Surviving Due Diligence, Part 4: Quality of Earnings

BurklandAssociates

MARCH 21, 2022

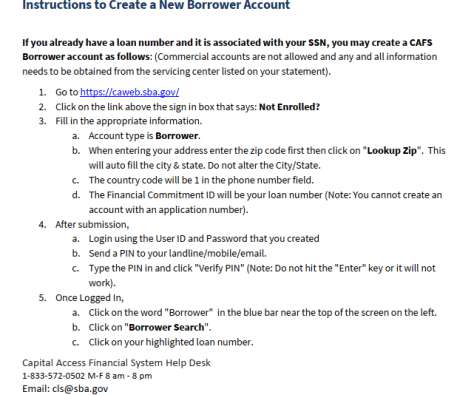

Welcome to the fourth installment of our Surviving Due Diligence series, a collection of best practices and tips to help startups successfully get through the due diligence process that precedes Read More. The post Surviving Due Diligence, Part 4: Quality of Earnings appeared first on Burkland.

Let's personalize your content