Cryptocurrency – the Wild, Wild West

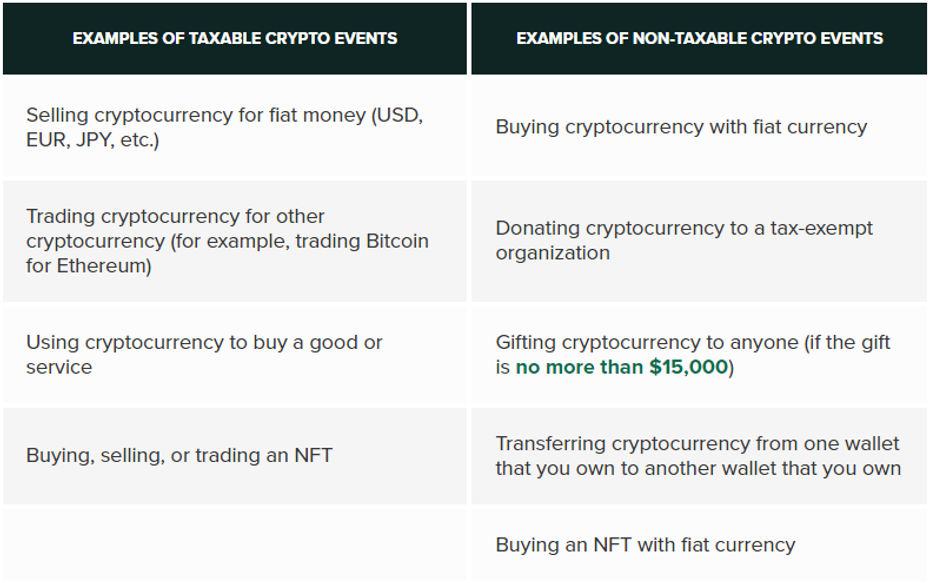

Even with prices falling, interest in cryptocurrency is on the rise. It is important to know the tax implications before you jump into the world of crypto. Whether you are invested in, accept or make payment with, or receive a gift of crypto it may give rise to a taxable event. The following chart is courtesy of Time.com:

It should be noted the gift limit for 2022 is $16,000, up from $15,000 in 2021.

It should be noted the gift limit for 2022 is $16,000, up from $15,000 in 2021.

The IRS considers cryptocurrency to be property. Therefore, when you buy, sell, or exchange you need to report it on Schedule D or Form 8949 as a capital gain or loss. Short-term capital gains rates may be between 10-37% depending on filing status and taxable income. If you hold the cryptocurrency for longer than one year, the gain will be taxed as a long-term capital gain. Click here to see a breakdown of the tax brackets.

You may also receive income related to cryptocurrency activities from things such as lending, dividend-earning tokens, forks and airdrops. In that case you treat the income as ordinary taxed at your marginal rate, anywhere from 10-37%.

Buying cryptocurrency is not taxable in and of itself. You can buy it and hold it for as long as you want to without paying any taxes on it. Taxes are only due when you sell or otherwise dispose of the cryptocurrency. However, the IRS requires all taxpayers to answer the question of whether or not they bought, sold or received crypto on their 1040.

Through the use of John Doe summons the IRS has been able to force companies such as Coinbase to turn over their records in order to properly identify individuals who had taxable transactions. As IRS Commissioner Chuck Rettig said, “The John Doe summons remains a highly valuable enforcement tool that the U.S. government will use again and again to catch tax cheats, and this is yet one more example of that.” He goes on to say, “I urge all taxpayers to come into compliance with their filing and reporting responsibilities and avoid compromising themselves in schemes that may ultimately go badly for them.”

Whatever you do, don’t be this guy.

As always if you have questions, please contact your Dent Moses advisor.