7 survival skills for sole practitioner accountants

Mark Lee

APRIL 18, 2023

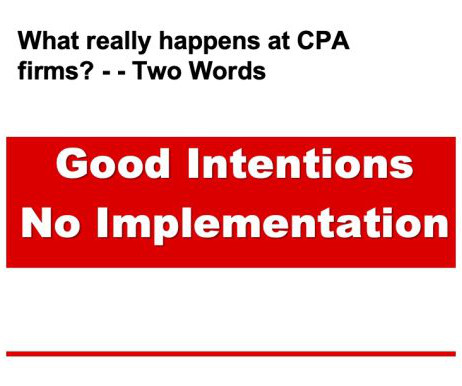

Many of the sole practitioners who contact me are feeling isolated, frustrated and/or overwhelmed. During our initial conversations I always ask what has prompted them to get in touch ‘now’ The details will vary but typically there will have been a catalyst – even if they were only prompted to get in touch ‘at last’ by something of mine they recently read.

Let's personalize your content