Gen AI Boosts Accounting and Audit Firm Efficiency

Accounting Web

JUNE 10, 2025

Tools purpose-built for accounting and auditing can improve the quality and efficiency of your work.

Accounting Web

JUNE 10, 2025

Tools purpose-built for accounting and auditing can improve the quality and efficiency of your work.

Accounting Today

JUNE 10, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Basis 365

JUNE 10, 2025

Let’s start with a familiar feeling: You’re preoccupied with running your business, trying to grow, trying to hire, trying to build something great. And then it hits you, your bank balance doesn’t look like it used to. You pause. You ask yourself, “How long can we last at this pace?” And if that question makes your stomach flip, you’re not alone. Far too many business owners and founders don’t actually know their burn or their runway, two numbers that can make or break your next big move.

Accounting Today

JUNE 10, 2025

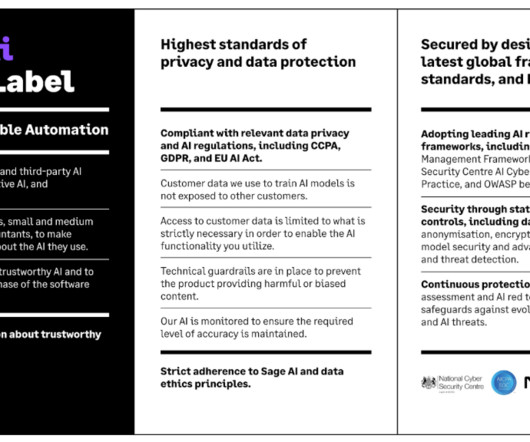

Accounting solutions platform Sage announced that its products will come with a new "AI Trust Label" meant to provide customers with accessible information on how AI functions across its product line.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Ryan Lazanis

JUNE 10, 2025

If you’re still buried in paper documents and manual tasks, this guide’s for you. In this article, I’ll show you […] The post A Complete Guide to Digital Accounting for Firm Owners appeared first on Future Firm.

Accounting Today

JUNE 10, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

AccountingDepartment

JUNE 10, 2025

Financial management is the backbone of any business, enabling owners to steer toward growth, stability, and long-term success. However, as businesses evolve and financial complexities escalate, choosing the right accounting model becomes a pressing decision. Should you rely on in-house expertise or entrust an outsourced accounting service? With rapid advancements in technology, talent shortages, and the rise of remote work, this decision is even more significant as we approach 2025.

CPA Practice

JUNE 10, 2025

A company that sells automobiles through an auction house claimed a software glitch outside of its control led to the non-filing of Form 8300. Did the Tax Court give the company a pass?

Accounting Today

JUNE 10, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

CPA Practice

JUNE 10, 2025

More than 74,000 individuals sat for the CPA exam last year, but only 11 met the criteria to receive the prestigious Elijah Watt Sells Award from the AICPA and NASBA.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Canopy Accounting

JUNE 10, 2025

In this webinar, hosted by Rightworks and Canopy, we’ll break down the three major stages of your firm’s tech journey: from manual processes and ad hoc tech workflows to a fully automated, secure, and cloud-hosted firm. Plus, hear real-world examples of firms we’ve worked with that have made the shift and the lessons they learned along the way.

CPA Practice

JUNE 10, 2025

More than half (52%) of accounting professionals expect their firms' headcounts will be at least 20% smaller in the next five years, with fewer entry-level employees expected to be needed in the future, according to a new report from the Indiana CPA Society and CPA Crossings.

Menzies

JUNE 10, 2025

Menzies LLP - A leading chartered accountancy firm. From independent estate agencies expanding regionally to property developers scaling up their residential activity, many UK property businesses are setting their sights on expansion. Yet, the biggest hurdle for many isn’t regulation, funding, or market volatility – it’s leadership. The stats… Research from our The Greatest Leap survey found that nearly 4 in 10 (39%) of UK business leaders were finding it difficult to build competent

TaxConnex

JUNE 10, 2025

Many companies don’t think about how to handle sales tax obligations until it’s too late. Previously we looked at how such back-office functions as the general ledger , tax calendar and billing system can cause problems with your sales tax compliance. Is it worth your time to pay attention to all these potential potholes? “It’s just sales tax. It’s just putting a number on a form,” you might say.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Withum

JUNE 10, 2025

On May 10, 2025, Rowan University presented its highest alumni distinction, the Most Distinguished Alumnus Award, to Chris DeMayo , Chief Operating Officer, partner and board member at Withum. This award recognizes his exceptional professional achievements and dedicated service to the institution. The honor was presented during Rowan University’s main commencement ceremony, celebrating Chris’s significant professional accomplishments and valuable contributions to the University and society.

Insightful Accountant

JUNE 10, 2025

For too many years, the accounting profession has been defined by its barriers to entry. From the 150-hour-rule to a notoriously difficult exam, it seems accounting education was designed with exclusivity in mind.

Accounting Web

JUNE 10, 2025

Are you an accountant looking for smarter ways to manage payments and boost your clients' businesses? You're in the right place.

Insightful Accountant

JUNE 10, 2025

In Part 2 of our 6-part AI series, host Gary DeHart welcomes back Diane Gilson—Top 100 ProAdvisor and founder of BuildYourNumbers.com—to explore “The Art of the Prompt” using ChatGPT.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Withum

JUNE 10, 2025

One significant advantage used in estate planning is portability. Under U.S. federal estate tax law, portability allows for the transfer to a surviving spouse of any unused portion of a deceased spouse’s federal estate tax exclusion. Prior to the introduction of portability in 2010, any unused estate tax exclusion was forfeited upon the death of a spouse.

Accounting Today

JUNE 10, 2025

Eleven accountants were given the Elijah Watt Sells Award, granted to those who earn a cumulative average score above 95.50 across four sections of the exam.

Accounting Web

JUNE 10, 2025

For employers, bookkeepers, accountants and agents, the delay to mandatory payrolling of taxable expenses and benefits is welcome but a sign that it is

Accounting Today

JUNE 10, 2025

Rev. Proc. 2025-23 updates the list of 'automatic procedures' for changes in methods of accounting.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CPA Practice

JUNE 10, 2025

Those impacted by the wildfires that destroyed at least 530 homes and businesses in parts of Oklahoma last March will now have until Nov. 3, 2025, to file various federal individual and business tax returns and make tax payments.

Accounting Today

JUNE 10, 2025

Extreme weather events like wildfires and hurricanes could drop corporate earnings up to 7.3% by 2035, KPMG's 2025 Futures Report found.

Insightful Accountant

JUNE 10, 2025

June 30, 2025, at 11:59 PM Pacific time is the deadline for QuickBooks ProAdvisor recertification. If your Level 1 or Level 2 certification was issued prior to November 1, 2024, you must recertify by June 30th.

Accounting Today

JUNE 10, 2025

A look at what's likely to stay in the Trump administration's tax bill, including pay-fors.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CPA Practice

JUNE 10, 2025

Ignition unveiled early plans this week for what it calls "AI-powered pricing intelligence," a brand-new functionality the company is developing that could be released by the end of this year.

Withum

JUNE 10, 2025

In a global trade environment shaped by unpredictable tariffs , disrupted supply chains and intensifying customs enforcement, importers face mounting pressure to protect margins and maintain compliance. Whether you’re dealing with Section 301 tariffs on Chinese goods or country-specific duty schemes, the cost to bring inventory in to the United States can vary significantly depending on its origin and final destination.

Accounting Today

JUNE 10, 2025

The much-debated tax and spending legislation could be finalized next month, giving answers to debates on the state and local tax deduction, Medicaid and more.

CPA Practice

JUNE 10, 2025

Search for: Home About Us Log In Subscribe for Free My Account Log Out Accounting & Auditing Accounting ESG Financial Reporting Nonprofit Small Business Auditing Audit Standards PCAOB SEC Tax Taxes Income Tax IRS Legislation Sales Tax State Local Taxes Tax Planning Payroll Payroll Benefits Human Resources Payroll Software Payroll Taxes Tech Technology Artificial Intelligence Automation Cloud Technology Digital Currency Hardware Security Software Advisory Advisory CAS Financial Planning Risk

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Let's personalize your content