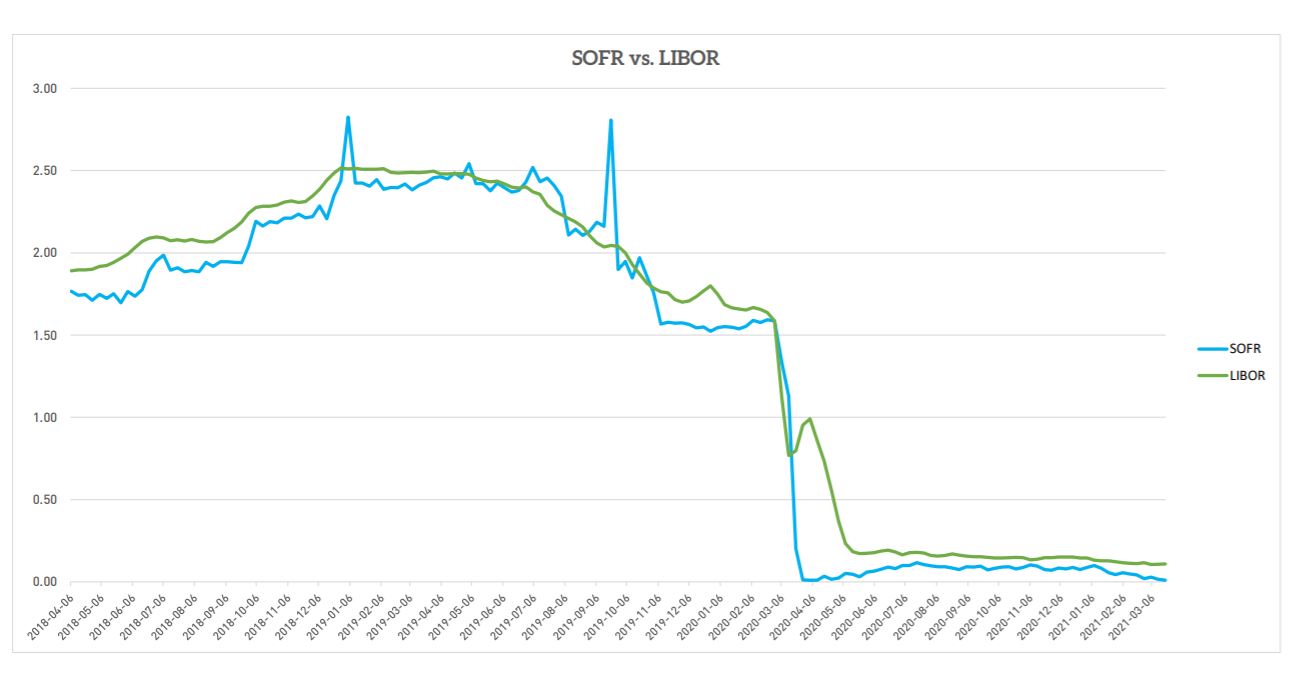

After a 35 year experiment, LIBOR (the London Interbank Offered Rate) is being replaced. That means most floating rate commercial debt agreements will likely be reworded or repriced over the next few quarters as the banking sector makes way for a new benchmark, the Secured Overnight Financing Rate (or SOFR, for short). LIBOR has been the global standard for debt underwriting, but was never supported by empirical data. Instead LIBOR was determined by way of a survey of global banks and what they said the market rate was, not what the banks were actually charging. As a result, in 2012 numerous global banks were charged with manipulating the overnight rate as a way to bolster profits of interest rate swaps and other products. At that moment, LIBOR began to be phased out. By Q4 2020, nearly $100 trillion of interest rate swaps had already been repriced under SOFR.

What is SOFR?

The new benchmark underlying the debt markets is based upon observed transactions in the Treasury repurchase market, where banks engage in overnight lending to meet capital requirements. The rate is quantifiable and auditable, meaning that the stated rate is much less open to manipulation since a bank would need to actually pay a certain rate in order for the transaction to be included in the data. Furthermore, with nearly a trillion dollars of SOFR benchmarked repo transactions occurring nightly, even several banks engaging in manipulation would likely not materially impact the rate. The deadline for the SOFR transition was previously December 2021, although the deadline has been pushed to June 2023.

What Does it Mean for My Dealership?

Most loan documents will likely be rewritten to replace LIBOR with SOFR unless your dealership is priced off of the prime rate. As far as impact on profitability, it is difficult to say how banks will reprice their debt agreements. An analysis of the two rates suggests that, historically, they have not been wildly different in magnitude. The SOFR has in fact been slightly less than LIBOR over the past year. The difference in pricing will likely come about by the uniform deployment of rate floors. Over the past 12 months, commercial lenders have attempted to implement rate floors for their LIBOR-priced debt agreements with mixed success. Understandably, banks are less happy about a LIBOR priced agreement when LIBOR is 0.25% compared to 3.0%, so the floor was their attempt to correct the economics of their agreements. Many dealers pushed back. The universal transition to a new benchmark may give commercial lenders a second opportunity to establish rate floors. Dealers should carefully review their next couple of floorplan renewals for language that may have a negative economic impact – whether on the rate floor or on the rate spread.

Dealership Services