What Is the Fair Credit Reporting Act?

Patriot Software

OCTOBER 14, 2022

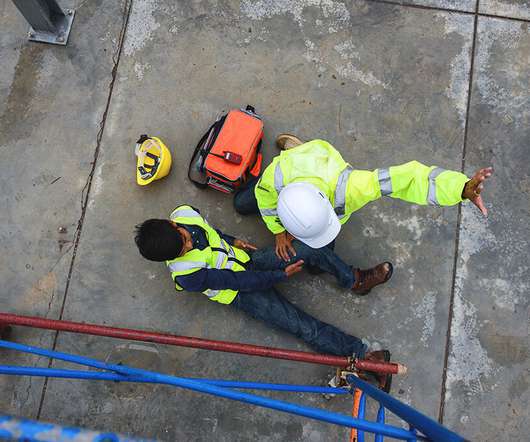

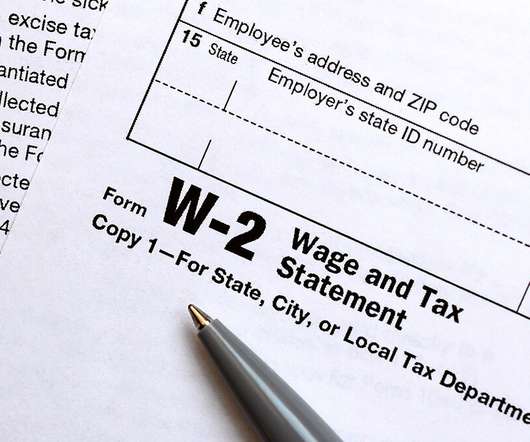

Before hiring a new employee, employers typically run background checks, or consumer reports, on the individual. The consumer report can reveal information like the applicant’s criminal and public records, as well as their credit report. But before looking into an individual’s credit, you need to know about the Fair Credit Reporting Act. What is the […] READ MORE.

Let's personalize your content