5 Reasons to Outsource Your Sales Tax Compliance Process

TaxConnex

MAY 16, 2023

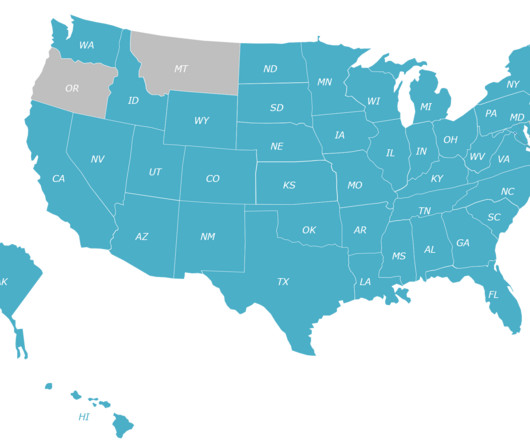

As you are likely aware, managing your sales and use tax obligations is not a small task. Ensuring you have the right people and processes in place is key to maintaining compliance and not putting yourself or your business at risk. Despite the risk, difficulties in hiring experienced accounting employees, lack of full knowledge of the rules and complexities and time constraints surrounding managing sales and use tax in-house, businesses continue to manage these obligations in-house.

Let's personalize your content