Top Questions to Ask to Stay on Top of Your Small Business Expenses

It is essential to keep up with your business expenses to manage cash flow and maximize tax deductions. But, how can you do this tedious task effectively when so many other jobs exist?

Here are nine questions to help reduce the chaos and keep your business expenses on track.

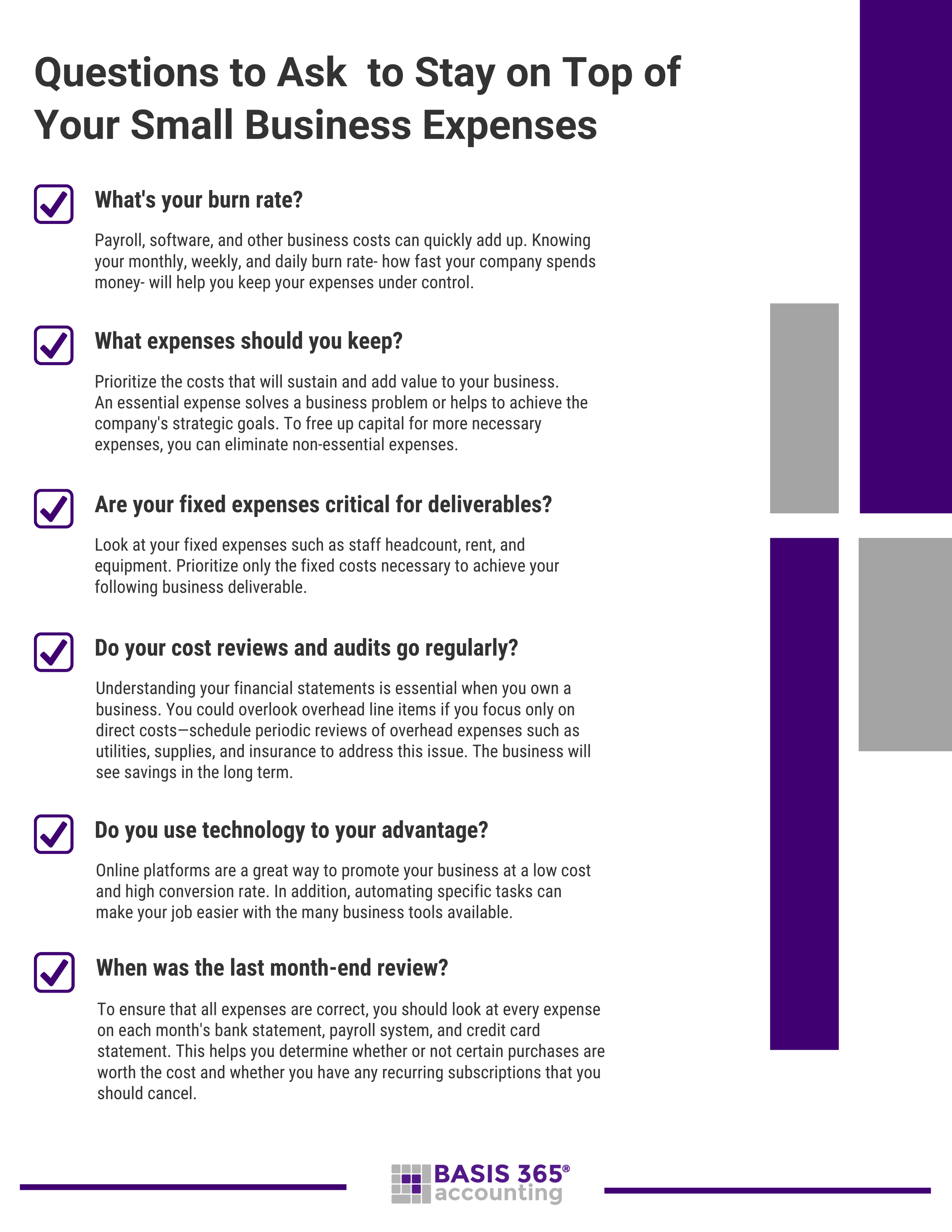

Q1 - What's your burn rate?

Payroll, software, and other business costs can quickly add up. Knowing your monthly, weekly, and daily burn rate- how fast your company spends money- will help you keep your expenses under control.

Q2 - What expenses should you keep?

There is no such thing as an excessive expense. It all depends on the company's business plan and its needs. Prioritize the costs that will sustain and add value to your business.

An essential expense solves a business problem or helps to achieve the company's strategic goals. To free up capital for more necessary expenses, you can eliminate non-essential expenses.

Q3 - Are your fixed expenses critical for deliverables?

For example, look at your fixed expenses such as staff headcount, rent, and equipment. Prioritize only the fixed costs necessary to achieve your following business deliverable.

Q4 - How slim can you get?

Leaning can make your business more profitable. Instead of purchasing multiple apps that do different things, search for software that does both. Remote working can also be a cost-saving option. For example, remote working is a great way to save money on travel. Instead of meeting in person, you can use an online collaboration tool and the office space savings for things that promote growth.

Q5 - Do your cost reviews and audits go regularly?

Understanding your financial statements is essential when you own a business. You could overlook overhead line items if you focus only on direct costs—schedule periodic reviews of overhead expenses such as utilities, supplies, and insurance to address this issue. The business will see savings in the long term.

Q6 - Do you use technology to your advantage?

Online platforms are a great way to promote your business at a low cost and high conversion rate. In addition, automating specific tasks can make your job easier with the many business tools available.

Q7 - Is it better?

Sometimes, we need to purchase quickly because of a lack of time. However, do your research later to find a better deal or a new service provider.

Q8 - Do you delegate enough?

Outsourcing can help reduce costs, improve quality, and decrease workload. Freelancers are available on an hourly or per-project basis. In addition, independent contractors and outsourcing firms will help you reduce costs by removing the need to provide workstations and insurance.

Q9 - When was the last month-end review?

To ensure that all expenses are correct, you should look at every expense on each month's bank statement, payroll system, and credit card statement. This helps you determine whether or not certain purchases are worth the cost and whether you have any recurring subscriptions that you should cancel.