Do remote employees create nexus? Well, a lot of times regarding sales tax, the answer to any question is, “It depends.”

And then some. Covid created unique conditions for companies that must collect and remit sales tax, including many temporary breaks regarding worker locations. At the same time, the pandemic turned remote work from an occasional perk to a standard way of operating a company.

Trouble concerning remote sales tax is, do all those far-flung workers now create nexus for your company – and a sales tax obligation?

New breed of nexus

Before 2018 and the Supreme Court’s Wayfair decision, a company generally needed a physical presence (such as a warehouse) in a state for nexus. The definition of physical nexus has long included employees working in tax jurisdictions different from your office locations.

Now, other tax developments may serve as the model for eventual physical sales tax nexus created by remote employees:

- For income tax purposes, residency can be based on where someone works, maintains bank accounts, maintains a driver’s license or votes, as well as by numerous other details of connection with a state or jurisdiction. California and New York are especially aggressive at going after taxpayers in other states who have these connections yet live somewhere else.

- Many states have statutory resident rules that kick in if your worker is physically present and living in that state for a certain number of days. Telework creates no exception to the rule, as was recently shown by the Supreme Court’s refusal to hear a remote work and tax case between New Hampshire and Massachusetts. Observers say the high court’s stance could encourage other states to create nexus based on telework.

- Pandemic relief is obviously expiring. Pennsylvania, for one, now makes it crystal clear that telework once again creates sales tax nexus. Sourcing could also be changing: A nonresident employee’s pay is not sourced to where the employee worked prior to Covid but to where the employee’s work is now performed.

What you should do

Remote work exploded at a speed that outstripped tax jurisdictions’ regulators. There simply aren’t many rules yet. But there may be soon: A recent Bloomberg survey found that three-quarters of states believe that just a few remote employees working in a state is enough to create an income tax nexus.

Start examining your potential new nexus footprint for state income tax and withholding requirements and try to gauge whether those same states may eventually declare that your employees in those states give you sales tax nexus. You may also find yourself quantifying the degree of your workers’ activity in their states and the number of workers.

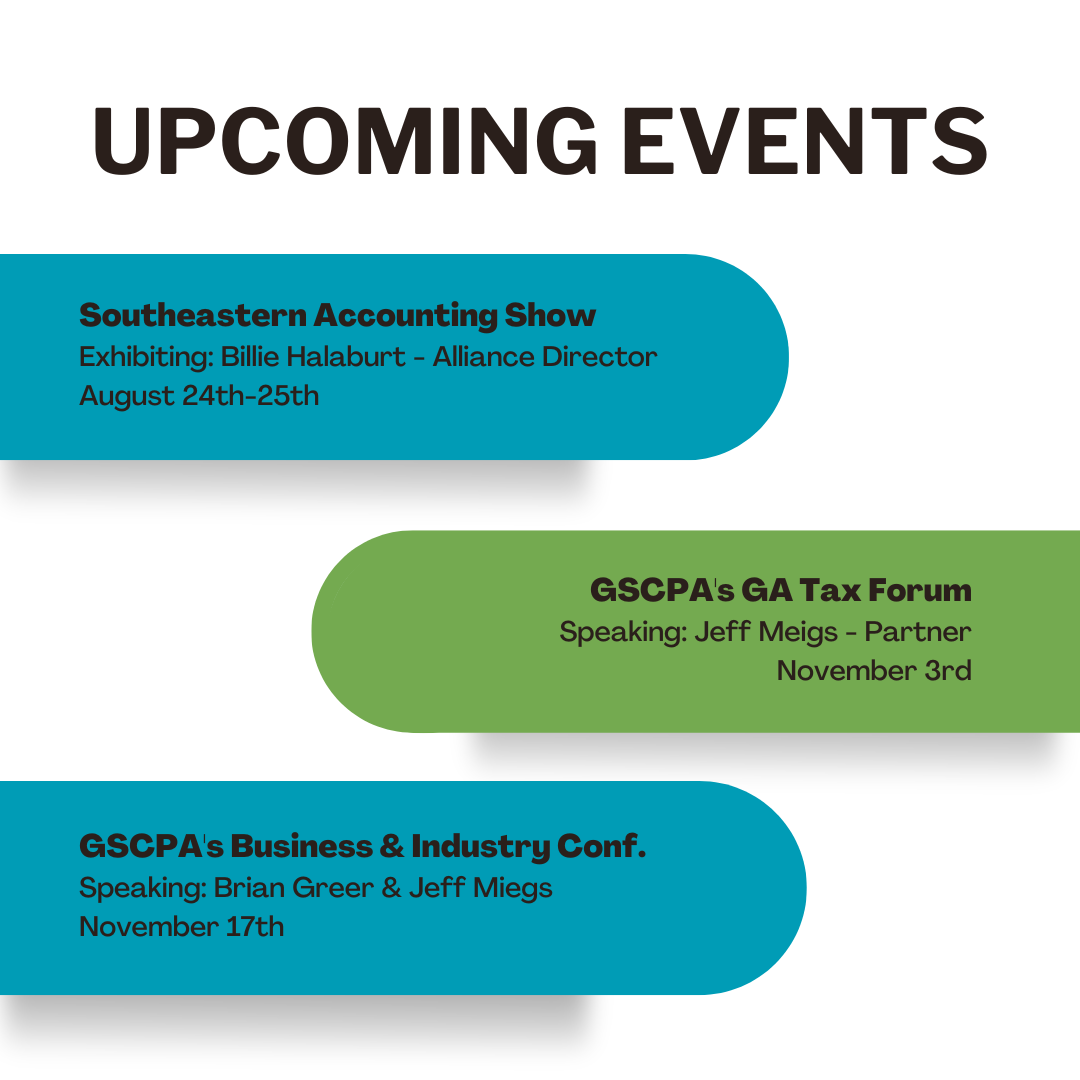

Of course, we’ll keep you up to date.

Contact us to find out if your business could be impacted by changing nexus and to gain a better understanding of your nexus footprint and help alleviate the burden of sales tax compliance.

.png?width=1200&height=628&name=2023%20logo%20with%20SOC%20and%20clearly%20rated%20(2).png)