Accounts payable automation: the ultimate game changer for accounting firms

Accounting Insight

NOVEMBER 29, 2022

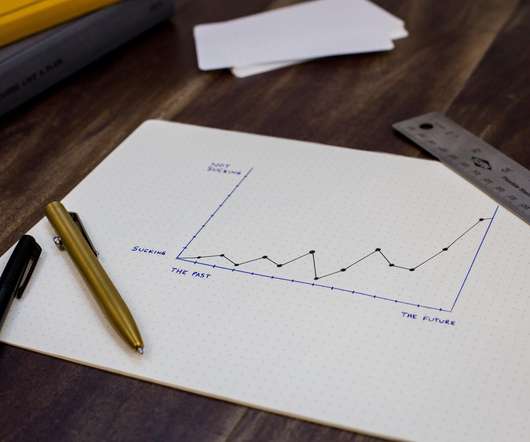

Accounts payable automation, also known as AP automation or invoicing automation, is the process of automating accounts payable processes and activities while collecting the critical data required to make smart decisions, improve efficiency, and grow your business. How can AP automation streamline your accounting firm’s processes? 1. IMPROVING AP EFFICIENCY BY ELIMINATING BOTTLENECKS IN THE AP PROCESS.

Let's personalize your content