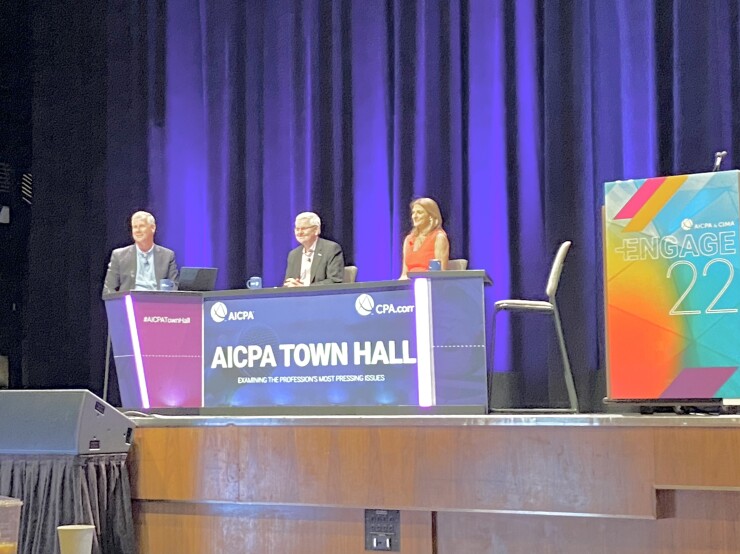

Rising inflation, global supply chain issues, the lingering impact of the COVID pandemic and other factors are pushing the U.S. economy toward a major slowdown, but there are some silver linings in the clouds, experts told a crowd of accountants yesterday, in an AICPA Town Hall broadcast live from the Engage conference in Las Vegas.

“There’s all this talk about recession,” said Jill Schlesinger, a business analyst with CBS News. “There’s going to be one; it’s going to happen, and it’s not going to be a two-month recession, it’ll be more garden variety. … We are in transition, and it’s tough to be a business leader during that kind of transition.”

CPA.com president and CEO Erik Asgeirsson highlighted a recent Wall Street Journal poll that found that 83% of respondents think the state of the economy is either poor or not so good, and 40% feel that can’t improve their standard of living.

That gloom is in stark contrast to attitudes at the very start of COVID, according to Schlesinger. “I go back two years in the middle of a global pandemic, and the confidence surveys then were better than they are today,” she said. “We had no idea what was going on. The economy was frozen, the S&P lost a third of its value, and yet people felt better than they do now.”

Part of that is due to serious government stimulus efforts that helped insulate many consumers from the immediate impacts of the pandemic — while they are definitely feeling the impact of the current economic weather now.

“It hits people in the face — at the gas pump, in the grocery store,” said AICPA president and CEO Barry Melancon. “It’s a regressive impact in a country where we’ve been fighting this have and have-not issue for a while.”

In particular, Americans are facing an inflation rate, 8.3%, that is unlike anything many of them have ever experienced. “We have an entire generation that have never seen inflation, and they’re freaking out and I don’t blame them,” Schlesinger said.

Inflation hawks at the Federal Reserve have already raised rates, and she expects them to raise rates again in June and July — though she worries that they may have started later than they should have.

“It’s hard to imagine that the Fed is chasing 40-year highs in inflation; they haven’t been chasing inflation in 30 years,” she said. “They’re tapping the brakes; it’s tough when you’re doing it late.”

Melancon posited that that long period of low inflation may have led to some “paralysis” within the Fed, keeping it from making a timely decision, while Schlesinger suggested they might have been fighting the last war.

“The Great Recession really scarred a lot of people at the Fed,” she explained. “It was a seminal moment where they did very well in the crisis, but did not manage the recovery well. In this iteration, they’re worried that if they raise rates now, it might hurt people who are just getting back on their feet.”

Whatever the reasoning, the Fed seems set on a course of rate hikes.

“Those are dampening confidence,” said Melancon.

“CEOs say they’re bracing for recession,” concurred Asgeirsson. “CEOs right now are having hiring freezes, and frothy job offerings are being cut back.”

It’s an ill wind …

Those last two points highlight one of a few possible silver linings of a softening economy — an easing of the Great Resignation and the staffing shortage.

“I’m hearing business owners say, ‘If things soften a little bit, I may be able to do the hiring I need to do,’” reported Schlesinger.

On the flip side, they may also be able to find less expensive labor.

“How long do you hold onto that higher-paid person who you might have overpaid for during this period?” asked Melancon.

That’s a serious consideration for accounting firms, which have been struggling with staff shortages for years. “Professional business services are rocking and rolling and moving along,” Schlesinger noted. “If I want to attract the next generation, how do I make room for them?”

Making the most of the potential in today’s uncertain economy won’t be easy.

“I feel bad for people trying to do business planning now,” Schlesinger said. “They’re asking what they can do. There are opportunities for business leaders and business owners. … These moments of crisis and inflection points provide opportunities. For survivors who have the balance sheets, there’s going to be lots of opportunities.”

To optimize those opportunities, of course, they’ll need the counsel of their most trusted advisor.

“When things start to turn down, the CPA is very much needed,” Melancon pointed out. “And when things start to turn up, the CPA is very much needed. That’s not the worst place to be.”