The latest on the NOMAD states

TaxConnex

MAY 11, 2023

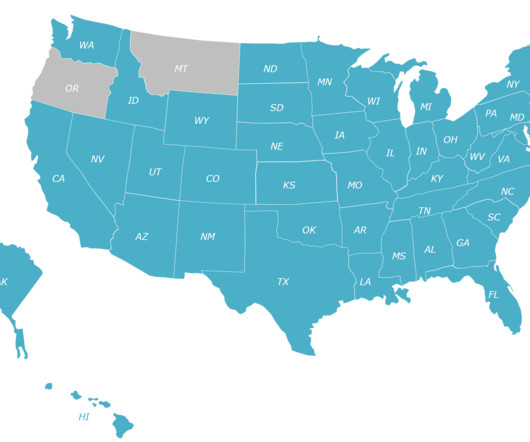

A state has not added a statewide sales tax since Richard Nixon was in the White House. Vermont was the last to due so in 1969. There are five remaining states with no state level sales tax: New Hampshire, Oregon, Montana, Alaska and Delaware – often referred to as the NOMAD states. Businesses based in these states still have the obligation to track their nexus footprint outside of their state and manage sales tax where they’ve determined they have an obligation.

Let's personalize your content