Pathways to Growth: The rise of the chief growth officer

Accounting Today

SEPTEMBER 2, 2022

Intuitive Accountant

SEPTEMBER 2, 2022

While today’s technology can help empower your business, it can be tough to keep up. HR analyst Fabian Sandoval shares a few tips to not only help your practice survive, but prosper.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Patriot Software

SEPTEMBER 2, 2022

Everybody makes mistakes. And if you’re an employer, you’ve probably made (or will make) a payroll mistake at some point. If you make a mistake or forget to pay an employee certain wages (e.g., bonus), you might need to provide retroactive or back pay. Read on to get the scoop on back pay vs. retro […] READ MORE.

Intuitive Accountant

SEPTEMBER 2, 2022

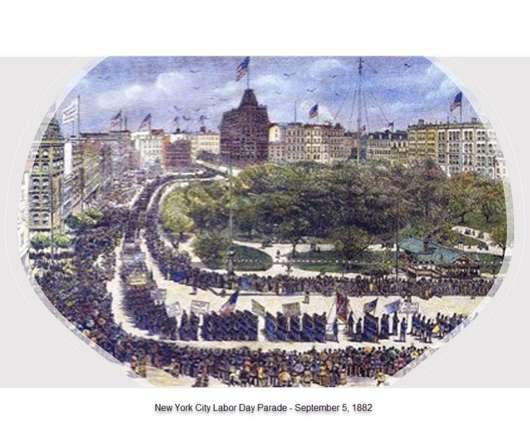

On Monday, Sept. 5, 2022, we observe the Labor Day holiday in the US. While many think of it as an end of summer event, it actually is a time to reflect upon the American workers who built this great country.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Patriot Software

SEPTEMBER 2, 2022

You’re trying to figure out a decent pay frequency for your business. There are a number of popular options, like weekly payroll, and some that are a little more out there, like bimonthly payroll. Have you ever heard of bimonthly payroll? If you have, would you consider it for your small business? You may not […] READ MORE.

Withum

SEPTEMBER 2, 2022

New York City’s tax code was amended on August 31, 2022, to harmonize a number of the City’s provisions with New York State. Governor Kathy Hochul signed legislation (S9454/A10506) adopting a factor presence economic nexus standard, while also retroactively accelerating New York City’s pass-through entity tax election to take effect for tax years beginning on or after January 1, 2022.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Intuitive Accountant

SEPTEMBER 2, 2022

The bill payment and credit solutions provider reports 337% increase in payments from utility companies over past 12 months.

Randal DeHart

SEPTEMBER 2, 2022

Traditionally, employers have relied on giving employees raises to retain their staff and reward them for being hard-working and loyal. Raises can get expensive, and there is often an upper limit for what you can offer regarding increasing salaries and wages. Keeping your employees happy makes business sense. You want to keep your good employees, and it costs money to find, hire and train new staff.

Accounting Insight

SEPTEMBER 2, 2022

Making Tax Digital for Income Tax Self Assessment ( MTD for ITSA ) is fast approaching, bringing with it significant changes to the way many unincorporated landlords need to store and file their financial information. HMRC estimates that around a million UK landlords will be affected by the new rules, which will require those with annual property and/or self-employment income above £10,000 to keep digital records and make quarterly submissions to HMRC from April 2024.

Withum

SEPTEMBER 2, 2022

The federal tax incentive for qualified energy property was extended through the IRA for most projects that begin construction before January 1, 2025 (2035 for geothermal energy used for healing and cooling a structure). Taxpayers are allowed a credit for a portion of the expenditures they make in placing energy property in service.Energy property, for purposes of the energy credit, consists of specifically listed energy-related property, and a second list of qualified energy-related property el

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Accounting Insight

SEPTEMBER 2, 2022

The payroll industry wants one thing from the new prime minister: Enough time to implement any changes. As the battle for Number 10 nears its end, the payroll industry is collectively hiding behind an enormous sofa, hoping against hope that the Daleks will strike and save us from mid-year tax and National Insurance changes. This seems unlikely. We can’t perfectly predict the future, but it’s close to certain that the new Prime Minister will want to move quickly on easing cost of living pressures

Going Concern

SEPTEMBER 2, 2022

The pandemic changed a lot of things, thank goodness it hasn’t impacted the profession’s inexplicable need to brag about their ping-pong tables at every opportunity. From Dallas Morning News : A fast-growing Dallas-based accounting firm is moving its offices in Deep Ellum to a bigger location that’s closer to Fair Park. “To accommodate the growing head count and dynamic growth, Embark is excited to announce it will be relocating the firm’s headquarters to its first dedicated building

Snyder

SEPTEMBER 2, 2022

Today, merchants have the opportunity to sell their products in a variety of locations and online marketplaces. To help increase visibility and drive sales, they also sell their products via multiple channels. But selling products across different channels can lead to a lot of complications when it comes to processing fees. The cost of transactions is one of the biggest and most common challenges digital marketers face today.

Menzies

SEPTEMBER 2, 2022

Menzies LLP - A leading chartered accountancy firm. The government has extended the availability of 100% first year allowances on the acquisition of cars, zero-emissions goods vehicles and equipment. This was due to end in April 2021 and will now come to an end in April 2025. The measure is designed to incentivise the uptake of zero emission vehicles, following the government’s announcement that it will consult on bringing forward the phase-out date for the sale of new petrol, diesel and hybrid

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Accounting Insight

SEPTEMBER 2, 2022

The next instalment in our ‘Meet the brand’ series is Findity, an expense management software designed for living. Find out a bit more about them, before visiting their stand at Accountex Summit Manchester in October! What do you do? I’m Carl-Johan Bixo Jacobsson, UK Partner Director at Findity. At Findity, we are experts in expense management.

Accounting Today

SEPTEMBER 2, 2022

Withum

SEPTEMBER 2, 2022

New Section 45W Credit for Qualified Commercial Clean Vehicles. Is now the time to replace gas powered vehicles for electric vehicles? For vehicles acquired after 2022, the IRA provides a new business credit for qualified commercial clean vehicles, in an amount equal to the lesser of 15% (or 30% for a vehicle not powered by a gas or diesel internal combustion engine) of basis, or the incremental cost of the vehicle (excess of purchase price of such vehicle over purchase price of a comparable veh

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Going Concern

SEPTEMBER 2, 2022

In the early hours of last Saturday, the body of a 27-year-old woman (note: she was incorrectly identified as 33 in early reports) was found at EY’s Sydney office and since then, questions have been raised about the events of the final hours of her life. Most reports say she went out for drinks with colleagues and returned to the office around 7 p.m. to finish some work.

Accounting Today

SEPTEMBER 2, 2022

Going Concern

SEPTEMBER 2, 2022

Ed. note: Although Going Concern observes Labor Day because our handlers are not monsters, we’ll be back Monday as usual. See you then and have a wonderful weekend (hopefully it’s a three-day one for at least some of you). Firm Watch. EY’s talks on potential split to continue into Autumn [ City A.M. ] EY’s talks on whether to separate its audit segment from its consulting arm are set to continue into this Autumn – despite initial suggestions the Big Four firm could reach a decision b

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

Accounting Today

SEPTEMBER 2, 2022

Let's personalize your content