New internet phishing alert!

Inform Accounting

MAY 24, 2022

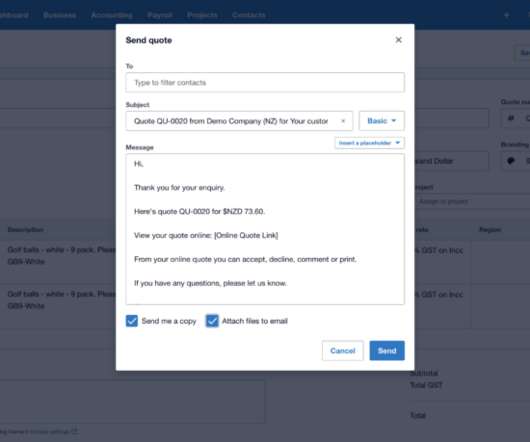

New emails and letters appearing to be from employees of the Government Legal Department / Bona Vacantia Division are in circulation. Emails are being sent from bogus email addresses purporting to be from members of the Bona Vacantia Division. These emails are not from the @governmentlegal.gov.uk address and may ask for confirmation of personal information or provide false links or download attachments.

Let's personalize your content