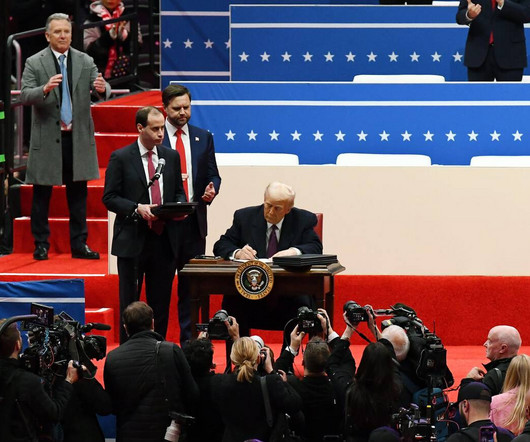

Pieces of the 2025 tax reform puzzle

ThomsonReuters

JANUARY 29, 2025

I often tell others that tax reform is like assembling a complex jigsaw puzzle. Although you start with the final image in mind, youre not sure how the various pieces fit together. Should you build the puzzle from the middle out, or is it better to focus on the edges and work toward the middle? And what if a piece is missing? Is an almost complete puzzle better than no puzzle at all?

Let's personalize your content