You’re researching flights for that much-needed vacation and are presented with two options: a direct flight or a connecting flight. Which do you buy? Given a choice, most people opt for the direct flight because it’s faster and easier. Connections add unnecessary time, stress, and risk to a trip – even when everything goes according to plan. Layovers that go awry also create a domino effect, enabling one delay or missed connection to disrupt your entire itinerary.

This same principle applies to AP automation solutions. Products using an intermediary or FBO account to make vendor payments are akin to connecting flights. These AP solutions move funds first from your bank account to the processor’s account before finally delivering them to the organization you’re paying. On the other hand, MineralTree’s AP automation solution uses a direct debit method, which debits authorized payments straight from your bank account over to vendors via their preferred payment method.

When looking to digitize their process, AP teams often focus on how easily solutions integrate with their existing systems and AP workflow, while overlooking an important consideration like the solution’s payment funding model. But the reality is that the funding model can greatly impact payment timelines, vendor relationships, cash flow, and more.

This blog outlines 4 considerations to help AP teams decide whether an intermediary account or direct debit funding model is right for their organization.

1. How and when are payments debited? And how do they impact cash flow?

First, it’s important to understand exactly when cash leaves your bank account. Solutions that use intermediary accounts debit money out of customers’ bank accounts before payments are sent to vendors. This debit may occur once a batch of payments has been authorized in the system, or some providers require the FBO account to be pre-funded, often at the beginning of the month.

Alternatively, direct debit AP automation solutions debit the customer’s account only when payments are made—with the timing varying by payment method. For example, systems will debit ACH payments once the ACH credit is initiated. Meanwhile, check payments aren’t debited until the vendor cashes the check and virtual card payments aren’t debited until the vendor processes the card. This approach allows you to hold onto your cash longer, particularly compared to the pre-funded intermediary account model.

2. Does the funding model elongate payment timelines (and benefit the provider more than you)?

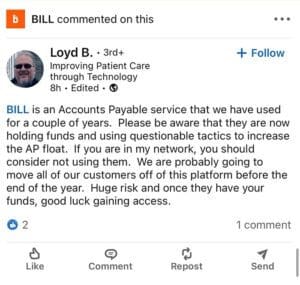

AP automation solutions that use FBO accounts reduce their customers’ control over when money leaves the FBO account and gets sent to vendors. If your account is debited upon payment authorization, the provider typically requires those funds to clear before payments are disbursed to vendors. As the image below from LinkedIn reveals, some AP automation vendors make money on the float and will thus hold on to your funds for as long as possible—often to the detriment of vendor relationships.

In contrast, there is no fund clearing period or float to be made with a direct debit AP automation solution. This allows payment timelines to be much quicker than those using an FBO account. For instance, ACH payments reach vendors within two business days while virtual cards can be sent to vendors within one hour of authorization. But that doesn’t necessarily mean that payments must go out as soon as they’re authorized. With payment scheduling capabilities, you have control over which vendors you pay when, based on information such as available bank cash, invoice due dates, and available early-pay discounts.

3. Do you want 1:many or 1:1 reconciliation?

With an intermediary account model, your account will be debited in one of two days: by pre-funding the account or by a lump sum for the entire authorized payment batch. In the latter scenario, if you authorize 12 payments for a total of $25,000, a single ACH debit of $25,000 will be drawn from your account. In either case, it’s nearly impossible to directly compare the bank statement to the payments record in the accounting system for reconciliation.

With direct debit AP automation solutions, there will be a debit on your bank statement for each individual payment. The vast majority of AP teams have a strong preference for this 1:1 reconciliation, though it should be noted that some accountants who manage AP across multiple clients may prefer the 1:many reconciliation of intermediary accounts.

4. Where are checks drawn from and what additional payment security controls are protecting your team?

With an intermediary account model, checks are drawn from the provider’s FBO account, which means that your bank account information isn’t on every check going to vendors. This may offer a greater sense of security, though with obvious drawbacks like the slower payment timelines and reconciliation issues noted above. In addition, you have no choice or control over which bank the FBO account is with, a seemingly minor detail that becomes critical in the event that funds are frozen or the bank fails.

Direct debit AP automation solutions, on the other hand, typically offer positive pay integration with your bank of choice, thereby mitigating the risk of B2B check fraud. Some providers also allow you to view an image of the actual check that went out within the platform—a feature that gives comfort to many CFOs and controllers. Lastly, should you choose to switch banks, the AP automation solution can be easily updated to work with your new financial institution without any interruption to your payments.

Intermediary Accounts: Risks Ultimately Outweigh the Rewards

Returning to our earlier flight analogy, travelers don’t always have the option to choose a direct flight. Unfortunately, some trips require layovers. This is also true with AP automation. Newer organizations or ones with a poor financial history may only qualify for an intermediary account model that uses a good funds approach. But for most, the extra step created by the FBO account will elongate payment timelines, reduce control over funds, and potentially jeopardize vendor relationships. As such, the risks most often outweigh any rewards.

If you’re interested in learning more about how an AP automation solution like MineralTree TotalAP uses a direct debit model, request a demo today. Our team of experts can walk you through the many advantages of a direct debit model.