Selling Into States with Unusual Sales Tax Laws

TaxConnex

FEBRUARY 9, 2021

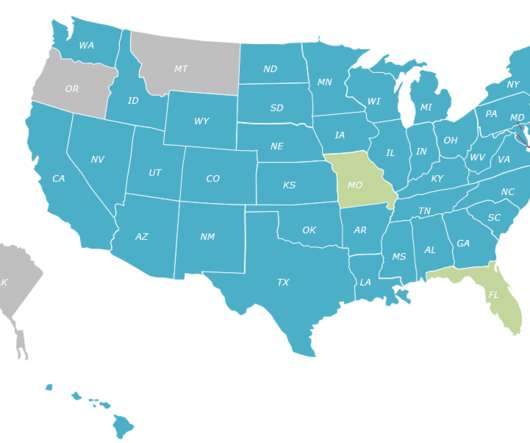

If you sell into the handful of states that don’t have nexus or don’t have a general sales tax, you might think you’re home free when it comes to obligations to remit sales tax. Maybe, and maybe not. Forty-five states and the District of Columbia have a statewide sales tax. Alaska, Delaware, Montana, New Hampshire and Oregon do not. ( Local jurisdictions in some of these, however, can charge sales tax based on state nexus thresholds and other criteria. ) Florida and Missouri have sales tax but h

Let's personalize your content