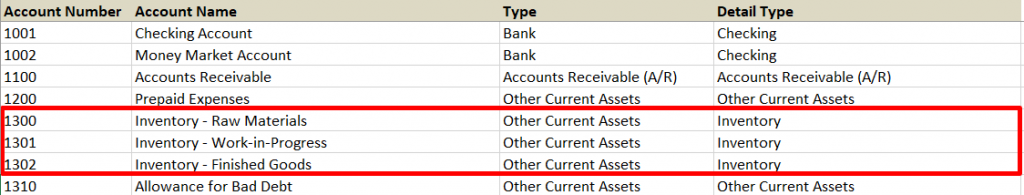

E-commerce startups should make sure to record inventory on their Balance Sheets. In the sample chart of accounts, you will see that we’ve created three accounts for inventory including raw materials, work-in-progress, and finished goods. If your startup is selling a few SKUs, it may be helpful to separate them out on the chart of accounts.

However, past five or six SKUs, the balance sheet will become cluttered with this information. In that case, using fewer accounts will lead to more clarity. The detail level can be maintained under the parent account.

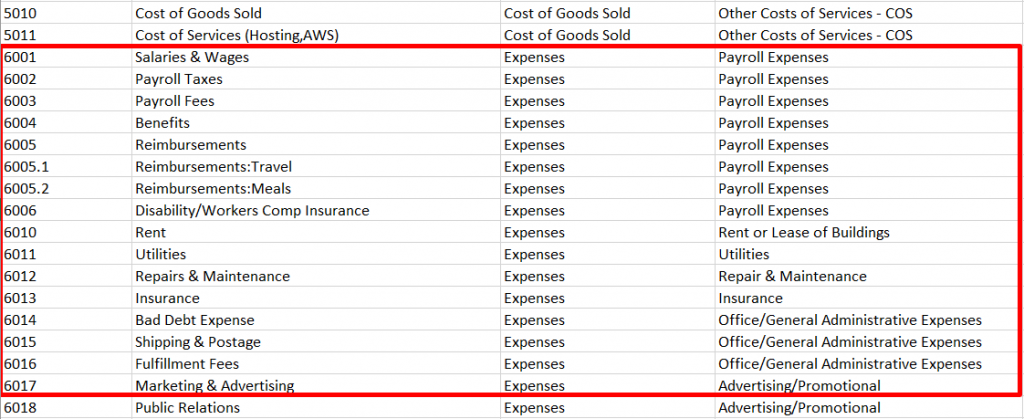

Using the parent account and sub-account, you can view a more detailed breakdown of your transactions. For example, you can track your domestic and international contractors by creating sub-accounts under the parent account of the Contractor. You can also track your employee reimbursements by various breakdowns such as travel, meals, office expenses, etc.

Early-stage founders sometimes make the mistake of recording convertible debt and investments as revenue on the P&L. We have created some commonly used accounts such as SAFE Notes, Convertible Debt, and various equity accounts, including common stock and preferred stock. If multiple rounds are raised, it’s common to see a separate equity account for each round (e.g., Preferred Stock – Series Seed, Preferred Stock – Series A, etc.).

For the revenue section, we have included e-commerce sales which can also be broken down further by channel (e.g., Amazon sales, website sales, etc.). The cost of services such as Amazon Web Services and other hosting costs should also be captured as part of the gross margin calculations.

Using account numbers comes in handy in Quickbooks Online, especially when it comes to expenses. Otherwise, things are ordered alphabetically. Larger expenses such as salaries, rent, and subcontractor payments should come first.

For those of you who have a finance background and want to calculate EBITDA (earnings before interest, tax depreciation, and amortization), I would recommend ordering those accounts last.

Getting set up for success

We hope this guide and the two sample charts of accounts will be a good foundation for your company to start. As always, customization is the key to getting the accounts to line up the best way for your taste and, ultimately, to help you make decisions.

We would very much recommend that you work with a CPA and Quickbooks ProAdvisor to help your startup get an optimum setup customized to your company. If you would like to schedule a time to speak to us regarding this, don’t hesitate to contact us.

To download the chart of accounts, please see the link to download.