With global companies operating with remote workforces, the frustration of manually sifting through records to determine which transactions should be indicated as qualified before filing deadlines will worsen. Understanding and reviewing your current 1099 process before year-end will help your finance department obtain any missing or incorrect information on time.

Sage Intacct customers have benefited immensely from their ability to manage and maintain 1099 status and type by providing the capability to mass update their vendors’ status, type and opening balance. Even if numerous vendors were not marked as eligible during the year, Sage Intacct easily tracks and updates their transactions, including vendors with multiple 1099 types.

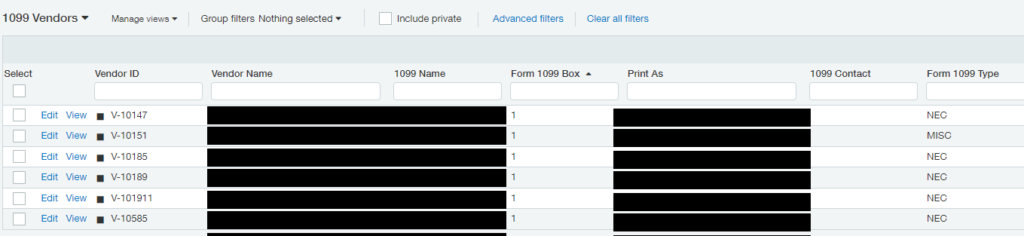

You can identify a 1099 vendor within the vendor record and have Sage Intacct track 1099 totals for printing on your 1099 form. You can verify the 1099 status for vendors by creating a custom view in your Vendor list that includes their default Form 1099 Type, Form 1099 Box, Print As, 1099 Name and 1099 Contact.

A review of the Taxpayer ID and Vendor Address is also recommended. The Print As is the name that will print on 1099 unless a different 1099 Name is specified. If unique names reside in each field, both names will appear on the 1099 with the 1099 Name on the top, and the Print As name right below. If there is a 1099 Contact and the name is different from 1099 Name, the 1099 Contact will print in place of Print As name. You can update any of these fields within the Vendor Information record.Sage Intacct offers a step-by-step guide to vendor 1099s to assist through the process.

If you plan to print your 1099s in-house, you can purchase Sage Intacct supported forms from Sage Intacct’s Home Page > Resources > Checks and Supplies. Be sure to order early and get extras, just in case – and don’t forget your envelopes! The 2022 tax forms are available now to purchase.

Out-of-the-box functionality allows customers to print finalized 1099 forms directly from Sage Intacct or easily integrate with third-party services to enable e-filing capabilities. If you choose to integrate with a third-party marketplace partner, your accounting team will no longer spend hours or even days printing and stuffing envelopes. Instead, they can focus on more value-add activities.

Fast-growing companies choose Sage Intacct for their accounting software solution. Why? As your company grows, you need to automate accounting processes while adding solid financial controls that ensure compliance and audibility. In a future release, Sage Intacct will roll out its 1099 e-filing integration with TaxBandits. TaxBandits is an authorized IRS 1099 e-filing provider. You will be able to skip the manual printing of forms and submit tax information electronically to the IRS.

If you have an interest in a native cloud offering, Withum’s Enterprise Resource Planning (ERP) team can work closely with you to understand your organization’s specific needs and identify if Sage Intacct is the best fit.

Author: Sonia Parsa, MBA | sparsa@withum.com

Contact Us

For more information on this topic, please contact a member of Withum’s Digital and Technology Transformation Services Team.