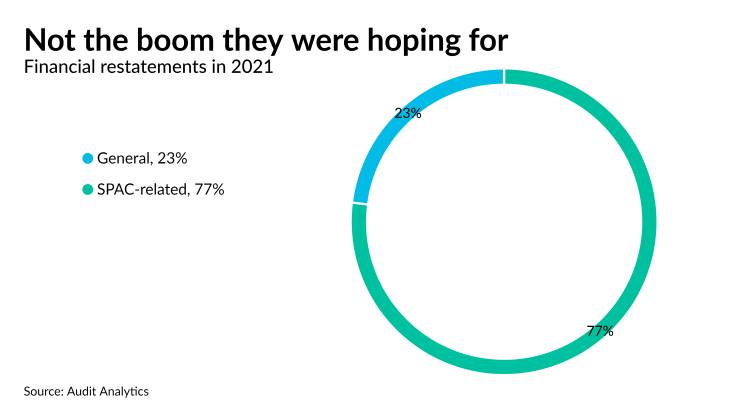

Financial restatements filed with the Securities and Exchange Commission by public companies hit a 15-year high in 2021, thanks almost entirely to special purpose acquisition companies.

According to a recent report by Audit Analytics, total restatements hit 1,470 in 2021, almost three times the number reported in 2020, and the highest number since 2006, when there were approximately 1,800.

However, without SPAC-related restatements, the number of restatements actually decreased 10%, which is more in keeping with the general declining trend over the past decade.

SPACs are companies with no operations that are created solely to raise capital through an initial public offering, or to acquire or merge with an already-existing company. They have been particularly popular over the last two years, with the number of new SPACs jumping almost tenfold between 2019 and 2021, according to

In response to that growth, the SEC last year in April issued

“The SEC's guidance on accounting for redeemable shares and warrant liabilities resulted in significant increases observed in both the number of restatements filed and the number of companies that disclosed a restatement during 2021,” the report said.

Audit Analytics’ report, which covers 21 years of trends in financial statements, is